Million Dollar Trading Mistakes, For Your Entertainment and Edification

I consider this article very important. Read through it and try to take and grasp as much as you can. Think about it, it might save you a bit, or a lot of money. These are mistakes that you and me and everybody does from the beginning and only way to fight it is to understand and aknowledge these practically "principles" for yourself.

For those of you that haven't read the other post of mine, I highly recommend you to read it:

https://steemit.com/vincentb/@domisun/9-rules-of-crypto-trading

So lets begin with the actual article:

In 2015 I had roughly $90,000 to my name before I bought 11,700 Ether for roughly $0.97 each, and over a few months, accumulated 21 Bitcoin (a total investment of about $17,000).

Today I have $1.2 million tucked away in retirement and traditional investment accounts, 650 Ether, and 21 Bitcoin.

Now, at this point, most people say, “HOLY SH!T, You’re a millionaire!!!”

Yep. Crypto made me rich. But… BUT… do the math there for a second. Ether is currently trading over $1000. Had I employed the buy-and-hold strategy, that would equate to about $11 million buckaroos today.

Needless to say, I did not buy-and-hold. Here’s an account of a few mistakes I made that whittled away around $9 million trying to beat the market. One important distinction to make before we get started … These are not the usual missed opportunities that we all experience (e.g. “Oh man, I knew buying bitcoing in 2010 was a good idea. I messed up bigtime!). These were active trading missteps — a decision between do something (make a ‘clever’ trade) vs do nothing (hodl).

Enjoy the fruits of my suffering. I realize I’m extremely lucky to have made the gains that I have, and I thank my lucky stars every day. Hopefully by putting this out there, a few folks might avoid the same mistakes I did and gain a bit more themselves.

Mistake #1: The DAO and Naked Shorts

Anyone involved with Ethereum in early 2016 will have the letters D.A.O. seared into their brain forever. I was a DAO contributor to the tune of 2000 Ether. In the end, I got it all back (plus some ETC on the forked chain), but that’s not where I f’d up. In fact, I got quite lucky at first by coincidentally selling a large amount of ETH the day before the DAO hack!!

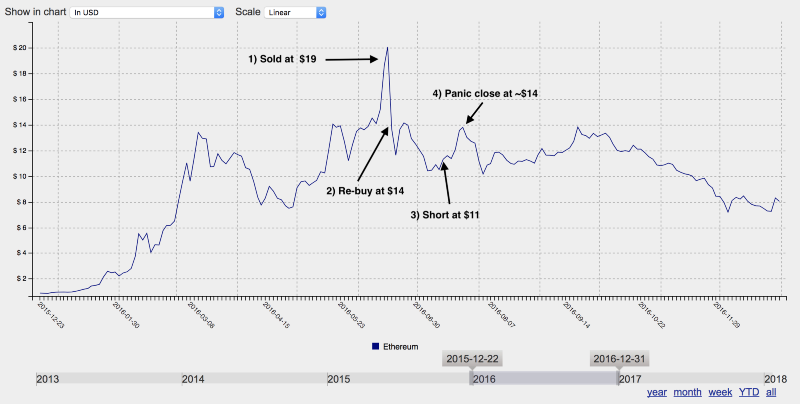

The price of ETH grew steadily as the end of the DAO contribution period neared, and finally shot up to $21 (all time high). I sold a big pile of ETH at $19 on June 16. Early morning on June 18, The DAO was hacked, funds were being syphoned, and the price of ETH plummeted to $12 in a few hours. I had a buy order set at $14, thus growing my ETH stack by around 800 ETH.

Pretty great so far, right? Well, during the great hard-fork debate of 2016, there was much hand-wringing. What would happen if hard fork? If not hard fork? Is this the end of ETH? Nobody knew, but there was a vast amount of anit-hard fork advocates predicting a crash once everyone got their DAO money returned after the fork occurred. I thought that seemed reasonable, so about 12 hours after the hard fork (but before the release of ETC), I decided to open a short position on ETH for the first time ever.

Whoops. Turned out the market itself was in favor of the fork, as ETH shot up from $11 to $14 almost overnight. I told myself I would ride it out to $16 (my liquidation price was ~$18). Nope. I panicked as I watched that dastardly green candle creep upwards. With tears in my eyes and shaky hands, I hit the ‘close position’ button and took a $30000 hit. The largest loss I’d ever experienced in my short life as a trader.

Short selling on margin is for hedge funds and idiots.

I felt sick to my stomach, and got pretty depressed for a few days. Especially after watching the price fall back to $10.50 two days later (which would have put me back in the black). Slowly my resolve returned after reading a bunch of stories on reddit from others that lost even more throughout the whole ordeal, then got distracted by the Ethereum Classic drama. Life moved on.

Moral of the Story: Never short Ether. Or anything. “Naked Shorts” are just plain stupid.

Mistake #2: Tribal Thinking and Emotional Trading

After TheDAO Incident, Ethereum Classic was born. Being a true Ethereum fanboy, I was grossly offended by it’s mere existence, and as a matter of loyalty, pride, and yes, moral imperative, it was my duty to dump all my ETC as quickly as possible for more ETH.

So I did. And three days later the price of ETC quintupled from an organized “marketing” campaign by its chief proponents. Bloody Hell. My blind devotion to a project that owes me nothing cost me dearly.

