Here's why Steem's witnesses should start paying SBD interest - today

Think of the Steem ecosystem as a garden. Right now, it's being choked by weeds. We have a possible weed-killer and fertilizer (SBD interest) that might help, but we're not sure if it will work. We should find out. Immediately.

By paying interest on SBDs, we may be able to encourage investment in the ecosystem at the same time as reducing the suffocating flow of rewards to low-value content.

Reasons:

1.) What we're doing isn't working. For several years.

- The number of minnow accounts is steadily declining.

- The quality of blockchain social content is not improving, especially the most highly rewarded content.

- The price of STEEM is stagnant or declining.

In short, something needs to change (or multiple somethings).

2.) Adjusting the interest rate is an easy "something" to change.

- Witnesses just need to set a parameter and stakeholders just need to vote for the ones that do.

- No code changes are required.

3.) It's safe and easily reversible.

If it doesn't work out, the interest parameter just needs to be reverted to 0 - where it is currently set.

4.) After the February SBD delisting on Upbit, SBD conversions have been fueling large increases in blockchain inflation.

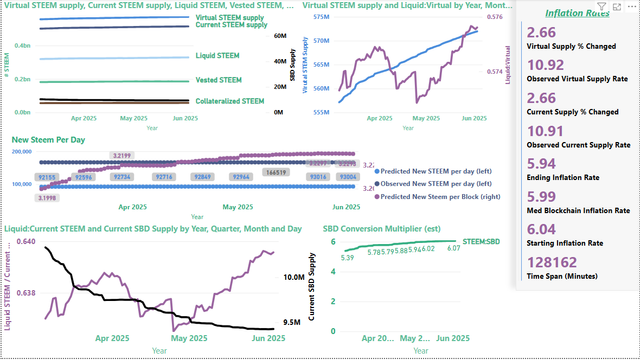

- During the last 90 days, the expected new STEEM per day was not quite 93,000 STEEM per day. However, the actual observed production was over 166,000 STEEM per day.

- The blockchain's median inflation parameter setting has been 5.99%, but the observed inflation rate has been 10.92%.

- These differences are due to SBD -> STEEM conversion activity.

- During that time, due to the declining "haircut price" from SBD conversions, the number of STEEM per SBD has increased from 5.39 to 6.07, almost a 13% increase (by value, not by count).

- It's conceivable that higher SBD interest could slow SBD conversions, which might actually reduce the overall inflation rate. i.e. we intentionally increase the expected inflation rate in order to reduce the observed inflation rate.

- This undesirable impact from SBD conversions will remain in effect for as long as STEEM is priced below the haircut price.

5.) It gives investors a way to get truly passive rewards, eliminating the need to pollute the blockchain social ecosystem with vacuous daily posts.

- In turn, this might reduce the vacuous content that is being powered by participation in Steem's existing voting services.

6.) New SBD production can fuel a more robust post promotion ecosystem. (especially in conjunction with other changes that could expand visibility in exchange for token burning.)

- Authors could buy & hold SBDs and use the interest to pay for post promotion.

7.) At present, more than 50% of the SBD supply is held by the SPS. This suggests that more than half of the interest will go to increase funding for development in the Steem ecosystem.

8.) Paying interest on SBDs could reward exchanges and their customers for participation in new SBD trading pairs.

What are the objections:

1.) We don't know what will happen.

We have ample evidence, however, of what happens if we do nothing.

2.) It will damage the voting services

Voting services are not investors. Their clients are the investors. The voting services have failed at satisfying their clients' needs for truly passive growth. Their clients should demand better.

3.) It's increasing the SBD supply and (maybe) the virtual supply.

- Most of the growth in the SBD supply will happen inside the SPS, so the effect on the liquid supply will be roughly half of the paid interest rate (at the start).

- As noted above, the downstream change in incentives might actually slow the growth of the virtual supply.

- The community will need to monitor this and make adjustments as effects are observed. Worst case, we turn it off again.

4.) It increases the blockchain's debt.

Actually, no it doesn't. The blockchain's debt is capped at 10%, regardless of how many SBDs are created. The value of SBDs is adjusted by the haircut ratio in order to keep that debt level constant.

Finally

My suggestion is that the witnesses should begin a 6 month experiment with SBD interest payments immediately. I propose a starting rate of 25%, with regular measurements/monitoring and a monthly rate adjustment.

What do you think? Let your witnesses know if you support this idea.

Я считаю, что паника на Upbit нанесла огромный вред платформе Steemit, когда обесценила SBD.

