10 keys for evaluating Initial Coin Offering (ICO) investments

The initial coin offer (ICO) is a fundraising method that trades the future crypto coins for cryptocurrency that has a direct liquid value. Typically, token percentages are sold to ICO participants and percentages are kept for the needs of the company (private investor, etc. Requirements differ from one ICO to another). ICO allows large and small investors to fund projects they like. The last year brought thousands of successful ICO stories. The motivation for this project is clear. The motivation for ICO investors is that the token price will be higher (or much higher) than the token price during ICO.

ICO is really hot among crypto investors. Recently, Hdac and Filecoin collected $ 258 and $ 275 million respectively. The success of ICO is influenced by many aspects. Investors should be kept in mind following the key elements discussed in this article.

At this point it is appropriate to mention a less successful story like ICO Mycelium. Members of his team disappeared after collecting money, and then reported that they used the funds to pay for their own holidays. Lack of regulation may be one of the reasons why it happens. A few days ago, $ 7 million was stolen when ICO CoinDash started. Just before the token sale begins, their website gets hacked and the address of the ICO wallet is changed to hacker addresses.

This article will discuss the key to paying focus when evaluating ICO investments.

* Important warning before we begin: ICO is a high-risk fundraiser. Never invest anything you can not completely eliminate. Remember that due to lack of regulation, you will have trouble getting back your lost money in case of failure.

1 - Team Composition

Find out everything you can about the team, especially the development team and the advisory board. Seek each team member for relevant experience. Google their name. Visit their LinkedIn profile. Look for famous names among project advisory boards. Find out if the team has a crypto experience and more importantly - where the project, or ICO, they are involved with and the impact they have.

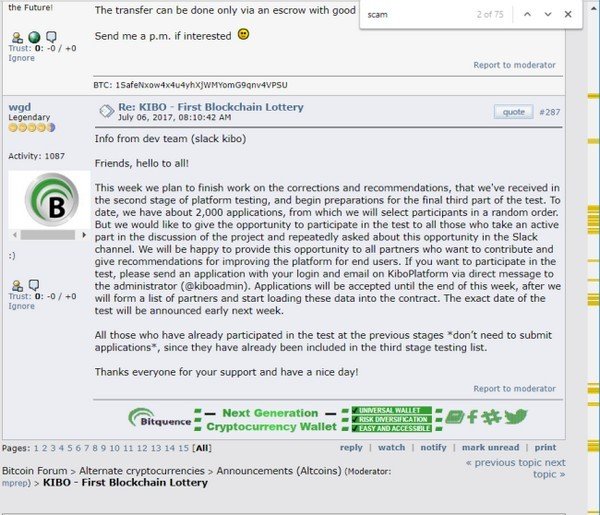

2 - Bitcointalk.org Thread

A good starting point is the project announcement thread (ANN) at BitcoinTalk.org, because Bitcointalk is the largest forum for Bitcoin and crypto related issues. It is strongly recommended that you read the message carefully. Investor concerns will be answered (or perhaps missed) on this thread. This is a bad sign when developers avoid answering certain questions or not collaborating. Sending private messages to see how they respond is also a good idea.

Each message in Bitcointalk contains the rank and activity level (the last number of messages) from the sender. Be aware of beginners and low-level writers. Reputation becomes very important and significant.

Be aware of the comments of experienced authors, and also look for negative messages, sometimes it can be a warning sign. Use Select [All] to view all comments in thread and use CTRL + F (Windows) to search for red flag words like 'scam', 'con', 'MLM'. See the relationship between search results and the total number of replies as can be seen in the following direct example:

3 - VC project and investment stage

Evaluate the project phase. Does it only have a whitepaper? Beta version? Are there any products that are launched with limited functionality? Prefer projects that have "multiple lines" of work code, however, many ICOs have proven that they can be success stories without written code.

