TRON Overtakes Ethereum as the King of USDT

With a record-breaking market cap for USDT, the Tron blockchain is positioned as the dominant network for the largest stablecoin, while Tether strategically invests in Latin America to drive financial inclusion.

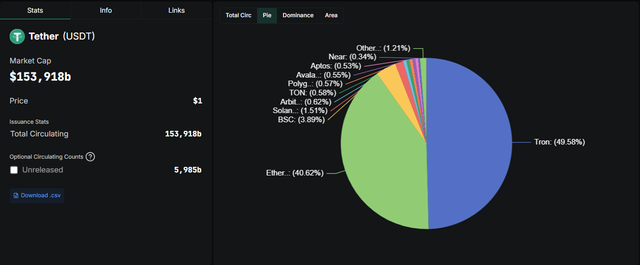

A seismic shift has occurred in the stablecoin ecosystem, with the Tron (TRX) blockchain surpassing Ethereum (ETH) as the primary network for the issuance and circulation of USDT, the world's largest stablecoin. This milestone not only redefines the dynamics of blockchain networks but also coincides with a new all-time high in USDT market capitalization, which reached an impressive $153.91 billion.

According to the most recent data from Defillama, the amount of USDT minted on the Tron network climbed to $76.31 billion, representing a commanding 49.58% of the total in circulation

TRON on Top: The New Home of USDT

According to the most recent data from Defillama, the amount of USDT minted on the Tron network climbed to $76.31 billion, representing a commanding 49.58% of the total in circulation. For its part, Ethereum, which long held the lead, now holds $62.52 billion in USDT, equivalent to 40.62% of the supply. The third-largest blockchain in USDT circulation is the Binance Smart Chain (BSC), with $5.98 billion, representing 3.89% of the total.

This changing of the guard underscores a clear trend in the stablecoin market: a preference for networks that offer greater efficiency and lower costs.

Why is TRON overtaking Ethereum? The key advantages

Tron's ascendancy over Ethereum as the preferred blockchain for USDT is no coincidence and is due to several key advantages offered by Justin Sun's network:

Low Gas Fees: Transactions on Tron are significantly cheaper than on Ethereum. While gas fees on Ethereum can fluctuate and become very high during periods of congestion, Tron's are consistently low, often fractions of a dollar. This makes USDT transfers much more economical for users and businesses, especially for frequent or smaller transactions.

Higher Speed and Throughput: Tron is designed for high throughput and higher transaction processing capacity (TPS - Transactions Per Second) compared to Ethereum 1.0 (before the Ethereum 2.0/Serenity upgrade). This translates into faster transaction confirmations, which is crucial for financial transactions that require immediacy.

Ease of Use for Microtransactions: The combination of low fees and high speed makes Tron ideal for microtransactions and for the everyday use of stablecoins in payments, remittances, and other commercial activities. This has driven its adoption in emerging markets and on gaming and betting platforms.

Energy and Bandwidth Model: Tron uses an "energy" and "bandwidth" system that allows users to freeze TRX to obtain resources and conduct free transactions, or pay very low fees, making it very attractive for intensive USDT users.

These features have made Tron a more attractive option for Tether and for users seeking efficiency and economy in their USDT transactions.

Tether Bets on Latin America: Strategic Investment in Orionx

In a move that underscores its commitment to financial inclusion and the expansion of digital payments in emerging markets, Tether announced on its website a strategic investment in Orionx. This prominent Chilean company, which operates as a digital asset exchange and financial infrastructure company specializing in cross-border payments, has closed its Series A financing round, led exclusively by Tether.

Orionx, with operations in Chile, Peru, Colombia, and Mexico, integrates cryptocurrencies into B2B and retail systems, offering cost-effective financial tools. This investment will allow Orionx to consolidate its regional operations, enhance its technological capabilities, and scale its stablecoin-based infrastructure for remittance, payment collection, and treasury services throughout Latin America (LATAM).

The Future of Global Payments Is Written on Blockchain

Tron's rise as the dominant chain for USDT and Tether's strategic investment in Latin America are unequivocal signs of the maturity and direction of the stablecoin ecosystem. The quest for efficiency, low fees, and accessibility is driving the adoption of high-performance blockchains like Tron. At the same time, Tether's commitment to infrastructure in emerging markets demonstrates the transformative potential of stablecoins to bridge the financial inclusion gap and redefine cross-border payments on a global scale. The future of decentralized finance and mass cryptocurrency adoption appears increasingly tied to the utility and accessibility that stablecoins offer on efficient networks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risks. Always conduct your own research and consult a qualified financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.