A Guide to Developing Custom Web Applications for Fintech

Fintech companies are disrupting traditional banking and financial services by leveraging technology to offer smarter, faster, and more personalized solutions. At the heart of this transformation lies one crucial asset: custom web applications.

Whether you're building an investment platform, a digital wallet, or a loan management system, custom web applications empower fintech firms to deliver seamless, secure, and regulatory-compliant services. In this guide, we’ll walk you through the key considerations, processes, and best practices for developing a custom web application tailored for the fintech industry.

Understanding the Fintech Ecosystem

Before you dive into development, it’s essential to understand the complex ecosystem in which fintech applications operate. This space is shaped by:

Strict regulatory requirements (PCI DSS, GDPR, SOC 2, PSD2, etc.)

High security expectations to protect sensitive financial data

Demand for real-time transactions and analytics

User-centric design to ensure seamless digital experiences

A successful fintech web application needs to balance innovation with iron-clad security and compliance.

Key Steps in Developing Custom Fintech Web Applications

Define Business Objectives and User Needs

Start by outlining the problem your app is solving and the unique value it offers. Engage with your target audience to map their journey, pain points, and expectations. Align these insights with your business goals to create a clear development roadmap.Ensure Regulatory Compliance

Fintech is one of the most regulated industries. Depending on your market and services, your app might need to comply with:

KYC/AML protocols for identity verification

PCI DSS for payment data protection

GDPR/CCPA for user data privacy

PSD2/Open Banking standards for API-driven financial services

Incorporating compliance from day one helps avoid costly redesigns and legal setbacks later.

- Prioritize Security Architecture

Security is non-negotiable in fintech. Your web application should be built on a security-first foundation. Best practices include:

End-to-end encryption for data in transit and at rest

Secure authentication (2FA, biometrics, OAuth)

Input validation and sanitization to prevent injection attacks

Regular penetration testing and vulnerability assessments

Security should be embedded in both the development lifecycle and infrastructure setup.

- Choose the Right Tech Stack

Scalability, performance, and security all depend on a reliable tech stack. Popular choices for fintech web apps include:

Backend: Node.js, Python (Django/Flask), Java (Spring Boot)

Frontend: React, Angular, Vue.js

Databases: PostgreSQL, MongoDB, Redis

Cloud Providers: AWS, Microsoft Azure, Google Cloud (all offering financial-grade compliance services)

The right stack will also ease future integrations with APIs, payment gateways, and third-party services.

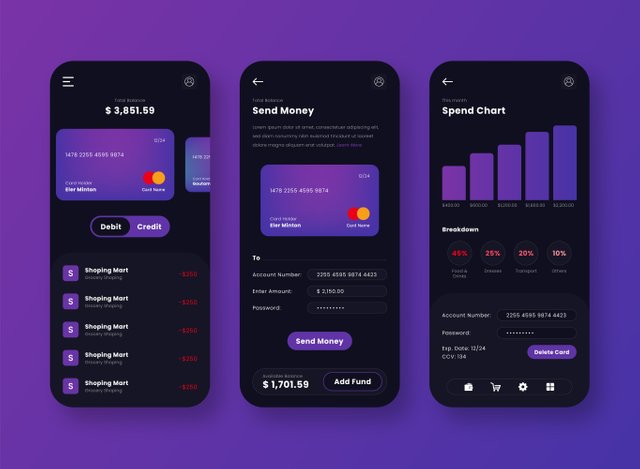

- Focus on UI/UX Design

A fintech app must build trust through clarity and usability. User experience design should emphasize:

Simple and intuitive navigation

Real-time feedback on actions (e.g., transactions, errors)

Accessibility across devices and browsers

Professional and clean visual identity that instills confidence

Embrace Agile Development and Continuous Testing

Given the dynamic nature of fintech, Agile methodologies allow your team to iterate fast and adapt to changing requirements. Pair this with continuous integration and automated testing to ensure stable, high-quality releases.Plan for Scalability and Future Growth

Your app should handle user growth and transaction spikes without breaking. Adopt a cloud-native architecture with auto-scaling, containerization (e.g., Kubernetes), and microservices to ensure flexibility.

Final Thoughts

Building a custom web application for fintech isn’t just about code — it’s about creating a secure, user-friendly, and compliant digital platform that can evolve with your business and user needs.

Partnering with the right development team and prioritizing a robust discovery and planning phase can save time and prevent future roadblocks. Whether you’re a startup or an established financial institution, investing in thoughtful web application development is key to thriving in the fintech space.

Readmore: https://www.synclovis.com/services/web-app-development-company/