VC (venture capital) tends to invest and support the project from an early stage. Look for this information usually on the main page of the project website. It would probably be great if the famous VC crypto was involved, like Blockchain Capital or Fenbushi (belonging to Vitalik Buterin - founder of Ethereum).

4 - Community and Media

It's important to have a wide-open support community like Public Slack for all investors. Openness is a very important thing in gaining our trust as a Github code. Try to understand the atmosphere within the community. Look at the size of the community and its activity.

Other sources such as Reddit, Twitter or Facebook can be relevant when evaluating a project. Be wary of posting gifts. It is a common practice to launch a prize thread to reward users for spreading positive information about a project to improve media coverage, or to help with translation. These prize threads can stimulate the hype around the project but they are not very objective. On the other hand some investors only participate for some tokens.

5 - What do they need that token for? Is blockchain required?

ICO means creating a new custom token for the project. One of the most important questions every project should answer is what token is? Why is Bitcoin or Ethereum not enough to serve as a project token? Yes, many projects only make scammy stories. Hi, ICO can not be ICO without special token. The same question needs to be asked regarding the use of blockchain technology behind the project.

6 - Unlimited / Hard cap

In the early days of crypto ICOs, the difference between open and hard caps did not have the same impact as the current ICO. The open lid allows investors to send unlimited funds to the ICO project wallet. The more coins in circulation, the less unique your token is to trade afterwards - through less demand.Because ICO becomes mainstream in crypto soil, very large quantities are collected. Take a look at Bancor, the project generates an astonishing $ 150 million in just three hours. This does not generate percentage gains for investors. Remember that when participating in ICO indefinitely.

On the other hand, you do not want to be the only one who invests in the project. The exchange has less interest in projects that increase very little, which makes it more difficult to sell this token after its release.

7 - Distribution Token - when and how

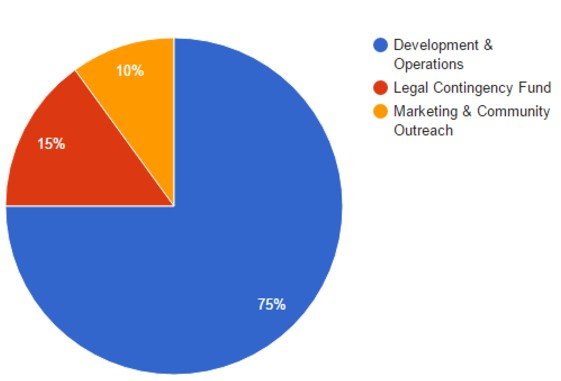

Greed can be defined with a high token distribution to team members, say, over 50% of suspicious tokens. A good project will link the distribution of tokens to the road map. Because each phase or project milestone requires a certain amount of funding.

Note the token distribution stage. Some projects just released their token a few hours after the ICO ended. Some projects need to develop a beta before sending a token. If you look at Etherium percentage gain (one year between ICO and token distribution, about 500% increase), Augur (1+ year, 1500%) and Decent (8 months, 350%), sometimes this pause creates a very positive, gembor around the project.

8 - Evaluating Whitepaper

Most typical investors do not actually read through the whitepaper, even though it contains all the necessary information about upcoming projects and ICO.

Do not hesitate to read it, or at least most of it. Pay attention to the strong and negative aspects and add some of your own research. In the end, whitepaper is a silver plate for potential investors. After reading it, you should be able to answer a simple question - what value does this project give to our world? You will also learn what you invest.

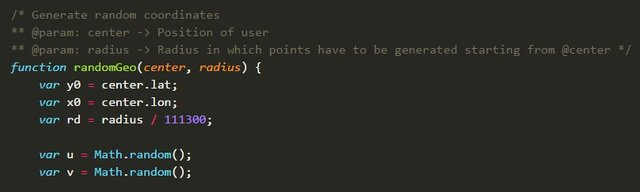

9 - Code Quality - Meet Github

If you have a little programming experience, you should use it here. The quality of developers can be understood by analyzing some of their code. As a non-technician, it is still possible to evaluate their quality by looking at the consistency of the code. Another good indicator, is the use of appropriate comments. Avoid messy developers. A piece of code reflects the developer's attitude.

