Why do so many traders lose?

Most traders lose money in the markets.

The sad truth that you don’t often hear is that you actually need to do far better than the top half of traders to make money. In fact, just to break even, you need to be a consistently profitable trader, as commissions, slippage and the bid/ask spread (the difference between the buying and selling price set by market makers) all need to be paid for. In order to be successful in the long-term, you must be one of the best. And this is in a field full of very smart people.

There are three areas which are essential for successful trading:

- Strategy (how and when to enter and exit trades);

- Risk; and

- Psychology.

By far the most attention is placed on developing a profitable strategy. But what use is a strategy if your risk is so high that you will get wiped out when it (inevitably) has a few losing trades? And what use is a profitable strategy if you can’t even follow it?

In reality, all three are essential. However, I believe that it is the third, our own psychology, that is often the most important, and also the most overlooked. Many people like to blame the market, or other trades when they lose money. But:

The enemy is never the market, the enemy is ourselves.

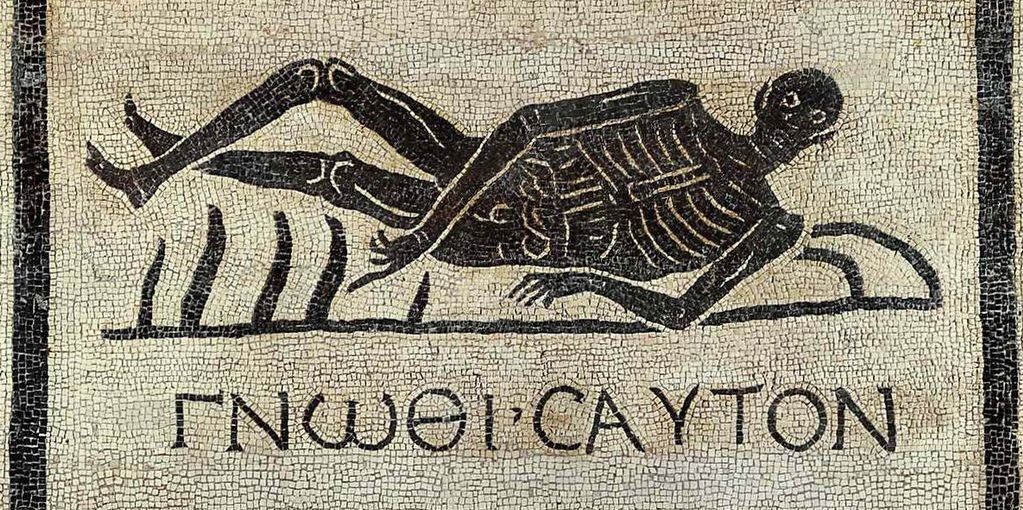

The picture at the top of this post shows the Greek motto: “Know thyself”. It is said to have been inscribed on the Temple of Apollo at Delphi. This phrase, and many similar derivations, have featured heavily among some of the great thinkers and philosophers of the ancient world.

I firmly believe that to master anything, we must first master ourselves. Nowhere is this more important than the markets, where your whole life can be affected so directly, and rapidly by your results.

It may be hard to believe before you experience it yourself. But it is incredible what an impact our long-held subconscious beliefs can have on our actions. The extent to which we can be capable of sabotaging ourselves. How following our natural instincts in our trading decisions is suicide. And how hard it can be to act against them.

Why do we hear so often about traders “blowing up” and losing everything?

Steps to take:

Record all of the trades you take. Include the reasons for your entry and exit and also take a note of the emotions you have before, during and after the trade. This will help to hold yourself accountable for your decisions and will enable you to review and identify issues.

Work on yourself. Examine your beliefs, biases and improve your mental clarity. A lot of work can be done with the help of professionals such as counsellors and coaches. A good place to start is with your own meditation practice. You may find this course useful.

This may sound like a lot of work. But I promise you it is essential if you want to succeed in this field. Furthermore, the benefits of this work will shine throughout the rest of your life and positively impact your success and happiness in many ways.

The unexamined life is not worth living

Socrates

Be guided on your journey to profits. Check out the Mangrove Trading Academy

Nearly everything you do is of no importance, but it is important that you do it.

- Mahatma Gandhi