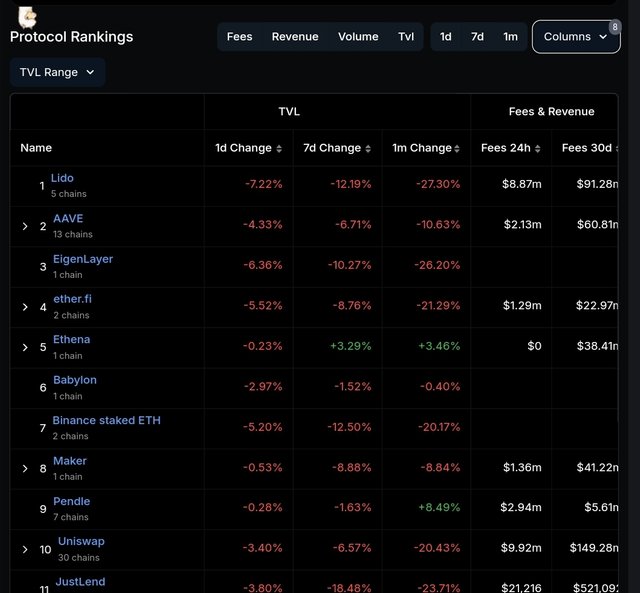

24h fees of ETH De-Fi protocols surged around 4 times 🤔

As far as I remember, recently 24h fees of ETH(Ethereum) De-Fi(Decentralized Finance) protocols were about $3m in average. But, it surged 😨 Why? 🧐

I wondered the reason. So, I checked the TVL(Total Value Locked) of ETH De-Fi protocols. Lido is the largest De-Fi protocol on Ethereum mainnet in terms of TVL. The TVL of Lido plummeted around -10%. Lido charges 10% fee of staking rewards, so TVL is not related to this issue.

As you know, 2 days ago, the crypto market plunged due to Trump's tariffs.

According to this article,

$2.24 billion liquidation event was larger than liquidations during the COVID-19 pandemic and the FTX collapse.

So, the reason might have been the liquidations. At that time, ETH price was collapsing, lots of derivative traders had to prevent themselves liquidation, so lots of them have unstaked stETH. After that, ETH tx(Transactions) might have been piled up, and then led MEV(Maximal Extract Value) increased.

Anyways, I thought 24h fees of ETH De-Fi protocols would reach $10m in a year. But, it already happened 😅 I hope Crypto Total 2 Marketcap will recover asap.