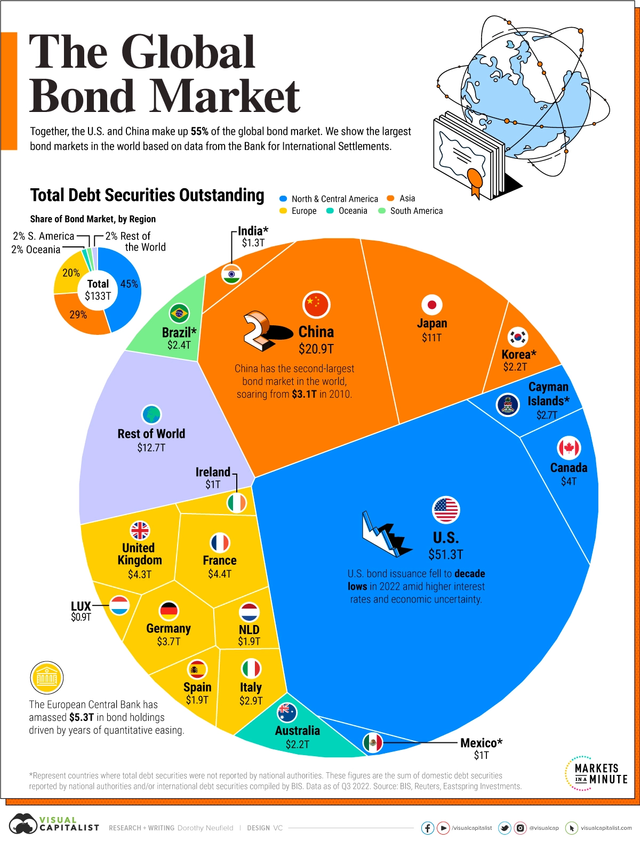

It seems Wall Street and WLF chose ETH. Why? What if ETH introduces the U.S. bond markets?

Once I checked the below data, I thought ETH(Ethereum) blockchain would likely introduce the U.S. bond markets. Let's check the data 🤔

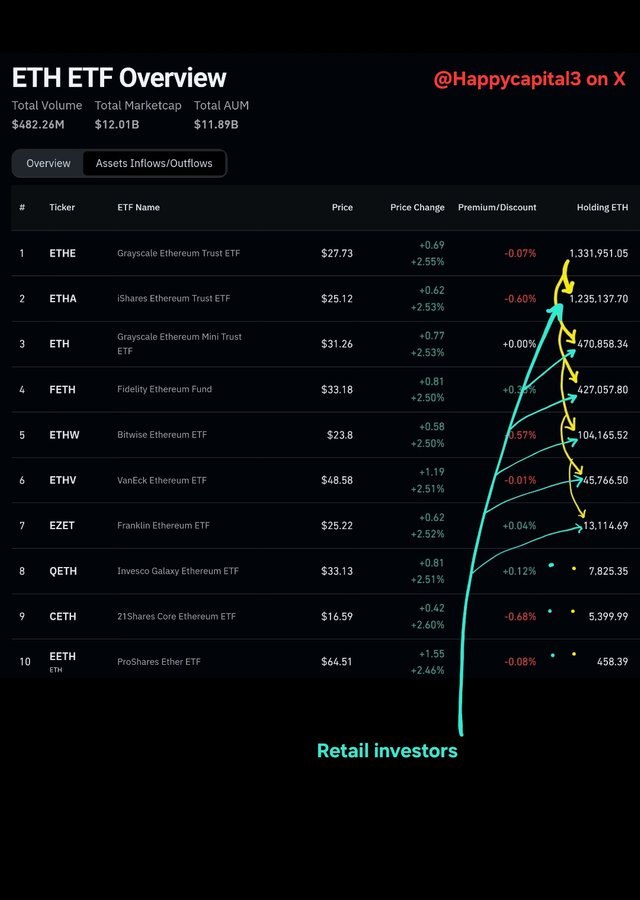

Do you remember this table? Let me explain it again. ETHE is the Grayscale's existing spot ETH ETF. It charges high fees. So, since spot ETH ETFs were approved by the U.S. SEC(Security Exchange and Commisions), much money has moved from ETHE to other spot ETH ETFs.

Of course, retail investors also bought them. Several months ago, I expected ETHA, BlackRock's iShares ETH Trust ETF, will likely surpass ETHE by 2024 December. Unfortunately, it wasn't. But, nearly close. I think ETHA will beat ETHE this month.

The total Wall Street's ETH holdings are around 3.65m ETH.

