xSigma Review 2021 (SIG)

What Is xSigma?

xSigma is a subsidiary of ZK International, which is a publicly traded company listed on Nasdaq (NASDAQ: ZKIN). Primarily conceived as a blockchain research and development lab to complement ZK International's foray into providing blockchain solutions, xSigma is working to address many of the key issues surrounding the adoption of blockchain solutions. use it to this day.

This involves exploring new ways blockchain technology can be integrated into existing infrastructures and improving them. It includes learning how to intelligently adapt blockchain for finance, logistics, supply chain, internet of things (IoT) and infrastructure.

As a new company, xSigma Corporation is currently building its own decentralized finance (DeFi) platform in an effort to bring inclusive and equitable access to financial services to all. xSigma wants to create a DeFi platform that is not only safe and highly secure, but also very user-friendly.

Forming a core part of xSigma's groundbreaking blockchain research and development, the team is led by developers and engineers from renowned technology organizations. This includes ex-employees at Google, Facebook, Ripple, Amazon, and xSigma's DeFi rivals. First launched in the DeFi arena, xSigma has attracted over $115 million in total locked-in value (TVL). ) in the DeFi protocol just 24 hours after launch.

What Can You Do on xSigma's DeFi Platform?

xSigma has garnered a lot of excitement following the launch of its decentralized finance (DeFi) platform on February 24, 2021. It is currently among the top 25 DeFi protocols by volume and base growth. user base shortly after its public release. because xSigma has the distinction of being a DeFi protocol backed by a large company listed on Nasdaq and also regulated by the SEC.

xSigma is a decentralized stablecoin exchange (DEX) and liquidity mining platform. It was built as a decentralized application (dApp) that was built and deployed on the Ethereum network.

xSigma's decentralized exchange protocol is based on the tried and tested StableSwap algorithm built by Curve Finance in 2019. The exchange itself - like many other DeFi exchanges - is powered by an automated market maker (AMM) to power trading.

This means that, unlike regular order exchanges, users on xSigma pool their tokens together into Liquidity Reservoirs. These users will become Liquidity Providers. Using xSigma's AMM model, the algorithm makes decisions based on available metrics such as supply and demand to find the best price for a given asset or trading pair. In essence, instead of having to match your price with an order book placed by someone else, users can trade algorithmically.

- Quickly and Seamlessly Exchange Stablecoins

Using an automated market generator has several key benefits over a more traditional order book exchange. Not only does it ensure that a particular trading pair is priced fairly and prevents slippage, which can be a big deal for less liquid assets to protect traders. It also allows users to earn passive rewards. Providers can earn a portion of trading fees from the tokens they have fed into the Liquidity Pool.

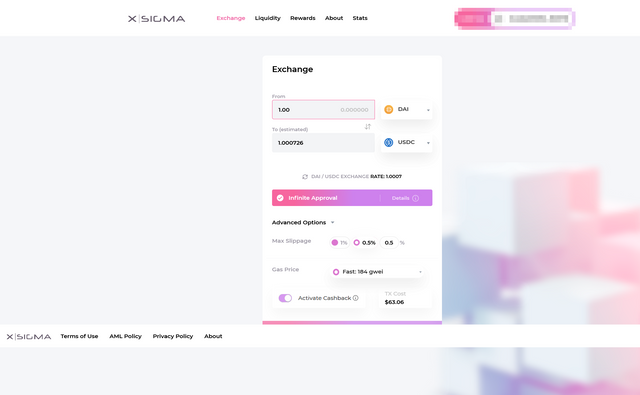

xSigma's stablecoin-focused DEX, users can easily and quickly trade from their choice of three different stablecoins - DAI, USDC, USDT - once they have connected their wallets to xSigma, just like using MetaMask browser-based crypto wallet. So this gives you a place where you can swap between stablecoins very quickly and more importantly, with minimal slippage to maximize the amount you get. That is if you don't charge ridiculous gas fees on Ethereum these days.

