Yield Farming Leads Crypto Market Gains

The DeFi sector demonstrates unstoppable strength, with Aave, Uniswap, and Compound leading a rally that rekindles investor enthusiasm.

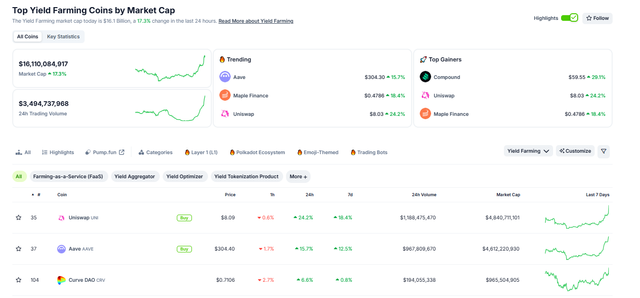

The yield farming sector has emerged as the undisputed protagonist of the current cryptocurrency market rally, recording the largest gains and attracting a wave of capital. According to the latest data from CoinGecko, the overall market capitalization of this sector saw an impressive 19.1% growth in the past 24 hours, reaching a staggering $16,322,950,762. This boom is supported by a solid trading volume of $3,456,269,283, demonstrating intense activity and growing investor interest.

According to the latest data from CoinGecko, the overall market capitalization of this sector saw an impressive 19.1% growth in the past 24 hours, reaching a staggering $16,322,950,762.

DeFi Giants Drive the Rally: Aave, Uniswap, and Compound Lead the Way

The list of the sector's most trending and top gainers reveals that large- and mid-cap decentralized finance (DeFi) protocols are leading this impressive rally.

Compound (COMP) is positioned as the king of gainers, up a whopping 29.6% to trade at $59.97. This rally suggests renewed confidence in one of the pillars of the DeFi lending sector.

Decentralized exchange giant Uniswap (UNI) is not far behind, posting a 25.0% gain to reach $8.16. Its presence on both the trending and top gainers lists underscores its critical importance and strong user interest.

Aave (AAVE), another leading lending and borrowing protocol, has seen its value increase by 17.1%, trading at $307.69. Its position on the "Trending" list indicates that the market's attention remains firmly focused on this asset.

Maple Finance (MPL), priced at $0.4862 and up 18.6%, demonstrates that interest is also extending to innovative platforms focused on institutional lending within DeFi.

The confluence of these prominent protocols leading the yield charts underscores an injection of liquidity and growing confidence in established DeFi platforms that are central to the yield farming ecosystem.

Category Overview: Optimization and Tokenization on the Rise

While the overall growth of the sector is notable, a more detailed analysis by category within Yield Farming offers interesting insights:

Yield Optimizer posted a solid 9.5% increase, with a market capitalization of $317,930,532. This reflects a growing demand for automated strategies that maximize yields.

Yield Tokenization Protocol also posted healthy growth of 7.9%, reaching a market capitalization of $743,590,081. Tokenization of future yield streams is gaining traction, suggesting interest in more sophisticated DeFi strategies.

Yield Aggregator saw an increase of 7.3%, with a market capitalization of $688,110,606. These platforms, which simplify access to multiple yield farms, continue to be a key entry point for many investors.

Farming-as-a-Service (FaaS), while positive with a 1.6% increase and a market cap of $3,823,519, shows more moderate growth in comparison, perhaps due to its smaller scale or adoption phase.

Yield Tokenization Product remains stable at 0.0%, which could indicate a pause in its movement or lower liquidity at this time.

Short-Term Outlook: Cautiously Bullish

The short-term outlook for the Yield Farming market is clearly bullish. The significant increase in market cap and robust trading volume are indicative of strong buying pressure. The substantial gains seen in key protocols such as Compound, Uniswap, and Aave suggest that confidence is returning to the decentralized lending and exchange space. The positive trend across most Yield Farming subcategories reinforces this optimistic outlook.

However, in such a volatile market, rapid rallies can often be followed by periods of consolidation or profit-taking. Traders and investors should remain vigilant for sustained volume, price action around key resistance levels for individual tokens, and overall market sentiment for Bitcoin and Ethereum, as these factors often influence the DeFi sector. For now, the data points to a positive and active market environment for yield farming assets in the near term.

What is Yield Farming? The Key to Decentralized Finance

Yield farming is a strategy in the world of decentralized finance (DeFi) where investors seek to maximize the profits from their crypto assets. It involves locking cryptocurrencies in DeFi protocols to provide liquidity, participate in lending, or staking, in exchange for rewards in the form of additional cryptocurrency. Imagine "depositing" your coins in a protocol and, in return, receiving "interest" or "dividends" in the form of new coins or fees for the transactions you facilitate. It's a way to earn passive income in the blockchain ecosystem, leveraging smart contract infrastructure.

Disclaimer: The information contained in this news item is for informational purposes only and does not constitute financial advice. The cryptocurrency market is highly volatile, and investments carry significant risks. It is recommended that you conduct thorough research and seek professional advice before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.