Steem inflation review for Q1/2025: Upbit's February SBD delisting triggered an inflation tsunami

As the first quarter of 2025 winds to a close, it's time to take another look at the current blockchain inflation information. I have been looking forward to this post, because we had some surprise events during the quarter - it was really sort of fascinating. But, I've also been apprehensive about it because I have to report that my previous claims of a November, 2023 peak in new STEEM per day were all wrong. I never like owning up to a mistake😉.

In all of my previous posts, I tried to include the caveat that the forward-looking numbers could be impacted by factors that I was unaware of. This quarter, one of those unanticipated factors came to light. So, let's look at how the delisting of SBDs on upbit and the subsequent SBD conversion activity affected inflation.

1. Here's what would be expected for the next few months, based on current values (subject to change from known and unknown factors):

| Date | Block # | Inflation Rate | Supply | New Steem Per Day |

|---|---|---|---|---|

| 2025-03-29 17:19:46 | 94250000 | 0.060100 | 563181955 | 92732 |

| 2025-04-07 09:39:46 | 94500000 | 0.060000 | 563986826 | 92710 |

| 2025-04-16 01:59:46 | 94750000 | 0.059900 | 564791505 | 92687 |

| 2025-04-24 18:19:46 | 95000000 | 0.059800 | 565595986 | 92664 |

| 2025-05-03 10:39:46 | 95250000 | 0.059700 | 566400267 | 92641 |

| 2025-05-12 02:59:46 | 95500000 | 0.059600 | 567204342 | 92617 |

| 2025-05-20 19:19:46 | 95750000 | 0.059500 | 568008208 | 92593 |

| 2025-05-29 11:39:46 | 96000000 | 0.059400 | 568811860 | 92568 |

| 2025-06-07 03:59:46 | 96250000 | 0.059300 | 569615295 | 92542 |

Note that the new STEEM per day value of 92,732 is up by about 4% from 88,823 in last quarter's post and it's also above the November 2023 value of 89,913 that I previously thought was going to be a multidecade peak.

This is despite the fact that the blockchain's inflation rate has dropped from a rate above 61/2% to a rate near 6%.

More about that later, in the section where we look at the values from this quarter. The short version is that converting SBDs to STEEM lowers the blockchain's median price parameter, which means that each remaining SBD is worth more STEEM in conversion value. That increase boosts the virtual supply and, in turn, the new STEEM per day. As we'll see, there was a substantial amount of conversion activity.

2. And here's what the full visualizations of expected new STEEM per day look like (also subject to change from known and unknown factors):

With today's numbers, we'd expect to get back to Q4/2024 daily STEEM production levels in May, 2027.

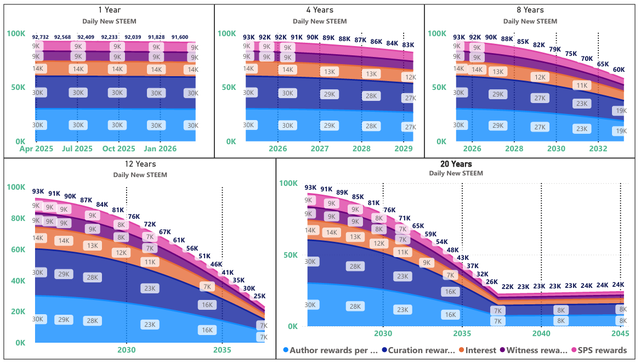

3. Looking forward, here are the currently projected values for 1, 4, 8, and 12 years (subject to change from known and unknown factors).

| Date | Block # | Inflation Rate | Supply | New Steem Per Day | Total Change in daily STEEM production | Total Change Pct |

|---|---|---|---|---|---|---|

| 2025-03-29 17:19:46 | 94250000 | 0.0601 | 563181955 | 92732 | 0 | 0.00% |

| 2026-03-29 07:19:46 | 104750000 | 0.0559 | 596772849 | 91396 | -1336 | -1.44% |

| 2029-04-04 17:39:46 | 136500000 | 0.0432 | 693114547 | 82034 | -10698 | -11.54% |

| 2033-04-02 01:39:46 | 178500000 | 0.0264 | 796507364 | 57610 | -35122 | -37.87% |

| 2037-03-30 09:39:46 | 220500000 | 0.0096 | 855900545 | 22511 | -70221 | -75.72% |

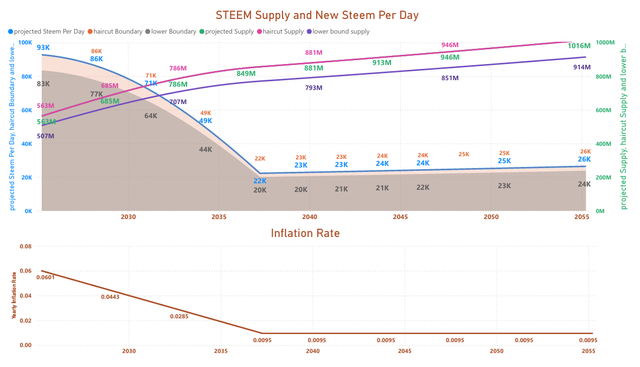

4. Here's a forward looking visual with projections for daily new STEEM, expected virtual supply, and the blockchain inflation rate. New for this quarter, I added upper and lower boundaries, so we can see the possible rates of production if/when the price of STEEM crosses above the SBD print threshold again.

For now, we remain stuck at the upper boundary.

