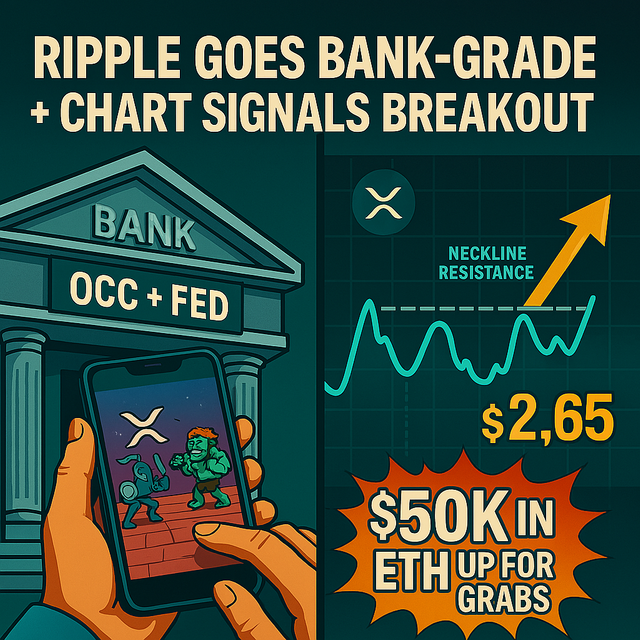

XRP’s Turning Point: Ripple Seeks US Bank Charter & Bullish Chart Setup Toward $2.65

What’s Happening?

- Ripple has filed for a U.S. national bank charter with the OCC, allowing it to independently operate custodial services and financial operationsใ

- It's also pursuing a Federal Reserve master account, enabling its RLUSD stablecoin to settle via Fed payment rails directly

📈 Chart Signal

- XRP’s price chart is forming an inverse head-and-shoulders. A breakout above the neckline could push XRP to $2.65–$2.76

- The market already responded with a +3% intraday jump and +6% for the week

🧠 Pichat’s Take

Ripple is transforming from a "blockchain performer" to a "financial infrastructure provider." If the charter is approved, XRP could become a legal, regulated utility — not just a speculative token.

🎯 Upsides vs Risks

- ✅ Upside: Institutional credibility, RLUSD settlement via Fed rails, mainstream acceptance

- ⚠️ Risk: Charter approval could drag, chart fails to break neckline and price corrects

📌 TL;DR

Ripple is aiming for bank status and XRP is flirting with a bullish breakout.

This could be a game-changer — or just a flash in the pan.

Time to watch closely and brace portfolios for impact!

Upvoted! Thank you for supporting witness @jswit.