Steem inflation review for Q2/2025: Inflation slowed but remains elevated

The story in Q1 was, this: Upbit's February SBD delisting triggered an inflation tsunami. In Q2, we're still seeing elevated inflation, but now it's just a swell, instead of a tsunami.

In terms of new STEEM per day, we seem to have hit a local peak of about 93,016 on May 24. Long term, it remains to be seen if that peak will last as a high-water mark. In terms of percentage, the 30-day APR is running at about 6.22% whereas the median blockchain rate during that time is just 5.92%.

This elevated inflation rate is the reason why I wrote, Here's why Steem's witnesses should start paying SBD interest - today and Below the haircut threshold - SBD Supply does not affect inflation during the last month. Counterintuitively, with STEEM's price below the haircut threshold, printing new SBDs would not raise the blockchain's inflation rate, and it might actually lower it by discouraging conversion activity from SBDs to STEEM. (OTOH, if it stimulates conversion activity, that would raise the inflation rate even more, so paying SBD interest is not without risk.)

Against that backdrop, let's get to the standard quarterly review:

1. Here's what would be expected for the next few months, based on current values (subject to change from known and unknown factors):

| Date | Block # | Inflation Rate | Supply | New Steem Per Day | Haircut Supply | Haircut Steem Per Day | Lower Bound Supply | Lower Bound Steem Per Day |

|---|---|---|---|---|---|---|---|---|

| 2025-07-03 10:50:45.682800 | 97,000,000 | 0.059000 | 574,909,164 | 92,930 | 574,909,167 | 92,930 | 517,418,250 | 83,637 |

| 2025-07-12 03:10:45.682800 | 97,250,000 | 0.058900 | 575,715,734 | 92,903 | 575,715,737 | 92,903 | 518,144,163 | 83,612 |

| 2025-07-20 19:30:45.682800 | 97,500,000 | 0.058800 | 576,522,065 | 92,875 | 576,522,068 | 92,875 | 518,869,861 | 83,587 |

| 2025-07-29 11:50:45.682800 | 97,750,000 | 0.058700 | 577,328,152 | 92,847 | 577,328,155 | 92,847 | 519,595,339 | 83,562 |

| 2025-08-07 04:10:45.682800 | 98,000,000 | 0.058600 | 578,133,991 | 92,818 | 578,133,994 | 92,818 | 520,320,594 | 83,536 |

| 2025-08-15 20:30:45.682800 | 98,250,000 | 0.058500 | 578,939,578 | 92,788 | 578,939,581 | 92,788 | 521,045,623 | 83,510 |

| 2025-08-24 12:50:45.682800 | 98,500,000 | 0.058400 | 579,744,909 | 92,759 | 579,744,912 | 92,759 | 521,770,420 | 83,483 |

| 2025-09-02 05:10:45.682800 | 98,750,000 | 0.058300 | 580,549,979 | 92,728 | 580,549,982 | 92,728 | 522,494,984 | 83,456 |

| 2025-09-10 21:30:45.682800 | 99,000,000 | 0.058200 | 581,354,785 | 92,698 | 581,354,788 | 92,698 | 523,219,309 | 83,428 |

Note that the new STEEM per day value of 92,930 is up from 92,732 in last quarter's post, and that was up from 88,823 in 2024/Q4 (11/2 months before the Upbit SBD delisting). The expected trend was down, but the actual trend was up.

Once again, I believe that the difference is almost entirely attributable to SBD conversion activity. In retrospect, the witnesses probably should have been printing SBD interest whenever SBDs were highly overvalued and the STEEM price was below the haircut threshold. That might've avoided the Upbit delisting. Water under the bridge...

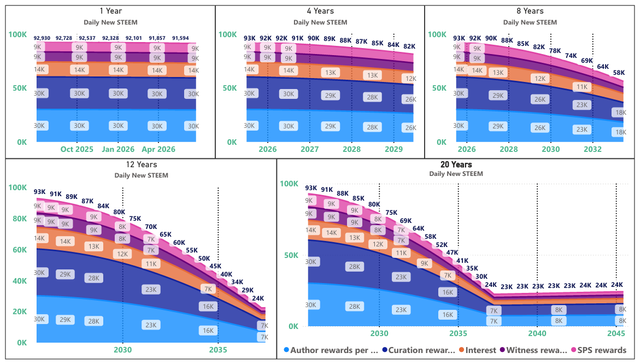

2. And here's what the full visualizations of expected new STEEM per day look like (also subject to change from known and unknown factors):

Under this quarter's projection, we'd be expected to reach December/2024 levels again in about October/2027, so the Upbit delisting appears to have pushed the daily reduction rate back by about 3 years (so far).