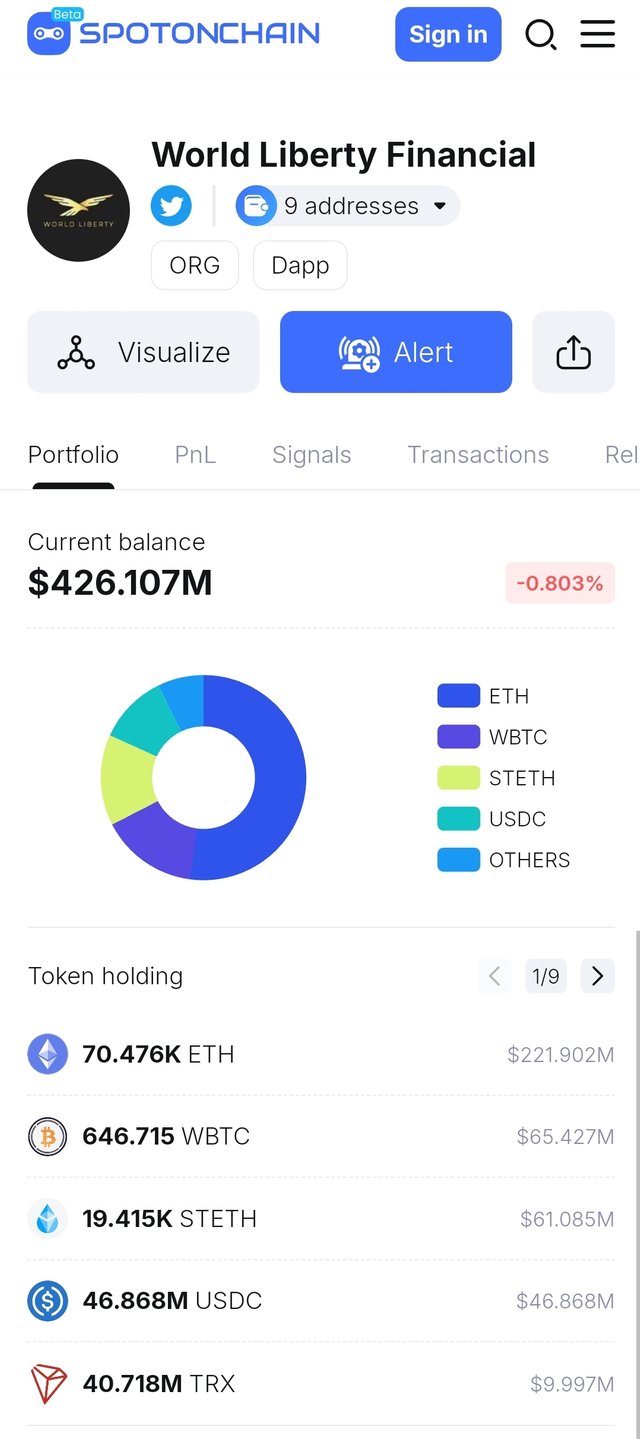

As you know, WLF(World Liberty Financial) is related to Donald Trump's family. They hold 90k ETH, including stETH(Lido Staked ETH).

Therefore, the sum of Wall Street & WLF ETH holdings is 3.74m ETH. It's 3.125% of circulating supply.

BASE is an ETH L2(Layer 2) blockchain which is developed by Coinbase exchange.

Thanks to the BASE chain, many retail investors including me are able to get using De-Fi(Decentralized Finance), meme coins, etc. on Ethereum chain with affordable gas fees. That means anyone in the world can use ETH via BASE chain.

Looking back on the name of WLF, the abbreviation of WLF is World Liberty Financial.

Alright. World looks like target custommers of the De-Fi service. It aligns with the target customers of the BASE chain.

Then, the next word, Liberty. Hmm, it's like freedom in a legal sense. Coinbase exchange has complied with the regulations of the U.S. SEC. so far, so they could be the custodian of BTC & ETH ETFs of Wall Street.

Alright, the final word, Financial. That means they provide financial services.

To encapsulate these, it seems that WLF will provide De-Fi services that anyone in the world can access the platform. It might not have been limited to De-Fi. The platform will be able to introduce a meme coin service as well.

Additionally, it looks like ETH is a strong candidate of public blockchains that the U.S. will adopt.

The U.S. bond market is more than $50T. If the WLF De-Fi platform using BASE chain attracts a very small portion of the market size, for example $50b, and it charges 0.5% for tx(Transactions) fees, and volume of bonds is $500b a year, annual fees will be approximately $2b, so daily estimate income from bond market is around $7m. Do you think it's ridiculous figure?

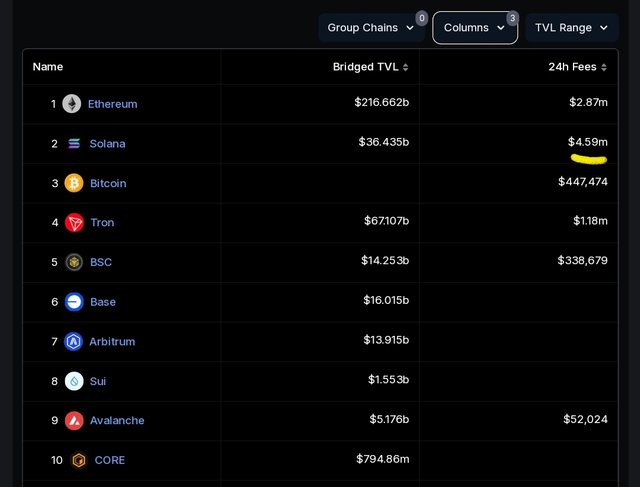

SOL(Solana) chain makes about $5m everyday from De-Fi platforms. I think it's an achievable target for ETH. Why not?

If ETH introduces the U.S. bond markets.. I expect ETH price would likely reach around $10k with respect to my conservative perspective.

The crypto market is bleeding. Most retail investors are spending a tough time now. However, when I took the current circumstances into account, it seems the U.S. already chose ETH as a service chain.

Many people said there won't be altseason anymore. So, did Wall Street sell tons of ETH this January? I believe these transparent data, and the growth of the crypto industry. I hope you will be able to make it at the end of the cycle