5. Now let's look backwards in time using data from SteemDB

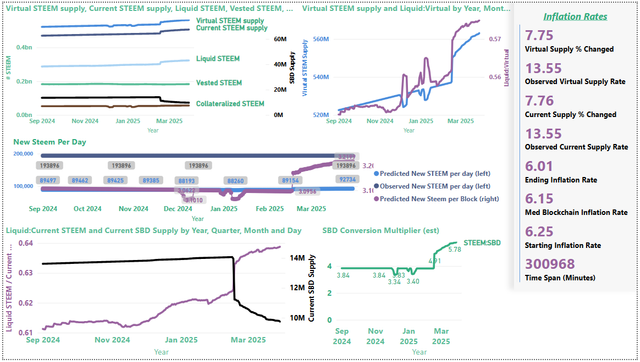

Here's where things get interesting. Note the bottom-right visual, which has the ratio of STEEM / SBD. This came out of nowhere - for most of the time that I've been watching this, the ratio was pegged a bit below 4 (as we see on the left side of the visual), but it suddenly became the main driver for inflation during the quarter.

Note also the "Collateralized STEEM" value in the top-left visual. That shows the elimination of debt when SBDs were converted from collateralized STEEM into actual STEEM. During the quarter, the SBD supply dropped from about 13.9 million to about 9.8 million. This eliminated a corresponding portion ( 29% ) of collateralized debt. With 5.1 million SBDs held by the SPS wallet, 52% of the blockchain's remaining debt is currently owed to the SPS.

5.1 Q3/2024

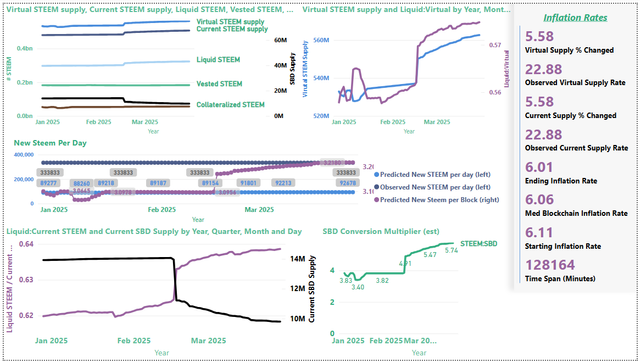

During the quarter, the blockchain inflation rate dropped from 6.11% to 6.01% and the annualized observed inflation rate after factoring in SBD conversions was a whopping 22.88%. Daily observed STEEM creation averaged 333,833 STEEM per day, which is more than 31/2 times the projected value.

5.2 All Available Data

From September of 2024 until today, the blockchain inflation rate dropped from 6.25% to 6.01%. After factoring in SBD conversions, the annualized inflation rate was 13.55%. The average daily STEEM production was 193,896 - which is more than twice the projected value.

Cautionary note

It's important to remember that these projections can all change, depending upon known and unknown factors. Known factors:

- Burning STEEM and/or SBD can reduce inflation

- If the STEEM price goes above the SBD print threshold, that will reduce inflation

- Witnesses can decide to start paying interest on SBDs, which would increase inflation.

- If the STEEM price goes above the SBD print threshold, additional price movements can either increase or decrease inflation - depending upon direction of change.

- Missed blocks by witnesses can reduce inflation

- Witnesses can change any settings they choose in a hard fork, which could have any conceivable result.

- SBD conversions increase inflation - as described above. This might change if the price of STEEM crosses above the SBD print threshold. I haven't thought through that scenario.

- There may be other factors that I'm presently forgetting or not yet aware of.

Conclusion

All in all, it was a fascinating quarter to observe. Until now, my assumption about SBD conversions was that they were inflation-neutral. This quarter disproved that assumption. By lowering the SBD print threshold, each remaining SBD becomes more valuable in terms of STEEM, therefore SBD conversions actually serve to increase inflation in a way that I hadn't anticipated in previous reports.

Since many SBD conversions are continuing - albeit more slowly, it's even possible that daily STEEM production has not yet peaked. We'll have to wait and see what next quarter brings.

Caveat Lector: Any/all of these reports may contain mistakes, so be suitably skeptical.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Thanks for doing all this. I'd been wondering how the Upbit delisting and subsequent price adjustments was impacting the chain finances... I had no idea that the inflation had jumped so much.

You're welcome. It was a surprise to me, at first, too. I was completely expecting SBD conversion to be inflation-neutral, since there's no change in value. The good news is, I'm pretty sure that conversions have now dropped off enough to bring inflation down to more reasonable levels..

I don't really think the subsequent price movements had much to do with inflation, though. I think that's just driven by external market conditions. The ratio between STEEM and HIVE stayed pretty stable for the whole time.

Upvoted! Thank you for supporting witness @jswit.

Thank you for sharing on steem! I'm witness fuli, and I've given you a free upvote. If you'd like to support me, please consider voting at https://steemitwallet.com/~witnesses 🌟

Your post is manually rewarded by the

World of Xpilar Community Curation Trail

https://steemit.com/~witnesses vote xpilar.witness

"Become successful with @wox-helpfund!"

If you want to know more click on the link

https://steemit.com/@wox-helpfund ❤️

STEEM-BINGO, a new game on Steem

Good luck and have fun playing Steem-Bingo!

How to join, read here

Prize pool:

Minimum Guaranteed 45 Steem for each draw

DEVELOPED BY XPILAR TEAM - @xpilar.witness