Forex Intro: Picking Up The Pieces

I have been trading forex off and on for the past 4 years. For the first 3 years I learned absolutely nothing because no matter what my approach was it was essentially blindly following others, whether that be through trade signals, worthless courses, and even handing over control of my actual account. In just the first few months solo I learned more through my own trial-and-error than years of garbage teachings. Ironically the core fundamentals that really made me breakthrough and finally become profitable are things that none of these self-proclaimed gurus would ever even know about. I've realized the hard way that those who cannot do...teach. Anyone out there in this industry trying to sell you something is a scammer, plain and simple.

A little over a year ago now I had by far the most financially successful month of my life, winning a total of $65k after one of my good friends final tabled one of the biggest poker tournaments of the year for nearly half a million, of which I had 10%. Shortly after that I deposited a $50,000 brick into my bank account and immediately wired it into my Oanda account. Within 3 weeks of daytrading the account was sitting at over $75k, of which I freely admitted was largely due to luck. I booked a trip to Europe to enjoy my recent success and started to seek out professional help in managing my account while on vacation because I still wanted to grow my account a little while staying away from the stressful screens.

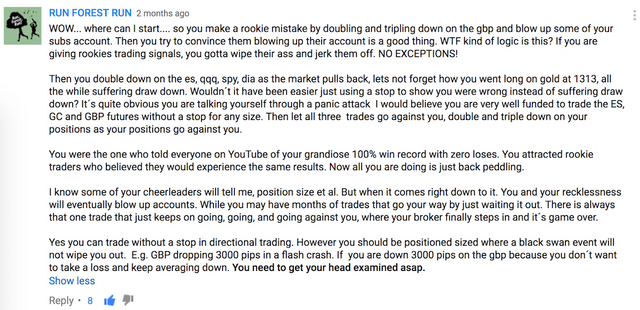

After stumbling upon an article regarding bad trading advice which I highly resonated with, I did more research into the author Michael Norman, though clearly not enough. He runs the basic looking website pitbulleconomics.com, posts multiple videos per week on youtube, and for his paid subscribers sends out a weekly newsletter called MMT Trader Report. Though I was skeptical of all trading services I figured him to be different because he had such a unique contrarian approach and boasted about having no losing trades in 2016.

To keep a long story short, I signed up for his newsletter which also came with personal email correspondence. Though he immediately gave a series of bad recommendations, as someone with a very high risk-tolerance I understand the severity of variance and figured this to be a bump in the road. The major call which followed was so unbelievably bad that going into the trade its actual outcome didn't even cross my mind as a worst case scenario. He advised to go short EUR/GBP at .8406, a position which not only went over 1000 pips underwater peaking at .9430 during the pound flash crash, but one that he also added onto and screamed at his followers to hold onto and not panic on. I lost an enormous amount of money on this trade, but the worst part was as it kept sinking deeper into the red he continued to cull his subscribers into financial ruin with the false reassurance that everything would be ok.

It is difficult to keep the summary of what happened concise without leaving out key details. In essence what Michael Norman does as a contrarian trader is proudly trade against the masses every single time, something which doesn't sound too unreasonable in theory but seeing as it clearly lacks any sort of adaptability is a seriously flawed approach. Trading against the masses is also a very ambiguous term as the Commitment of Traders Report (COT) is often misinterpreted and applied incorrectly. After truly delving into Michael Norman's history and carefully examining the FX trades in the previous MMT newsletters what I found was that there were many trades which would immediately go 300+ pips underwater and once it reversed months later he would close the trade out for a 10 pip gain and call it a win. If he does not block you his default response is to claim that you are overleveraged, but if you are risking so little that -1000 pips is not a big deal, then obviously +100 pips means absolutely nothing. Clearly this is an unsound trading strategy, but just like every other fraud trying to sell you something in the forex world he covers this up by deleting the majority of the comments on his videos.