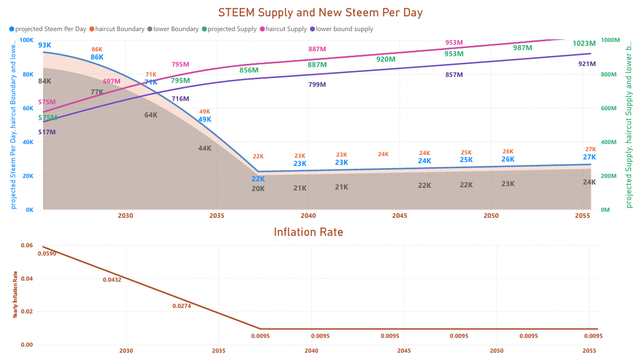

3. Here's a forward looking visual with projections for daily new STEEM, expected virtual supply, and the blockchain inflation rate with upper and lower values, depending upon the price of STEEM in comparison to the haircut ratio.

This does not include unpredictable behavioral factors like burning tokens or converting SBD to STEEM. As usual in recent (most?) years, we're presently continuing along the upper boundary.

It remains true that the most impactful way to reduce STEEM daily production would be to raise the price of STEEM above the haircut threshold - which would lower the number of STEEM paid for each SBD far more efficiently than by paying SBD interest.

4. Now let's look backwards in time using data from SteemDB

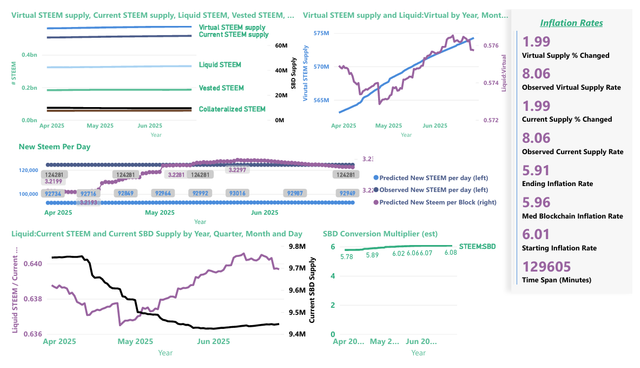

4.1 Q2/2025

During the last 91 days, the blockchain's inflation rate dropped from 6.01% to 5.91% with a median of 5.96%. Meanwhile, the observed inflation rate was 8.06% (not shown - it's down to about 6.22% over the last 30 days). New STEEM per day started the quarter at 92,729 and today it's at 92,947.

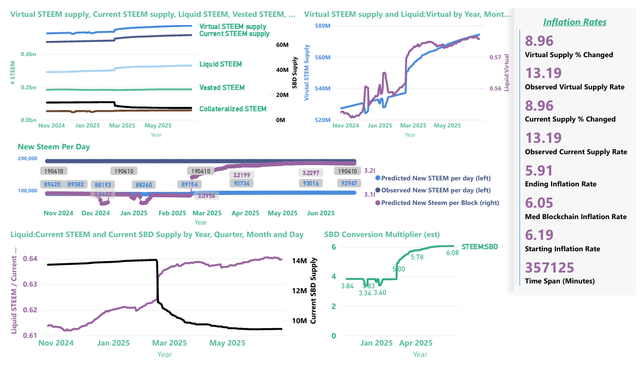

4.2 All Available Data

From October 23, 2024, the blockchain inflation rate dropped from 6.19% to 5.91%, with a median of 6.05%. Over the same time span, the observed inflation rate was double that, at 13.19%. The number of STEEM being paid for SBD conversions increased from 3.84 to 6.08, and the new STEEM per day increased from 89,420 to 93,016 on May 24, and fell from there to 92,947 today.

