Vitalik's Ambition: Making Ethereum "Bitcoin-like" Within Five Years

I. Vitalik's Ethereum Simplification Plan: From "Functionalism" to "Minimalism"

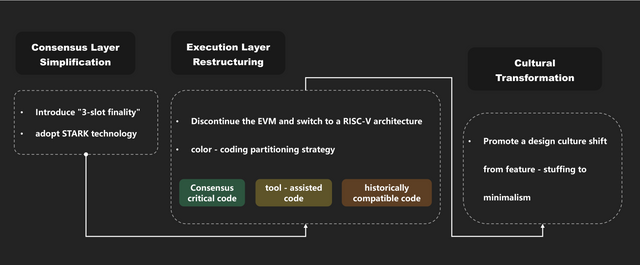

In 2025, Ethereum co - founder Vitalik Buterin proposed a long - term plan to simplify Ethereum's core protocol to near Bitcoin's simplicity. The goal is to boost resilience and decentralization by reducing protocol complexity. The specific path includes:

II. The Tug - of - War Between Simplicity and Functionality

III. Layer2 Battleground: Why Are Ethereum's "Clones" Experiencing In - fighting?

Despite Ethereum's expansion through Layer2 (similar to "sub - networks"), the ecosystem faces three major crises:

Power Game: What Happened to Decentralization?

- The core controllers of top Layer2s (like Arbitrum) remain in the hands of development teams, causing users to fear a "comeback of centralization."

- Token economy malfunction: ARB and other tokens plummeted on launch. Instead, Coinbase's Base chain rose by "not issuing tokens and focusing on social features."

External Rivalry Intensifies

- Solana attracts users with its 'second-level transactions,' while TON grows rapidly using Telegram's 900 million users.

- Ethereum's Layer2s are trapped in homogeneous competition: issuing points, doing airdrops, yet offering similar functions;

- Developer Complaints

- Creating DApps now is like opening a chain store – you have to redo the renovation on each Layer2, which is too costly!

IV. ETF Approval: An Opportunity and A Shackle

- SEC Gives the Green Light: In May 2024, Ethereum spot ETFs were approved and began trading in July, drawing in $9 billion in the first week;

- Price Roller - Coaster: ETH surged to $3,700 but fell back to the $3,000 range as it couldn't be used as collateral (due to fears of being deemed a security);

Future Effects:

- Institutional funds may flow to Layer2 tokens and AI projects (like rendering network RNDR), intensifying market segmentation;

- Regulatory Aftermath: The inability to use ETFs as collateral is akin to buying gold but not being able to earn interest from a bank. This reduces long - term appeal;

V. The Greatest Challenge of the Five - Year Plan: High Hopes vs. Harsh Reality

- Switching to RISC - V architecture requires rewriting smart contracts. Veteran developers ask,"What's the difference between this and learning a new programming language?"

- Risk of Community Split: Some argue that current ZK - Rollup tech suffices, and further changes are unnecessary;

- User - base growth lags behind the rate of Gas - fee reduction. The revenue from the DA layer (data storage) can't support the ecosystem;

The envisioned "explosion of modular applications" remains elusive. Do you believe in Vitalik's five - year gamble?

.png)