Selling Shovels in a Cannabis Gold Rush

There is a popular phrase in the startup world that “during a gold rush you can mine for gold or you can sell shovels”. During the California Gold Rush, in 1849, thousands flocked west to seek their fortunes in the rolling hills and mountain ranges of the wild open country.

While most Joe Schmoes were out in the river panning for gold and looking to strike the motherload, some savvy entrepreneurs saw the large market that was developing in selling to these prospectors. Entrepreneurs like Levi Strauss and Samuel Brennan were among those who sold pickaxes, jeans, wheelbarrows, tents and whatever else the gold-thirsty men wanted and wound up millionaires.

Mining for gold ended up on-aggregate to be a worse return on labour and capital than setting up shop as a provider of ancillary goods (aka “selling shovels”).

Fast forward 170 years and there is a new Gold Rush upon us: the Cannabis Gold Rush. If you are less inclined to invest directly in volatile cannabis company stocks but want exposure to the sector, or think a “selling shovels” strategy is more your style, then here are some companies that are ancillary to the cannabis industry but not cannabis companies for you to consider in your portfolio:

The Brink’s Company (NYSE:BCO)

Cannabis is illegal at the federal level in the United States. It’s a Schedule 1 drug – the same category as LSD and heroin and seen as having no therapeutic value. Big banks and payment companies are too scared to dabble in providing their services in the states where cannabis is legal, so cash is king. Cash is also dangerous to have, which is why cannabis companies use armoured car services such as Brink’s to move and store their money. With the cannabis business booming more money being spent means more money that needs to be moved and protected which means more business for protection service companies like Brink’s.

Shopify (NYSE:SHOP)

Canadian software-as-a-service provider Shopify has been working hard to get involved in the cannabis space. In a recent earnings call Spotify’s COO Harley Finkelstein made clear the company is already well set up, and has contracts in place, to “capture the upside” of the cannabis industry in Canada. Shopify’s value-ad is it runs an e-commerce platform that connects retailers with suppliers and consumers. The platform will analyze large troves of the data it generates and recognize within it consumer buying trends which will help retailers, suppliers and growers maximize their revenue.

Shopify has partnered with some of the largest growers in Canada including Canopy Growth Corp. (NYSE:CGC), Aurora Cannabis Inc. (TSE:ACB), The Green Organic Dutchman (TSE:TGOD), Hexo Corp. (TSE:HEXO) as their point-of-sale platform provider. The company is also involved with the Government-run cannabis store websites for the provinces of Ontario and British Columbia.

There is a popular phrase in the startup world that “during a gold rush you can mine for gold or you can sell shovels”. During the California Gold Rush, in 1849, thousands flocked west to seek their fortunes in the rolling hills and mountain ranges of the wild open country.

While most Joe Schmoes were out in the river panning for gold and looking to strike the motherload, some savvy entrepreneurs saw the large market that was developing in selling to these prospectors. Entrepreneurs like Levi Strauss and Samuel Brennan were among those who sold pickaxes, jeans, wheelbarrows, tents and whatever else the gold-thirsty men wanted and wound up millionaires.

Mining for gold ended up on-aggregate to be a worse return on labour and capital than setting up shop as a provider of ancillary goods (aka “selling shovels”).

Fast forward 170 years and there is a new Gold Rush upon us: the Cannabis Gold Rush. If you are less inclined to invest directly in volatile cannabis company stocks but want exposure to the sector, or think a “selling shovels” strategy is more your style, then here are some companies that are ancillary to the cannabis industry but not cannabis companies for you to consider in your portfolio:

The Brink’s Company (NYSE:BCO)

Cannabis is illegal at the federal level in the United States. It’s a Schedule 1 drug – the same category as LSD and heroin and seen as having no therapeutic value. Big banks and payment companies are too scared to dabble in providing their services in the states where cannabis is legal, so cash is king. Cash is also dangerous to have, which is why cannabis companies use armoured car services such as Brink’s to move and store their money. With the cannabis business booming more money being spent means more money that needs to be moved and protected which means more business for protection service companies like Brink’s.

Shopify (NYSE:SHOP)

Canadian software-as-a-service provider Shopify has been working hard to get involved in the cannabis space. In a recent earnings call Spotify’s COO Harley Finkelstein made clear the company is already well set up, and has contracts in place, to “capture the upside” of the cannabis industry in Canada. Shopify’s value-ad is it runs an e-commerce platform that connects retailers with suppliers and consumers. The platform will analyze large troves of the data it generates and recognize within it consumer buying trends which will help retailers, suppliers and growers maximize their revenue.

Shopify has partnered with some of the largest growers in Canada including Canopy Growth Corp. (NYSE:CGC), Aurora Cannabis Inc. (TSE:ACB), The Green Organic Dutchman (TSE:TGOD), Hexo Corp. (TSE:HEXO) as their point-of-sale platform provider. The company is also involved with the Government-run cannabis store websites for the provinces of Ontario and British Columbia.

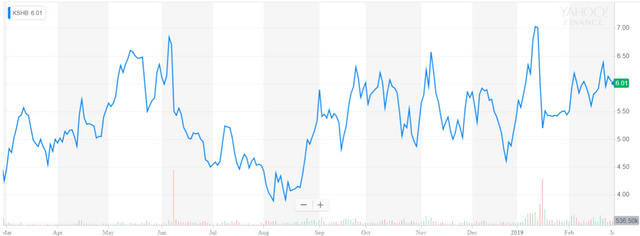

KushCo Holdings (OTCQB:KSHB)

KushCo Holdings is the parent company of Kush Supply Co., Kush Energy, The Hybrid Creative, and Koleto Innovations. These companies provide a range of ancillary products and services for the regulated cannabis and CBD industries.

One major product line for KushCo is packaging. Regulations for packaging and labeling in the cannabis and CBD industries vary widely across different jurisdictions. KushCo provides tamper and child resistant packaging that comply with regulations. The company already provides products and services to over 5,000 growers worldwide.

Kush Energy, owned by KushCo, provides hydrocarbons and solvents used in producing cannabis oils and extracts. Hybrid Creative provides brand development services and e-commerce solutions targeted at the cannabis industry. KushCo just added legendary investor and entrepreneur Danny Moses to KushCo’s advisory board. Mr. Moses “will help provide strategic advice and expertise to help accelerate profitable growth, manage risk and enhance operational performance” for the company.

Thank you!

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/selling-shovels-in-a-cannabis-gold-rush/

!cheetah ban

Plagiarism

Okay, I have banned @tellall.