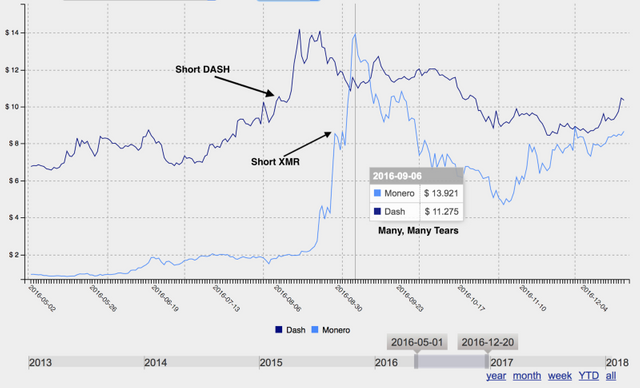

Later that summer, Monero gained some notoriety by being acceptable currency for a popular darknet market site (you know, where you buy nefarious items via Tor sites in the name of ‘freedom’). Privacy coins became all the rage, and Monero and Dash started seeing daily gains in the neighborhood of 30% to 70%.

Surely this was a mistake, as these were shitcoins compared to BTC and ETH, right? Right?!? Well, what goes up must come down, I thought. So I dusted off my Poloniex account, click the Margin Trade tab, and went to town selling Monero and Dash.

I forgot that short selling is a bad idea.

Whoops again. $10k later I was licking my wounds and wondering what was wrong with the world. Turns out nothing. Markets be markets, and traders be trading. Once again, my tribalist mindset of BTC and ETH maximalism thrust me into some really shitty trades.

Moral of the Story: Don’t be a tribalist butthole. The market doesn’t care about your favorite team.

Mistake #3: Buying the Hype

Any prudent investor will tell you that diversification it’s a good idea. In fact, I hear if you try to buy a few stocks with the intention of beating the market, Warren Buffett himself will come to your house and slap you in the face for not buying index funds.

But alas, there are no index funds in crypto. So in late 2016, I figured it would be a good idea to take a bit of Ether and Bitcoin and spread it around to other crypto projects.

But what to buy? Well, this one time, Vitalik Buterin himself said he liked the work being done by the Synereo team. So I bought some Synereo AMP. It’s like Facebook for blockchain, or something. And… AND… they just happened to be having (another) crowd sale. Lucky me! There was also a nice bonus for contributing 10 BTC or more. Yep, this was a sure winner, so why not?

Then a bunch of internal drama happened with the Synereo team, and the lead developer left to go start a new blockchain project. AMP bottomed out while everything else started to recover in early 2017. I sold all I had for a measly 3 BTC.

Morale of the story: Don’t buy something because other people say it’s cool. At least read the website first.

Mistake #4: Swing Trading

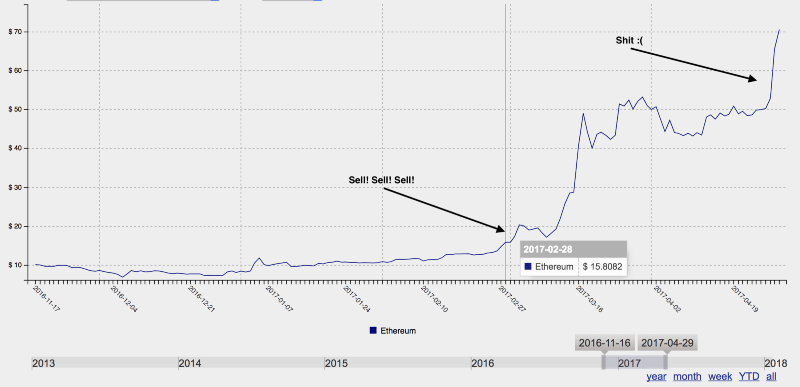

Despite the multitude of screw-ups in 2016, I still managed to exit the year with 9500 ETH, some ICO tokens, and my Bitcoin. Not bad, but my bag of ETH sitting below 10k started to bother me. I wanted a 5 digit balance. I needed it.

So in March 2017 when Ether jumped from around $10 to $13, then $14, I thought to myself, “these are nice price increases, but they never last. Ether always retreats after breaking $14.” So I sold. Then the price went up. And I sold some more. Then the price went up again. And I sold some more. Finally, we were sitting in the mid-20’s, and I began to panic. I’d sold off 4500 ETH with an average price of $16.

“It’ll correct back. Don’t worry, it’ll correct, and I’ll buy the dip.”

I told myself this over and over as the price moved north of $30, then $40, then mother f*$ing $50! Sonofagun! There were minor dips, but nothing anywhere near what would get me close to 10k ETH ever again. I finally capitulated and bought back in at $85.

Selling at $16 did not help achieve my goals of making millions.

You’d think I’d have learned my lesson after that, but no. Every jump of $20 — $30 or so, my finger would hover over the sell button, hoping to catch the top of a wave and ride it down. I had a few small wins, and a couple big losses. By the time June ended, my portfolio was about 80% cash and the rest ETH and BTC, with both reaching all time highs.

Morale of the Story: You cannot predict the future. Only sell when you reach your goals or need the money, not because you think you can time the market (because you can’t).

For more examples (like taxes) continue reading here:

https://hackernoon.com/million-dollar-trading-mistakes-for-your-entertainment-and-edification-e9bbf9675a8b

Excelente amigo muy buena información, los tendré siempre presente en mis operaciones.

Thank you @coriantun! :-)

Great article! I thoroughly enjoyed reading it and kind of wish it were longer. Well done.

Thank you man, I appreciate you enjoyed! @doc-gonzo

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/million-dollar-trading-mistakes-for-your-entertainment-and-edification-e9bbf9675a8b

You got a 2.63% upvote from @upyou courtesy of @domisun!

This post has received a 0.66 % upvote from @booster thanks to: @domisun.

You got a 0.70% upvote from @mercurybot courtesy of @domisun!

Sneaky Ninja Attack! You have been defended with a 0.88% vote... I was summoned by @domisun! I have done their bidding and now I will vanish...Whoosh