Жаль, что команда Steemit не обратилась к участникам платформы и не призвала всех держать SBD и не продавать его.

Мне могут возразить и сказать, что рынок формирует цену, но заинтересованная команда должна была предпринять какие-либо действия для сохранения SBD и не опускать цену.

Бездействие порождает недоверие! Последние 3 года мы не видим, чтобы Сан что-то делал для развития платформы. Раздел Steemit нанес вред платформе и наша криптомонета планомерно теряет свою ценность.

Мне жаль тех инвесторов, кто вложил огромные средства в Steem и не получает до сих никакого почтения, уважения и поддержки от команды. Им приходится обращаться к бустерам, чтобы получить хоть какое-то возмещение тех затрат, которые они понесли при покупке Steem по цене $0.50 - $8.00

У меня нет позитивного прогноза по увеличению цены Steem и SBD, к сожалению. Но, хотелось бы ошибиться!

I agree!

I've been thinking for some time that now would be a good time to pay interest on SBD.

So far the following points have stopped me:

We currently have an supply of 9.4M SBD.

With an interest rate of 15%, we would pay 1.4M SBD per year and 3.9K SBD per day. Of this, 54% (2.1K SBD) would go to the SPS Fund, 23% (900 SBD) to exchange account cold.dunamu (it is not clear whether the exchange will forward the interest to customers) and only 23% (900 SBD) to all other accounts.

In half a year, we would end up with about +0.7M SBD, which leads to a 7.5% increase in supply. That's not much considering that it may prevent further conversions and achieve the goals you mentioned.

From this point of view, I would even consider an even higher interest rate of 20% to be suitable.

I will see what other witnesses say, but I assume that I will adjust my props accordingly. Even if I can't achieve much with my current position, this may have a positive aspect in the desired direction.

Yeah, this is why I mentioned the need to monitor and adjust. There are risks, but TBH, it's hard for me to imagine that it could make things much worse - as far as incentives go. To me it seems like the potential upside outweighs the potential downside by a long shot - under current conditions. I think the main time to reevaluate will be if/when the STEEM price crosses, convincingly, above the haircut threshold.

(It would even be possible to set up an SPS burn proposal to offset the amount of the new interest, but that's a topic for a different day. I'm not advocating for that, but it might be something to think about.)

I think this is one of the main reasons that interest was stopped in the first place. People didn't like seeing the interest going to the exchanges. But in the wake of the Upbit delisting, I'm starting to think that a little bit of incentive for the exchanges is a good thing. And it can be hoped that their customers would eventually pressure them into sharing the windfall.

SBD interest rate is a great idea, it will bring back some SBD for sure.

I keep mine on HTX where I've been converting some STEEM to SBD but didn't find any motivation to bring it to Savings at the moment.

No SBD interest on the exchange, so I guess even 10% will bring back some SBD to the chain. That is good in the long run, right?

In my view, it is good if SBD (at the current time) are not converted. If we are above the Haitcut price with the STEEM price, that is a different matter.

Therefore, any SBD that is held (whether in savings or in balance) is good.

One negative aspect of the current logic is that exchanges would receive interest for SBD in customer wallets, but it is not certain that they will forward it to customers. If interests would be payed it is therefore better to hold them in the personal wallet.

Absolutely!

I believe that any price under $1.00 is too low and thus, probably a good long investment. I also think that if SBD savings here starts paying interest, many will deposit and this will in terms also increase the demand on the exchange and increase SBD price.

What needs to be done so SBD Savings starts paying interest?

Witnesses consensus only or any devhours need to be spent?

The witnesses can do it without any code changes/dev hours. If I understand correctly, each witness sets their own parameter (from 0%-100%) and the blockchain sets its interest rate to the median value. I believe that code changes/dev hours would be needed if the community wanted to pay interest only on SBDs that are held in savings.

Thank you for that info. This sounds fair and flexible enough, given there is consensus, probably that is much harder to achieve but then, there is the median value that reflects the witness sentiment.

I think generally SBD interest is paid only if SBD is staked at Savings?

How could regular users see this? Somewhere in the UI?

I believe SBD interest would be paid on all SBDs, regardless of whether or not they're in savings.

If I recall correctly, it used to be visible in the SBD section of the Steemit wallet. Not sure if that's been removed, or if it just disappeared because it's currently set to 0. It's also visible in steemdb.io, as "sbd_interest_rate".

That's interesting, as I was thinking only in Savings would bring interest.

I checked it today, thanks for the resource link, it is zero indeed. Unless it is greater than that and shown in the Wallet UI, it won't matter, I think, as there won't be any mass of accounts keeping SBD there, right?

