ICO AUDIT: SNAPUP - LEGIT OR NOT?

This will be an ongoing series where I try to investigate if an upcoming ICO is legit or not. I will randomly choose from lists on upcoming ICO websites.

DISCLAIMER: The results and findings in these posts are but my own opinion. As investors, you should make your own research and draw your own conclusion.

As an auditor by trade, my opinions might seem negative, but we were trained to enter every engagement with professional skepticism. That means, in general, that everyone is lying to you unless proven otherwise. So bear with me.

SNAPUP

This should not be confused with the iPhone app with the similar name that allows users to take screenshots of items they want to buy be able tracks those items’ prices to make sure they get the best prices. This is a different product than the one we'll be talking about here. That is bad research on Snapup's part though since they are also a shopping based tech.

Value Proposition

As stated on their website:

"Snapup is a revolutionary way to shop for premium products, that leverages cryptocurrencies and the power of the community to make our customers save from 80% up to 90% on the retail price of the products they love and desire most!"

Here is a video on their website explaining how it works:

If you ask me though, they didn't really explain anything. How will bidding on a product give you 90% discount on it. What is in it for the seller? Why would you auction off your product for 90% less than you would get if you sold it on an online store? How is this different from existing and proven coupon discount apps? Let's go deeper into their whitepaper.

Before we go deeper I just want to point out one very good thing about their whitepaper. It is this statement that they wrote:

"We firmly believe that every business relationship should be founded upon mutual consensus and most importantly trust; therefore, if you are not willing or able to trust our Board for the economically sound management of the funds, we encourage you not to invest in our business." This is the mentality you should have in every investment you make.

Problems They Claim to Address

a) The mobile apps market reached saturation. There are millions of apps on the app store but numerous surveys have shown that on average every user is actively engaged with no more than 5 apps installed on her device, besides the stock ones, pre-installed by the manufacturer brand.

b) 77 percent of users never use an app again within the first 3 days after the install, which is why of the >1.5 million apps in the Google Play store, only a few thousand sustain meaningful traffic.

c) Installing software on devices means having to release updates that people will have to download, and thus having to deal with the complexity of handling different versions of your app simultaneously on the devices. This makes the development and maintenance costs skyrocket.

d) Your code is in the hands of a third party. To release an update for your application you have to ask for permission to the store in which the app is deployed and wait for approval. This process can take several days.

e) Smartphones run many different Operative Systems: IOS, Windows Phone, Android. These OSs are not compatible, so you must have at least 3 different versions of the same application if you want to be able to use it from any device.

How They Claim to Address the Problem

"Up to a few years ago the specific technologies to achieve these results did not exist, and the ones that did were incredibly inefficient, overly complicated and costly to manage at scale. This is no longer the case thanks to the latest advances in the IT Industry pioneered by Google and Facebook engineers.

We invested countless hours of study and research on the most bleeding edge technologies, that combined with our revolutionary sales mechanism are brilliantly solving all the problems that prevented such opportunities to emerge in the market."

I don't know about you guys but they didn't explain jack sh*t how they were gonna address those supposed problems. This was just a mesh of buzz words and jargons. As a rule of thumb, if they can't explain to you in a 2 sentence paragraph how they were solving a problem, they most probably don't know either.

Questions they failed to answer are:

a) How does their supposed bleeding edge technology allow users to access the same program across multiple operating systems?

b) How do they solve the problem of constant updates?

c) How do they ensure that any update they release is audited if no third party audits and checks them before launching?

d) How do they ensure separate their app from the rest and not just be part of the junk that 77% of people claim to ignore after the first 3 days?

e) How the f*ck will you give customers a 90% discount and still leave a gain to the seller? Perhaps this specific question can be answered with their business model.

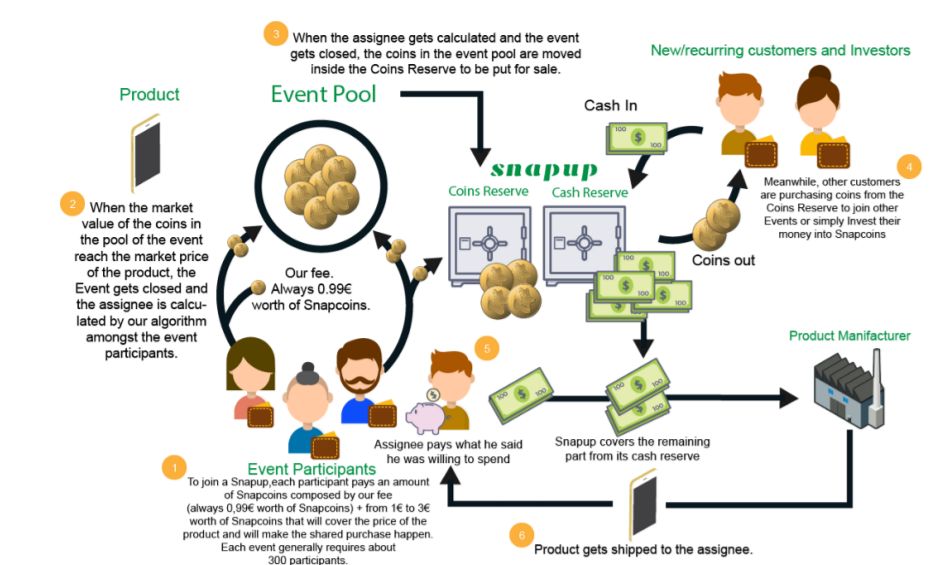

Business Model

Apparently, they make a profit off a small fee to participate in the auction or in events they call "Snaps." The Snap ends when the total amount of the collected fees total the market price of the product. They also earn money from people buying snapcoins.

