Strategy: Brief Overview

Looking back at my first few years attempting to trade I can't help but cringe thinking about how doomed my approaches were from the start, the poker term being drawing dead preflop. Whether it was taking suggestions from the daily ForexLive trade ideas, entering longer-term fundamental positions based on financial news articles, and even seeking out supposedly professional management services, the outcome was always going to be the same. The worst part about all of these strategies was that I not only did myself a great disservice by learning absolutely nothing but also poisoned my mind in the process.

As humans we are naturally social creatures and when it comes to things of uncertainty, such as gambling, that is amplified as we seek reassurance that what we are doing is correct. This is the reason why most poker players are part of a chat group. Especially when going through extended downswings where their supposedly +EV decisions go unrewarded for so long, they need to be reassured their decisions are indeed +EV as it is only natural to lose confidence. The problem when it comes to trading is that there isn't anyone to turn to and seeking such help will usually have the opposite effect.

When most people first get into forex they start with Babypips.com to learn all of the basics, which don't get me wrong is certainly helpful. However, one of the main writers for the site made an article about his trading performance for the year, which was something ridiculously pathetic like 1.9% well into the 3rd quarter. How can you possibly take anything that guy writes seriously, especially when you consider how long he's been in the game? It is the equivalent of a self proclaimed poker pro who's been playing for over 10yrs and is still buying in for $300 in a 2/5 game.

To wrap up my thoughts on this subject of solitude I want to summarize the various social aspects of forex for what they really are. On ForexFactory what you have are threads which discuss planetary solar cycles being used to predict euro patterns; indians whose post counts are higher than their balances, posting screenshots of their 1-minute chart analysis. ForexLive is a massive news feed of hindsight analysis and various financial data that serves little to no purpose, and every so often the veteran traders who run the site will come out with suggestions, quoting themselves repeatedly if they are right but making no mention of it again if they are wrong. On every social media outlet you have these parasite con artists trying to sell you their worthless systems and signal services, even going so far as to photoshop their trading portfolio. Absorbing this information will only cloud your judgment down to the subconscious level, either through eroding your conviction or giving you a false sense of security. I cannot stress enough how distressing it was to see two supposedly successful traders who I respected having opposing views, of course the plot twist being that they were both a fraud.

After extensive backtesting I have come to realize just how important timing truly is. Upon reaching the dreaded weekend at the end of a usually unprofitable trading week I would anxiously start counting down the hours until the Sunday open. Examining breakouts of the previous week I would try to figure out why they occurred, why they stopped at a particular price level, and how it slipped under my radar. In my personal studies I found that for most pairs the largest moves occur around the London open during the first half of the week, the early hours of the NY open (dependent on data) during the latter half of the week, and on Wednesday 2pm EST with the occasional FOMC event. This is obviously basic information, but when you look at a number of these moves you start to see that the 3am breakouts have consistent follow-up pressure, the 9am or 10am breakouts have a much higher rate of sharp reversals, and the 2pm breakouts consolidate relatively quickly. Such information is crucial to avoiding false breakout setups even after waiting for the hourly close, though as simple as it may seem most people are oblivious to it.

Textbook Breakout Trade. The most ideal trade setup is when a period of well-structured consolidation is followed by a wickless 1h breakout close around the London open that has adequate room to run. Well structured meaning that there is a strict, clearly-defined range to confine any volatility, almost as if there was an invisible rectangle containing the wicks, as opposed to a sloppy one where these wicks are protruding. Adequate room to run meaning that the breakout has the potential to freefall/skyrocket with no major S/R levels nearby, or that the breakout extensions before the consolidation weren't a choppy mess and provide well defined targets. It is very important that a breakout does not close precisely at the previous high or low for the week because there is a high chance of forming a double top, even if it closes with no wick rejection. You most often see this setup materialize when a pair begins to consolidate for 12+hrs starting from around noon ET up until the wee hours of the morning, remaining in a <20 or <30 pip range before finally making a decisive break.

This is an example of what I mean when I say that I go back to examine historical chart data. In this particular analysis what I did was note the start of a consolidation period followed by the eventual breakout and its size. As I previously mentioned they generally start around noon as liquidity fades and end in the twilight hours as London opens. The interesting thing to take away here is that when the breakouts come out of these clean ranges they have consistent follow-up, meaning that if a pair broke out for 30 pips it quickly goes into profit and continues for an additional 30 pips, providing a reliable 1:1 RR setup. The Thursday rally didn't have this same continuation because it was coming out of a choppy mess which doesn't provide the opportunity for stops to build up both above & below a range to fuel the inevitable break.

Moving Averages. I have never been a fan of technical indicators because to me they just complicate what should otherwise be a very simple & straightforward approach, not to mention the fact that the vast majority of them don't even work. However, I find the moving averages to be an exception because apart from basic support & resistance levels this is the most widely used form of technical analysis. Because those price levels are being incorporated into most trading strategies these levels actually hold great significance, unlike wave structures and fibonacci levels. Where this gets tricky is the MA is completely dependent on the numbers you input on the timeframe you are using and there really is no right or wrong.

I mainly rely on the 30m EMA 14 with the SMMA 7 on the 30m, 1h, and 4h timeframes being used for further confirmations. Because moving averages are very similar to trendlines it may seem overly simplified but when you really backtest this and experiment with various inputs you'll begin to realize how useful this really is. When a moving average crossover occurs on the 30m/1h/4h chart simultaneously it provides a very clear cut setup.

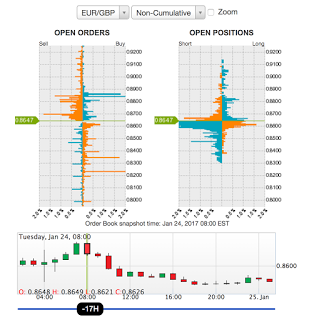

Orderbook Flow. Oanda is one of the only brokers to showcase its clients' positions in an orderbook that anyone can view. Since it is reasonable to conclude that the market will move in a manner in which the most amount of traders get screwed out of their money, it seems like the perfect strategy to simply position yourself against the masses when it is clear that they are overwhelmingly on one side of a trade. It makes perfect sense but at the same time it sounds too good to be true...and it is. It is difficult to explain how a currency pair can continue to skyrocket when 85% of retail traders are long and the logical expectation would be a vicious stop hunt to the downside. This is not to say that retail positioning data such as the CFTC reports are completely useless, but they certainly don't hold much value.

This strategy portion of the blog has actually been edited off and on for months. In the end I decided to cut out a lot and keep it simple because anything more is simply unnecessary. It may seem like this is very easy to do, but like anything else it is much easier said than done. I have encountered many poker players who you would think are solid, winning players based on the way they can come across as very knowledgable and competent in a discussion. However, that completely changes observing their actual play as they just don't seem to have the discipline to execute what they just talked about. This is why I judge players solely on their play alone (notice I did not say results).

I am very outspoken about how detrimental it is to expose your mind to the trading content out there which provide nothing of value. However, there is one thing I stumbled upon which is undoubtedly valuable, and those are the free videos from trading mindset coach Rande Howell. The reason this is an exception is rather than discussing actual strategy he talks about cultivating the right mindset and learning to master your emotions, similar to the SchoolofCards youtube channel which is the only beneficial poker content I've found. For me the hardest part about executing these trades properly is patience, which is ironic because in poker my discipline is unrivaled. It is not easy going from a 5/10 $2500 buyin game to a 1/2 $300 max game; in fact for most people it is so humbling that they find it too humiliating to do it. I am in such a rush to get back to my previous financial status that my anxiety shrouds the way to get there.

There are many things Rande Howell teaches that you wouldn't hear anywhere else and they make perfect sense. He talks about the dangers of fantasizing and wishful thinking, of visualizing yourself being a successful trader. Doing this makes us feel good, and to the brain that is the success, which is self-sabotaging because we trick our subconscious into thinking we have already achieved that success. People always like to make the uneducated comparison of trading to poker, but Rande says one of the main reasons that people who are very successful in their line of work can't transition into trading is they come into it thinking that what made them successful in their former profession will also help them in this one. The hard-working go-getting attitude of making things happen simply doesn't work in trading like it does in everything else. Another point I've found very helpful is to stop looking at your P&L statements, which is similar to examining poker in BBs rather than $ amounts, because whether we admit it or not it will subconsciously have a negative influence.

Congratulations @imahustlababy! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Congratulations @imahustlababy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!