Secret Tips for Crypto traders

Many people have knowledge on how to trade cryptocurrencies. Also, many people trade cryptocurrencies to earn profit. Sadly, more than 80% of crypto traders lose much money despite sticking to great trading strategies. I have been one person who used to lose many trades in the past before I discovered many tips I will share with you now and in the future. From now on, I will post helpful material to enable crypto investors, especially traders, to succeed in their investments.

Today’s tips

Even when you have a great strategy you may fail to win some trades. This is not because your strategies are wrong. No! It is because you may not understand a few key things.

Daily bias: Each day you should start by establishing the crypto market daily bias. By daily bias we simply mean the general direction the prices of the cryptocurrencies are going during that day. We have two main daily biases, a bullish daily bias and bearish daily bias.

Bullish daily bias: This is when prices of most cryptocurrencies are rising. There are different ways to establish the daily bias. For example, look at the price direction of bitcoin, the crypto king. If bitcoin has gained by a significant percentage during the past 24 hours, then the daily bias is bullish. As a trader look for bullish positions. If you short some cryptocurrencies during such a day you may lose some trades. This is because most savvy crypto traders start by looking at the daily market bias. You cannot oppose the entire market and win, even if your strategy is very good.

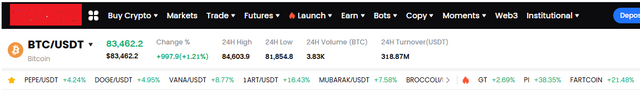

Another way to tell the crypto market bias is to look at the price direction of most assets on your watch list. If most assets on your watch list are in green, then the market has a bullish bias. If they are in red, then most of the assets are bearish. The following picture illustrates the point.

As you see in the image, all the coins in the watch list are in green. This shows that there is a bullish daily bias. As a result, there is a high chance that those who take long trades may have winning positions. Also, even if some assets have great sell set ups their price direction may easily turn bullish leading to losses. So, the daily bias is also very important for futures contract traders.

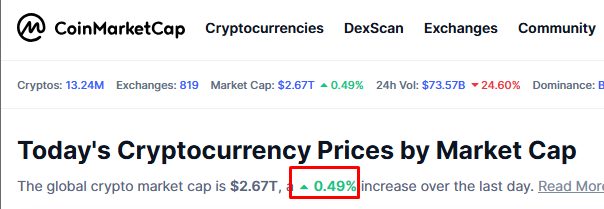

Another way to tell the market’s daily bias is to check the 24 hour change in the total crypto market cap. One can use platforms like CoinGecko or CoinMarketCap to do so. If the 24 hour change in total market cap is bullish, then the daily bias is bullish as well. Let’s look at the following example.

As you see in the picture the total market cap had increased by 0.49% during the previous 24 hours. This is a sign that the entire crypto market is bullish. Thus, it is very wise to open long trades. However, short traders may need to buy when the market has a bearish daily bias.

Conclusion

Generally, it is wise to check the daily market bias every day before buying and selling your cryptocurrencies. This gives you an edge in your investment drive. Also, as you have noted having winning trades does not only depend on your trading strategy but other factors such as the market daily bias, among others. Definitely, we will discuss some of these in the future, step by step.