Strong disagree. SBDs are currently overvalued relative to the haircut price, what we need is less incentive to hoard them, not more.

There's no evidence that this is a weed-killer. What happens when you dump fertilizer on a weed-choked garden? Fertilizer doesn't selectively target non-weeds. The economy needs more flow and dynamism, not the stasis-inducing effects of people continuously doubling-down on their current positions.

The SBD conversions are good, not bad. The results of them are desirable, not undesirable.

I agree to a certain extent. But at the moment, increasing conversions are bad. It further increases virtual supply and inflation.

At this point Everything we can add that may be attractive to investors I think is useful, and adding this APR to the SBD I think is a good addition and it is worth the attempt.

I think that giving real utility to the SBD can be quite positive and a good experiment to see if we bring more external capital to the platform.

This is the first step to expand the community, as I currently consider it unproductive to promote the platform and attract new users on a massive basis. Current users are receiving few rewards with their publications, attracting more users will only reduce the rewards that current authors receive, so I consider it necessary that we first try to attract more external capital from investors who first maintain their SBDs and then consider expanding their participation in the ecosystem using part of their profits/resources in content curation.

It's a good start, why not try it?

I'd consider a few things:

Monthly rate adjustment may only add confusion and uncertainty. I think it would be better to have a stable rate for, say, 6 months.

Testing period should be at least one year, allowing for at least 1 rate adjustment if necessary.

SBD interest should be distributed to only savings, not liquid SBD.

Though I'm maintaining voting services, I don't think "damaging" voting services with SBD interest will necessarily undermine STEEM as a whole. So, I'd definitely say it's worth a try.

Just my two cents. Thanks!

A stable value can only be achieved if all witnesses set the same percentage in their props. This is unrealistic and not necessary.

The blockchain has mechanisms for this and determines the median, as it does for the STEEM price. It would not be unusual if the witnesses consider a different percentage to be appropriate.

However, the witnesses must check the interest rate regularly.

As far as I can tell, investors hate uncertainty. In my opinion the rate should be stable enough so that people can at least roughly estimate ROI. I'm not saying "stable-coin" grade stability. I just think the rate should be discussed among the top witnesses to maintain a degree of stability.

Thanks for the feedback!

In general, I agree, but at the beginning I think that smaller and more frequent adjustments are called for - since the initial rate is likely to be suboptimal. In the original post, I thought about suggesting a year-long experiment with quarterly adjustments, but that seemed kind-of slow at the beginning. I'd rather see small and frequent tweaks than big jumps at long intervals. Once it settles down, quarterly or semi-annually would probably be plenty.

In the end, it's really more like herding cats anyway. Witnesses are free to adjust their rates when and how they choose, and voters can decide which rates get into the top-20, so having a consistent schedule is just sort-of aspirational. In a competitive system, I wouldn't really expect it to happen on a regular schedule at all. It's all up to the stakeholders.

I agree that this would be ideal, but I think it requires a code update. If we wait for that, we're stalled indefinitely. So, in the spirit of "Don't let the better be the enemy of the good", I think we should start with what we have and maybe update the code later - when we have more of a blockchain development capability.

It might even be that voting services will find alternate business models (i.e. purchase votes with SBD, TRX, BTC, etc...; or even something like @thoth.test) that are just as profitable. Selling votes for external cryptocurrencies would bring external value into the system, so it might even help the voting services, the clients, and the ecosystem as a whole. The only way to know is to give it a shot...

I think frequent change may prevent investments. I'd prefer predictable sub-optimal value than frequently changing one. Anyway I agree that it's worth a try.

@remlaps, this is a vital and timely post! The garden analogy perfectly captures the current state of the Steem ecosystem, and the proposed SBD interest solution is a breath of fresh air. I particularly appreciate how you've laid out the potential benefits: reinvigorating investment, curbing inflation fueled by SBD conversions, and promoting a healthier content ecosystem by offering a genuine alternative to "vacuous daily posts."

The point about the SPS holding over 50% of the SBD supply is HUGE! Imagine the boost to development funding! I'm also relieved to see you address potential objections head-on, especially the point about the blockchain's debt.

A 6-month experiment with a monitored interest rate seems like a pragmatic and responsible approach. This post is a MUST-READ for anyone invested in the future of Steem. Everyone, let's get the conversation going and share this with our witnesses! What are your thoughts on a 25% starting rate?

For transparency, even though it agrees with me, readers should be aware that this is an AI generated reply (not under my control).