Understanding XinFin’s Financial Solution

It is worth noting that the global financial structure does not favor participants in international trade. From XinFin’s perspective, the major players ought to have a stable financial structure that lets them trade without hitches. With its formulation as a “Blockchain for Trade and Finance”, XinFin is here to disrupt the traditional settings in international trades. We’ll look at the process of acquiring and using funds within the TradeFinex platform.

Application and Review

It is an assumption that many beneficiaries (individuals, organizations, and governments) that want to embark on a project often have shortfalls in finance. Therefore, they resort to alternative means of raising money. In fiat settings, the World Bank and related agencies, such as the International Monetary Fund (IMF) can offer a helping hand.

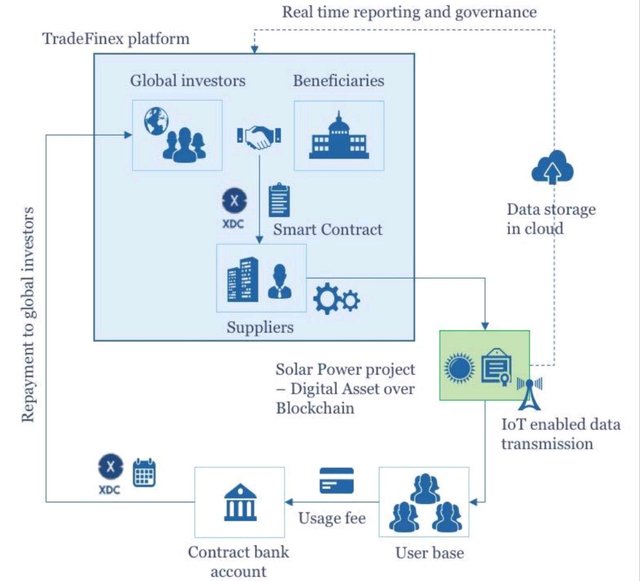

Because of the decentralized structure, XinFin wants the applying and receiving parties (Beneficiaries and Financiers) to perform transactions via the decentralized trade platform – TradeFinex.

The first stage is the application and review of fund requests. In this case, the beneficiary posts a finance query/applies for finance through the TradeFinex.org platform. The query gets wide distribution and interested financiers can get in touch with the beneficiary. After each party determines and gets satisfaction with the underlying terms, they can then accept the proposal from each party and proceed to the next stage.

Agreement and Funds Disbursement

TradeFinex use the smart contract technology to underwrite the terms of agreement between the two parties. In this case, the beneficiary and financier will include the terms of the contract into the blockchain-based smart contract.

Afterward, both parties will integrate their digital wallets into the smart contract for onward disbursement and receipt of funds. Note that the funds will follow a stage-by-stage disbursement format. This implies that the completion of the first stage leads to release of funds for the second. With this postulation, it will be easier to monitor and fast-track progress on the project.

Contracting, Reimbursement, and Project Completion

The final stage of the project’s milestone is the contracting of the supplier. As funds get to him in bits, the beneficiary remits the same to the supplier in exchange for items needed for the project. On completion, the beneficiary raises funds and begins milestone reimbursement to the financier. After successful completion of the borrowed funds, both parties (the beneficiary and the financier) will close the smart contract and rate each other’s performance.

Roadmap

Token Information

Ticker: XDCE

Platform: Ethereum

Token Supply: 15 billion XDCE

Token Standard: ERC-20

Token Type: Utility

Country of Registration: Singapore

Conclusion

A decentralized solution, such as the one presented by XinFin will go the extra mile in changing the fortunes of international trade. It is worth mentioning that the availability of finance and an effective monitoring system (courtesy of the smart contract technology and the XDC01 Protocol) will go the extra mile in boosting XinFin’s fortunes in cross-border trades.

WEBSITE | YOUTUBE | LINKEDIN | TWITTER | TELEGRAM | GITHUB

Contact Me

Name: Chidiebere Umeh

Telegram: https://t.me/iCollinberg

Email: [email protected]