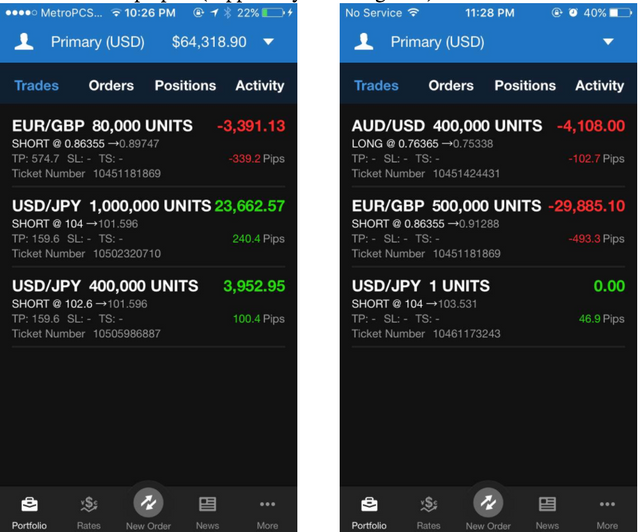

After losing almost $45k on the EUR/GBP disaster and bringing the NAV of my formerly robust account all the way down to $10k, I was still going through volatile swings but ultimately making a nice recovery. Prior to the night of the presidential election my account was at around $38k and I wanted to place an enormous bet on Trump but there was no way I could place a very large bet on such short notice. I decided to bet on him by going all in on a USD/JPY short from 104.00, my reasoning being that a Clinton win (supposedly USD positive) was already heavily priced in, but that there was no floor for a Trump upset (supposedly USD negative). At least that was what the talking heads of the trading world stated...

A few hours into the trade it peaked at +31k but it was mostly hovering at +20k with extreme fluctuations. I wasn't exactly sure where to exit but many veteran posters over on Forexlive, including the owner of the site himself were calling for USDJPY to break below the 100 figure. When I posted updates of the trade to my poker chat group I was told that being up 15k was no big deal, that it was "meh," not anything worth bragging about. I am not trying to make it sound like I'm blaming others, but their comments of both Forexlive and my chat group greatly influenced my decisions to keep holding the trade. This taught me the need to keep my trading private, as there really isn't any good that can come from sharing it. The election went much longer than expected and I ended up falling asleep, waking up to a complete reversal. I had no excuse to not use a stoploss to at least stop the trade out at breakeven, and for the first time all year I ended up tilting and blowing up the rest of my account on my own.

A year and a half ago I was posting monthly updates to my poker blog. In my experience having a detailed journal to reflect upon is a serious aid to personal development and growth as you have a clear look at what you have done, where you are now, and where you are headed in relation to your goals. Without it I find it very easy to just drift through life with no direction and then wonder where all your time/money went. As someone who prefers to end things on a high note I ultimately discontinued the blog because I had been taking so much time off there wasn't much poker content to go off of and I wasn't going to sacrifice quality. I told myself that if my trip to Poland in April had went well I would restart it, but we all know how that turned out.

I have decided to start a blog again seeing as the first one served its purpose, though this time it is devoted to my trading endeavors instead of poker. You will hear many comparisons being made between poker and trading, which is extremely irritating because trading is exponentially more difficult than poker and the unqualified people spouting this garbage are not skilled in either one. Contrary to what it appears to be on the surface, although there is clearly lots of socialization in casinos, grinding poker is really a life of solitude, even more so in trading. The majority of people in the poker world are subhuman, so it is hard to find anyone worth befriending, but it isn't that difficult to find someone to discuss strategy with and learn from. On top of having to deal with the steep learning curve in trading there is almost no one to turn to and learn from, so having a blog to reflect upon and review my trading history to improve future performance is something that I deem as not an aid, but a requirement to be successful in my trading.

I don't want to make it sound like I'm blaming others for what happened, but ultimately their comments strongly influenced my decision to keep holding on election night. Because I have lost so much money trading in the past I know that my statement doesn't hold much weight, but I know that at the time of writing this I now have a considerable edge, more so than in poker. Everyone is well aware of the potential that trading provides given the concept of compound interest, but they get sidetracked by that. I know exactly why I lost and what needs to be done to finally get into the lifetime black.

nice read hope your trading goes well this year