Crypto 101 - Digitizing The World's Assets...

With so much focus put on the crypto world - especially after the December 2017 rally ..

It's surprising that most people have almost no idea about how it actually works.

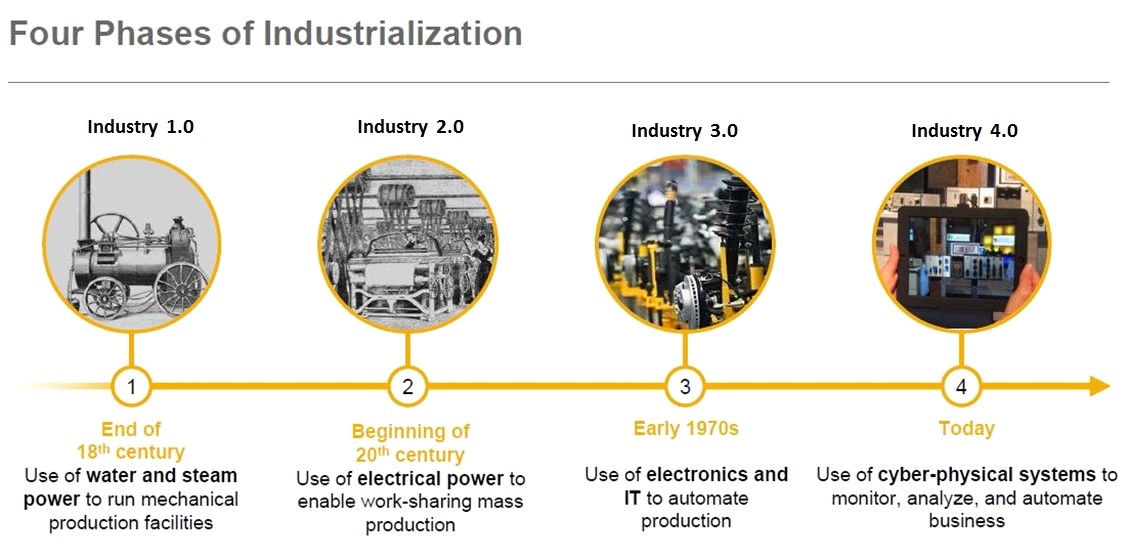

The truth is that crypto is basically a conduit for two "ideas" in the tech space - Internet of Things and Industry 4.0. Both of these ideas are suggestive of a new ‘paradigm’ designed to give access to a post-information world. The point is that what most people see as a ‘price’ attributed to Bitcoin, or even just a "decentralized technology" in the form of blockchain - is really the onward encroachment of technology into the way humans live their lives.

We're now entering the age of "digital assets", and it's only going to get more pervasive...

This tutorial is going to explain how "crypto" works on a technical level, as well as the underlying economic impact associated with how each of them will contribute to the world moving forward.

Whilst "crypto" is an effective way to achieve these ideals, it's obviously very focused on providing a technological paradigm to the system. We've found that if you're doing this properly, it will give you the capacity to invest heavily into different areas, and see a credible return in each.

What Is "Crypto"?

The term "crypto" comes from cryptography - which means that it's designed to provide a secure way for technological systems to process transactions. "Cryptography" has existed forever, but in terms of the new way the "decentralized" currencies work, it lies at the core...

Ultimately, the only ‘currency’ in ‘cryptocurrencies’ is trust.

The aim of Bitcoin and the other "currencies" has been to create a self-governing monetary transaction system, not dissimilar to how a bank would work (minus the corruption, government control and printing of money).

The way that this was achieved was with a piece of software known as ‘blockchain’.

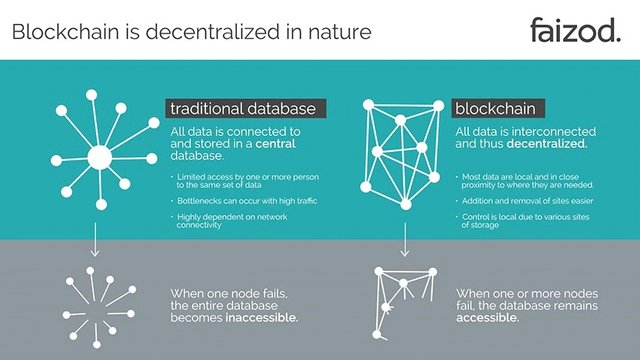

Blockchain is a decentralized database which essentially provides people with the ability to send and receive transactions ratified by a huge "decentralized" network which allows people to essentially verify if a transaction is valid.

This is the work of a bank/clearing house today - essentially taking "money" from one account and applying it to another. However, rather than having a single central source of ratification for the exchange, it's ratified by the "network" - and signed off with a cryptographic signature.

This means that the "crypto" space is basically a self-governing system through which any multitude of transactions can be sent. In other words, whilst Bitcoin has removed the necessity for "banks" to clear online payments, the other "crypto" systems have worked to provide users with the ability transact with other forms of data (contracts/documents etc).

However, no matter how intriguing the technology - the underlying problem for "crypto" is the way in which the various systems are designed around providing transactability for specific assets - there's no economic quantifier for the system as a whole. Understanding this quantifier is where the smart money splits from everyone else...

Bringing Assets Online

The whole "point" about "crypto" is that it's meant to provide users with the ability to interact directly with each other, without the need for centralized processing services.

To this end, the idea that "Industry 4.0" and other advances in technology is to provide users with the ability to interact with a large number of other assets that are not currently handled by "crypto" etc.

The way that "crypto" looks to be moving is to bring other assets into the digital realm, allowing users to trade them with each other...

@millz to stay up to date on more great posts like this.

@millz to stay up to date on more great posts like this.

ㅤㅤ

ㅤㅤ .png)

You got a 57.89% upvote from @brupvoter courtesy of @millz!

For future viewers: price of bitcoin at the moment of posting is 9293.40USD

and fluctuating at every time

Very interesting post...