- Earn Passive Rewards by Providing Liquidity

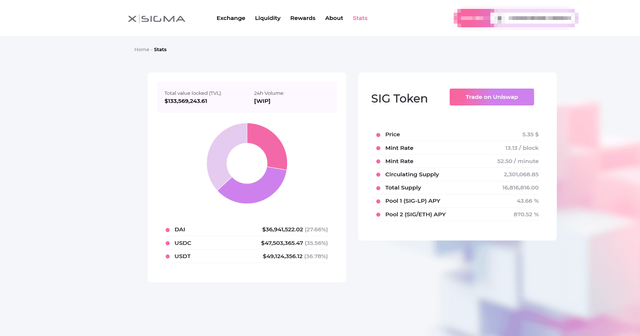

users can also choose to pool their stablecoins together into select liquidity pools to earn rewards. By doing so, those Liquidity Providers can earn a portion of the fees on transactions and exchanges that occur from the liquidity pools they have chosen. At the time of writing this xSigma review, there is over $133.5 million in total value locked (TVL) in its liquidity pool - $36.9 million DAI, $47.3 million USDC and 49 ,3 million USDT.

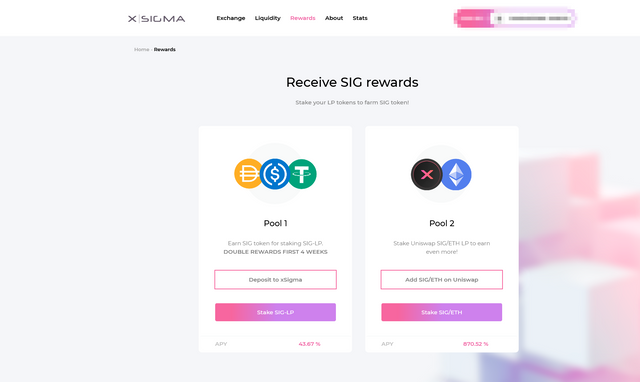

In return, they can earn xSigma's native SIG-LP (Liquidity Provider) tokens as an incentive. xSigma's SIG-LP tokens are used to represent your share in the liquidity pool. These SIG-LP tokens can then be placed into two select pools which then enable the Farm Liquidity Provider for SIG crypto tokens. There are currently two staking pools available on xSigma:

Group 1 - Fully supported on xSigma where you can stake SIG-LP crypto in return for earning SIG tokens. At the time of writing this xSigma review, you can earn 46% APY earnings in SIG.

Group 2 - Much riskier but also more profitable. You can stake your newly earned SIG tokens on Pool 2, which is the SIG-ETH liquidity pool supported on Uniswap. There you can earn 853% APY earnings - as of writing this xSigma review.

xSigma's Future Roadmap Updates

Although still very young in the fierce and fairy-tale competitive unregulated DeFi arena, xSigma has already gained a large following and is now working to fulfill its very ambitious goal of rapidly opening expanding its user base in 2021. In addition to xSigma's DeFi effort, we have also hinted earlier that xSigma is planning to enter the equally hotly discussed world of tokens that cannot alternative (NFT) with its own market.

Powered by multiple blockchains beneath it, such as Ethereum and Polkadot, xSigma will build a new open NFT marketplace where users can buy, sell, or trade a variety of NFTs. In 2021 alone, NFT has become a $1.3 billion industry. Recently in this xSigma review, xSigma was able to engage NBA champion Dwight Howard in promoting xSigma's DeFi platform and hopefully gain a similar celebrity following for the NFT ecosystem as well. its.

The rest of 2021 - mostly within March and April - will see xSigma continue to improve on their DeFi platform. Additional marketing and technical optimizations are underway, as is their DAO upgrade to make xSigma a truly decentralized network.

xSigma will also explore other options to attract more users, such as listing new tokens, adding new farming pools, integrating Layer2 scaling solutions, applying more data sources for pricing models, UI redesign, porting xSigma's DEX to other blockchains and much more.

More info:

website: https://xsigma.fi/

https://medium.com/xsigma-defi

https://t.me/joinchat/AAAAAE8dxPOt5w8MPcbBdg

https://discord.com/invite/FpkMHJq

https://twitter.com/xSigma5

whitepaper: https://docs.xsigma.fi/

Authur: Gabriela1999

ETH : 0x85B47A2cdD209475c6755C6dff4b4C488cB2C849