5. SBD Conversion activity

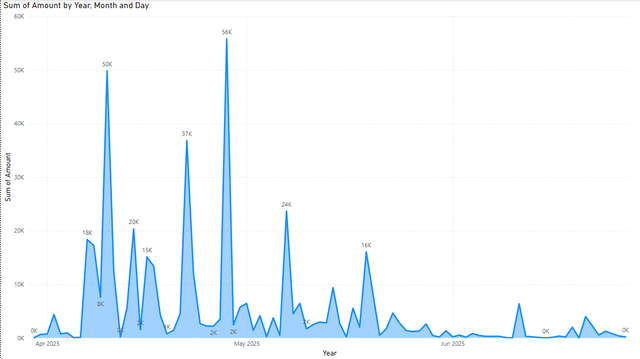

Based on this link, here is a visualization of SBD conversion activity during the quarter. There's clearly a long term downtrend, but we'll have to wait 'til July to see if that reversed itself in mid-June.

Cautionary note

It's important to remember that these projections can all change, depending upon known and unknown factors. Known factors:

- Burning STEEM and/or SBD can reduce inflation

- If the STEEM price goes above the SBD print threshold, that will reduce inflation

- Witnesses can decide to start paying interest on SBDs, which could increase or decrease inflation - depending on the price of STEEM relative to the haircut threshold and on how/if interest payments influence SBD conversion behavior.

- If the STEEM price goes above the SBD print threshold, additional price movements can either increase or decrease inflation - depending upon direction of change.

- Missed blocks by witnesses can reduce inflation

- Witnesses can change any settings they choose in a hard fork, which could have any conceivable result.

- SBD conversions increase inflation when the price of STEEM is below the haircut threshold.

- There may be mistakes in these reports or other factors that I'm presently forgetting or not yet aware of.

Conclusion

During Q2, blockchain inflation has remained elevated, but it is much reduced from the Q1 rate. The 30-day observed rate of 6.22% is about 5% above the blockchain rate of 5.92%. I believe that the elevated inflation rate is due to the effects of ongoing SBD conversions after the February SBD delisting on Upbit. This increase inflation has pushed our inflation curve back by about 3 years - relative to December of 2024.

As always, the best way to reduce inflation would be to raise the price of STEEM above the haircut threshold (the higher the better). This would reduce the contribution that SBDs make to Steem's virtual supply.

Beyond that, as long as the price of STEEM remains below the haircut value, I continue to believe that the witnesses should experiment with SBD interest payouts as a way to incentivize holders to keep SBDs instead of converting them.

I also very much hope that the number of conversions will remain low. Fortunately, market prices are now so harmonised that conversion is no longer better than buying/selling on the internal and external markets.

As far as SBD interest rates are concerned, I don't currently see the benefits outweighing the risks. For me, the first reason was the reduction in conversions. However, this is no longer a major problem at present.

Yeah, the reduction in conversions definitely took the urgency out of it. I still think it would be good to experiment, though, just because it's a possible way to attract investors to the ecosystem for passive interest, and because 0% has a long long history proving that it's not very helpful.

Looks like we're in for another quarter with elevated inflation, unless the STEEM price gets a substantial boost. I don't think we're going to offset that bump with burning.

What sums does the diagram show?

Oh, sorry, it's an updated version of the same graph from above, but I should've specified it again here. It's SBD conversions from here. Roughly 3% of the remaining SBD supply got converted to STEEM on the 20th. And that lowered the haircut price by about 3/5 of a cent.

Oh, wow. That would have been clear in the context of the post. I had only looked at my comment to which you had written your reply.

300K is quite a lot! The account had already converted a larger sum a few months ago. Seems to be very speculative. The SBD transfer took place back in April.

Yes, I also think that we can't compensate for the sum by burning.

I'm preparing an experiment with @gentbg account, which is an attempt to create automated perpetual STEEM bruning loop. I don't know if it will gain traction or not, but I think it's worth a try.

Looks like a fun experiment. If I understand the rules, you could accomplish the same thing with a 100% powerup post and a 50% @null beneficiary, right? It would save you the extra step of transferring the liquid rewards to null.

Yes, but I chose the current method so that I could re-use functions from my previous dev projects. By the way, if you have some spare voting power, you can contribute to burning by giving upvotes to @gentbg's posts. Initial run will last for two months. Thanks!