Furthermore, the length of the function is another indicator. Functions containing more than 50 lines of code should raise a red flag. Modularity is important and makes the code easier to read and maintain.

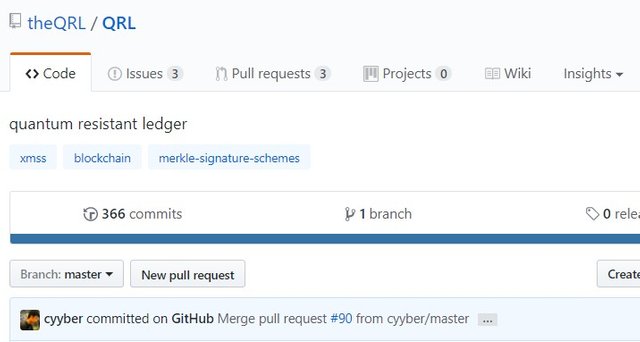

Crypt projects tend to have open-source code. This creates trust among the project community, encouraging developers from the community to make suggestions or improvements. The open source project provides an opportunity to view the commit log. Commit is basically a developer slang to push a piece of code into the Github code repository.

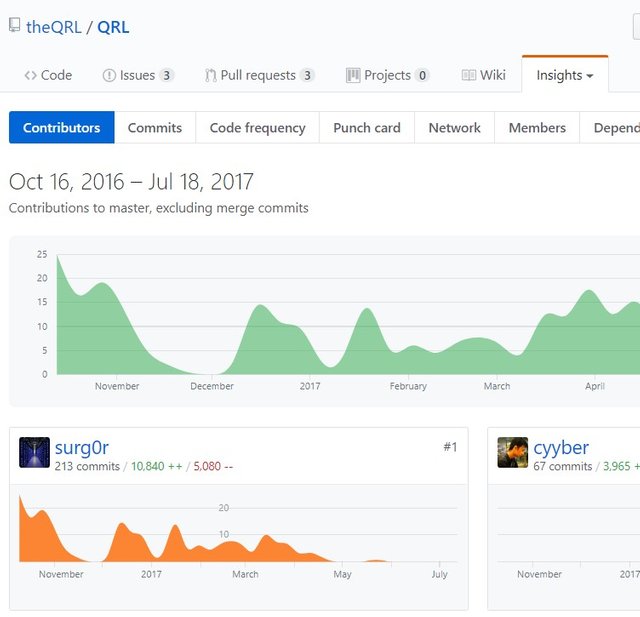

You can view each commit by clicking on the text that says "366 commit". This allows you to investigate any changes. The "Insights" tab gives you a more general summary of developer activity. This tab shows graphs with number of commit every day. Below the graph, you can see each developer's activity individually. This information is the key to investigating the development team.

Bonus: Ask yourself why the project chooses to run on a particular blockchain. Whether it's in blockchain Bitcoin, Ethereum (smart contract), Waves, and more. Recent months have shown increasing popularity among ICO smart contracts based on Ethereum ERC-20. These tokens can be stored easily on Ether-based wallets (such as MEW - Myetherwallet), sometimes they do not require exchange for trading, and they usually have high liquidity.

10 - The Bottom Line

ICO will become increasingly 'mainstream' as a method to raise funds. There will be many projects to choose from, so it will be more difficult to assess these projects.

This is the key to investigating and reading as much information as possible and writing down all important, positive and negative aspects before making an investment decision.

Coins mentioned in post:

wow.. is cool @coin.info

Hi I upvote you.... I am new to this platfrom plz visite my profile........ if you like my contents then follow me and upvote me :) @palcrypto

thank you @palcrypto