The winner of the Snap is determined using an algorithm. The algorithm benefits users that have accumulated the most "Karma Points." Karma points are earned by every action a user performs on their platform, like inviting a friend to join, sharing your experience or other’s on your social media, buying Snapcoins, etc.

Questions pop up in my mind regarding their business model that are not answered in their whitepaper are:

a) What happens when the total value of the collected fees don't reach the market price of the item being offered? Does this mean the Snap will go on forever?

b) Their business model assumes that users will constantly buy and interact with their system by the large. The number of participants in a Snap and the frequency of these Snaps determine their income. What happens when several products go unsold? I guess they solve this by employing a dropshipping model where they don't really have to spend anything until a product is actually sold. But it doesn't remove the fact that this is similar to a Ponzi Scheme.

c) What portion of the cash reserve is allocated to the purchase of the product, employee salaries, and investments? Is there a fund being maintained to help the company survive in case there is a prolonged period where people stop interacting with the system?

The Team

I'm not gonna pretend that I know everyone in the crypto world. Frankly, I have no idea who any of these people are. So let's research the top guys together.

a) Alessio Cozzolino

Fact Checking:

The only credible link I found was his linkedin page: https://www.linkedin.com/in/alessio-cozzolino-838493108/

I don't like these sources since they were also made by the individual themselves. I prefer those done by credible 3rd parties. I couldn't find any though. The person that fills google pages when I type his name is an accomplished University of Dublin professor.

b) Carmine Cozzolino

I found nothing on this guy as well apart from his linkedin profile: https://www.linkedin.com/in/carmine-cozzolino-1a315253/

The person that pops up on google is a world renowned chef.

The only other sites I found referring to these two are sites that talk about Snapup, which to me are not reliable. When it comes to gathering evidence, 3rd party sources with no interest in the objective at hand are always top of the heirarchy.

Partners

NONE. Nada.

But they do post this on their website:

Keep in mind, these are POTENTIAL partners. It baffles me why they placed this. Since normally the company should give you permission before you can use their icons on your site and state that they are your partners. So they might already be engaged in talks who knows.

Conclusion

I personally would not invest in them. Given that they have several unanswered questions and their business model is not self-sustaining. There are also several discount and coupon apps that address their proposition, though it may not be 90% discount. Also the fact that I couldn't find jack sh*t regarding their top members. Again, this is just my opinion. You should make your own research and draw your own conclusion.

Great analysis. Here are some that I'm interested in. Hopefully you could review at least one of them.

https://ico.nexus.social

https://www.ongcoin.io

ahoolee.io

http://revain.org/

https://dmarket.io/

Keep up the good work!

can't really tell if it is legit, until you hold the coins/tokens and can dump at decent prize if you wish to do so...

that Estcoin might be exception, cuz it's backed by country...

love the analysis!

my approach to nonsense content is to just skip blabla till something interesting pops. but apparently as you reasonable notice, nonsense content in white paper is not good sign, probably its there to throw to the air some shiny buzzwords to make it feel sexy an expert and fill the space

from now i will use 'nonsense test' in my ico valuation

random thought: you should run web cite for ico valuations and make money with ads. actually just negative ones is great, no one could say you are biased.

second thought: better not.. they will eventually corrupt you with lures and the cite will start to promote junk icos based on amount of bitcoins paid for promotion...

By reading the analysis is clear that you haven't researched the project.

Each user joins an event paying a fee in Snapcoin and places his bid between 10 to 20% of the retail price of the product.

The number of participants will generally not surpass 300 people.

The product gets purchased directly from the retailers at its full market price, with the corresponding amount in FIAT Currency of the sum of the Snapcoins payed by the users, and gets drop-shipped from the retailer directly to the Assignee of the Event, that pays the amount of money he said was willing to spend.

The assignation process is based on Meritocracy.

The more you are an active user on the platform, and the closer to 20% of the retail price of the product you are willing to pay, the higher your chances are to be the assignee for that Snap.

Please before undermining the reputation of a company,

make sure that what you are saying is correct, and also do your research,

because we have thoroughly spoke about all the issues you were concerned about on our youtube channel, and bitcointalk announcement thread

YOUTUBE: https://www.youtube.com/channel/UCftxx2X6RcyXshjivYsMOaQ

Bitcointalk: https://bitcointalk.org/index.php?topic=2047956

WHITEPAPER: https://ico.snapup.biz/snapup-wp.pdf