You are viewing a single comment's thread from:

RE: Proposal for SBD Liquidity Provision and Market Making (MM) Bot Development for the STEEM Ecosystem

Arbitraging between exchanges seems like a good idea in general. With what you're talking about here, I'm not really following why you need a lot of SP for this. Can you expand on that? Also, why 100 SBD per day in operational funding to just issue automated trades? What is so expensive about that?

The reason why SP is needed is because Resource Credits are needed to use the STEEM internal exchange.

Since the STEEM internal exchange operates on-chain, it requires a lot of Resource Credits to create order books.

We needed about 15K SP to continuously create about 3 order books for 24 hours.

We estimate that about 50K SP will be needed to add two-way trading and more order books.

Developing an MMbot algorithm requires the efforts of many developers.

There are many parts that need to be developed, such as an MMbot that operates on the HTX exchange, a system that discloses transaction history through API, an MMbot that operates on STEEM, and a strategy to increase the number of STEEM using the MMbot.

Considering planning, website construction, MMbot design development, etc., 100SBD is honestly a very low amount.

I haven't run the numbers, but my general impression is that you'd need to run a huge number of transactions before hitting an RC limit. Why do you need to so many transactions?

Why do you need to create multiple "order books"? Why do you need to do it "continuously"?

Why? That doesn't make sense to me, especially if you've already done it once. What's complex about the algorithm here?

Maybe a broader question here: What is doing this via bot getting you that doing straightforward arbitrage via manual transactions couldn't?

Why do you need to construct a website to issue transactions on a blockchain and the HTX exchange?

The market price keeps fluctuating. We need to keep re-creating the order book to match this change.

The MM bot we operated is a one-way system that buys SBD from the STEEM internal exchange, transfers it to Upbit, and resells it.

And we need to develop it again to match HTX.

Also, the MM we created is a system developed for our own profit, and it is different from the nature of the proposed proposal.

If the above proposal is approved, everyone needs to check how the MM bot works, so additional development is absolutely necessary.

If there is no MM bot, there will be an order book gap in the STEEM internal market, and there will be a lot of losses when buying or selling SBD.

I thought your premise was that there was a systematic distortion where the markets were always out of sync. If there are constant fluctuations that cross whether there's an arbitrage opportunity isn't that an indication that the markets are already naturally close? Right now it looks like the orders on the internal market put the price at between 0.19 and 0.20 SBD/Steem. Coingecko says that on HTX SBD is trading at $1.34 and Steem is trading at $0.2581, so 0.2581 / 1.34 = 0.193 SBD/Steem. Those seem pretty close to me. What transactions would your bot be issuing in an environment like that?

The automated posts kept saying that your Upbit bot was preliminary. Why did it never get to full release? How effective was your bot at closing the price differentials between the internal market and Upbit?

If there are profits to be made by arbitraging between HTX and the internal market, wouldn't it be better and more decentralized to just let the profit motive incentivize whoever wants to take the risk to do buys and sells, and natural economic equilibrium keeps the markets in sync? What is the benefit of a bot that does this and burns the profits?

Why? Historically there has been a gap but that seems likely related to distortions of the highly restricted Upbit market. Isn't HTX much more open?

I think you have only observed the market for a short time. Your opinion is that if you leave it to the market freely, everything will be resolved.

MM bots are working on all exchanges, but they are working very limitedly on the STEEM internal market. There are several reasons for this, such as development limitations and insufficient trading volume.

We processed more than 250K SBD transactions through Upbit MM bots, and users traded SBD with a difference of 0.x%.

And MM bots are not officially released. (This is not a service that is open to everyone.)

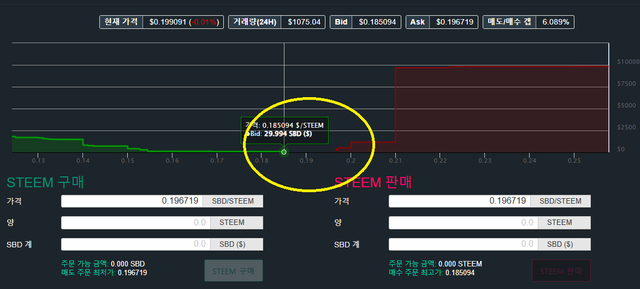

Simply put, if there is no MM bot, there will be a gap in the order book as shown in the picture below.

Users who trade during this gap will suffer losses.

Currently, there is a gap of more than 3% in the order book.

And the reason for making this is to look at it from a long-term perspective.

The current volume of the internal market is very low, so it may not seem like a problem, but what if the volume increases?

This gap increases even more, and more trading losses occur.

This in turn reduces the frequency of using the STEEM internal market.

My opinion is that if things don't seem to be resolving to what a standard economic analysis would tell us then there must be some other factor in play. It seems like there was something weird going on with the Upbit exchange. I am skeptical that "not enough trading bots" on the internal market was, is, or will be a problem. How far out of sync have SBD prices historically been with non-Upbit exchanges?

You seem very focused on things like quantity of transactions. How much profit did you make off of your transactions?

Wait. Who are you saying is suffering losses in this situation... Buyers? Sellers? Both? People with access to exchange markets? People without access to exchange markets? Both?

It's too hard for me to tell you all the cases.

Most of the trading volume of SBD so far has been on Upbit. And Upbit was only available to Koreans. The problem here is that users who can trade on Upbit traded at 1SBD=$5, but users who can't use Upbit traded at 1SBD=$4.5.

I provided liquidity to the STEEM internal market at around 1SBD=$4.9x$ through MM, so that users who don't use Upbit can trade at close to 1SBD=$5.

Then, users who can't trade at 1SBD=$5 have to sell at about $0.5 cheaper than the market price, which means that they incur relative losses.

If there's a lack of liquidity, it's difficult for many users to trade. This is the key point.

I want to make sure we are on the same page about how your previous system has been working: you were buying SBDs on the internal market, depositing them to Upbit, selling the SBDs on Upbit, buying Steem on Upbit with the proceeds of your sales, withdrawing the Steem from Upbit back to your account here, and then using that Steem to buy SBDs on the internal market (repeat from beginning). Correct?

Se que acabo de llegar a este hilo, pero concuerdo mucho con @danmaruschak, sin una estrategia clara es difícil que se llegue a un consenso

No se mucho sobre liquidez y el mercado, pero en lo poco que he leído entiendo que quieren igualar el precio de Upbit con las operaciones creadas con ese fondo que piden, pero considerando la gran cantidad de usuarios que existen, cuando tiempo cree que duraran las transacciones que se programen? pienso que el fondo en algún punto se acabara y volveremos al principio

Además, recuerde que el SBD fue creado para valer 1$ (con esto no estoy diciendo que estoy conforme con ese precio, solo que el mismo Whiterpaper juega en contra de lo que esperamos como comerciantes)

Si el precio estaba siendo manipulado o no en Upbit, no cree que el precio podrá cambiar si dejamos que todas las operaciones comerciales sean trasladadas a HTX? (por lo que veo el precio que esta en HTX solo representa el 0.19% mientras que las operaciones de UPbit son mas de 99%)

El 12 de febrero esta a la vuelta de la esquina, en caso de que su propuesta se apruebe, hay alguna fecha tentativa para su implementación? estaré atenta a todas la opiniones y dudas que se resuelvan