CME to Gauge User Interest for Ether Futures After Index Launch

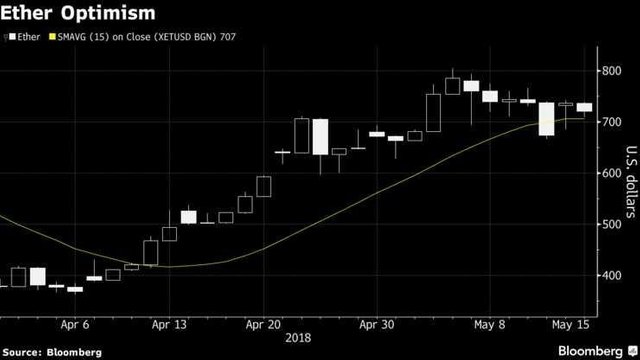

CME Group Inc. will review client demand for Ether futures after launching an index tracking prices of the second-largest cryptocurrency.

“We’ll continue to gauge with them to ascertain the demand for futures,” Tim McCourt, CME’s head of equity products, said during an interview Monday at an industry conference in New York. “There are no plans at the exchange to launch one currently.”

CME started publishing the CME CF Ether-Dollar Reference Rate and the CME CF Ether-Dollar Real Time Index on its website Monday. Trading platform Crypto Facilities Ltd. calculates the rates using transactions and order book activity from cryptocurrency exchanges Kraken and Bitstamp.

CME launched the Bitcoin reference rate and index in November 2016 and started offering Bitcoin futures in December. While Bitcoin futures trading volume has been lower than what some expected given the hype around the launch, McCourt said CME is encouraged to see volume rising every month and the tight spread between futures prices and the spot market.

Claims that Bitcoin futures trading on the CME and Cboe Global Markets Inc. led to the decline in the cryptocurrency’s prices are probably off, McCourt said.

“If you look at the notional that trades, it’s tough to say that futures were responsible for that selloff given the relatively small percentage contribution to Bitcoin trading,” he said.

There’s demand for physically-delivered Bitcoin futures in addition to the CME’s and Cboe’s cash-settled ones, but the market infrastructure for institutional trading of such a contract isn’t there yet, he said.

“There’s a clear demand for it in the market; people would welcome that innovation,” McCourt said. “With physical delivery you have to figure out what to do with the Bitcoin; are you going the custody route, are you going the private key route, those are very interesting questions and we’re looking forward to some of those solutions availing themselves in the market, but right now the community is best served by a financial contract.”

By: Camila Russo

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.reddit.com/r/Buttcoin/comments/8job7o/cme_the_folks_behind_bitcoin_futures_to_gauge/