U.S. Stock Rally Fizzles as Tech Drops, Oil Slumps: Markets Wrap

blob:https://www.bloomberg.com/4020998d-52cb-43ea-be61-7afbfe232365

U.S. stocks edged lower as selling in technology shares overwhelmed an advance by companies poised to benefit from proposed cuts to corporate taxes. The dollar strengthened and oil slumped.

The S&P 500 Index reversed gains of as much as 0.9 percent and the tech-heavy Nasdaq fell as investors assessed a rally that’s propelled stocks to numerous records this year. An index of the biggest tech shares slumped to a five-week low as investors switched out of the sector. The yield on benchmark U.S. debt climbed after the Senate’s passage of the legislation early Saturday drew focus away from the investigation into connections between President Donald Trump’s aides and Russia.

Play Video

Belski Says Market Is Now Playing Catch Up on Taxes

blob:https://www.bloomberg.com/5f3e679d-292d-4093-9709-cc23e6ec3a42

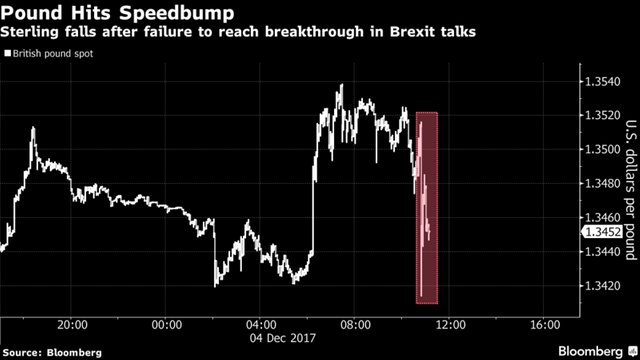

As the dollar gained, the euro slipped versus most major peers. Traditional safe-haven assets fell, with gold resuming its downward path after a jump on Friday and the yen slumping. West Texas oil fell below $58 a barrel. The pound erased gains after Brexit talks ended without a deal.

The Stoxx Europe 600 rose the most in five weeks. The MSCI Asia Pacific Index was little changed following a drop for Japan’s Topix and a jump for South Korea’s Kospi.

Terminal customers can read more in our Markets Live blog.

Here are some of the key events facing markets in the coming days:

The European Commission College of Commissioners discusses Brexit on Wednesday and will likely make its recommendation on whether sufficient progress has been made to move negotiations onto the future relationship.

The U.S. faces a partial government shutdown after money runs out on Dec. 8 if Congress can’t agree on a spending bill by then.

U.S. employers probably hired at a robust pace in November as the unemployment rate held at an almost 17-year low. The Labor Department’s jobs report next Friday may also show a bump up in average hourly earnings.

Countries setting monetary policy this week include Australia, Brazil, Canada, India and Poland.

These are the main moves in markets:

Stocks

The S&P 500 fell 0.1 percent as of the close of trading in New York.

The Stoxx Europe 600 Index climbed 0.9 percent.

Japan’s Nikkei 225 Stock Average dipped 0.5 percent.

The MSCI Emerging Market Index gained 0.6 percent.

The U.K.’s FTSE 100 Index increased 0.5 percent.

Currencies

The Bloomberg Dollar Spot Index rose 0.2 percent.

The euro decreased 0.3 percent to $1.1855.

The British pound slipped 0.1 percent to $1.3464.

The Japanese yen sank 0.3 percent to 112.52 per dollar.

Bonds

The yield on 10-year Treasuries rose one basis point to 2.37 percent.

Germany’s 10-year yield climbed four basis points to 0.34 percent.

Britain’s 10-year yield increased six basis points to 1.28 percent.

Commodities

West Texas Intermediate crude decreased 1.6 percent to $57.40 a barrel.

Gold fell 0.3 percent to $1,278.80 an ounce.

Congratulations @naresh785! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP