Opinion: Bitcoin Price Dip Could Get Worse Before the Inevitable Rebound

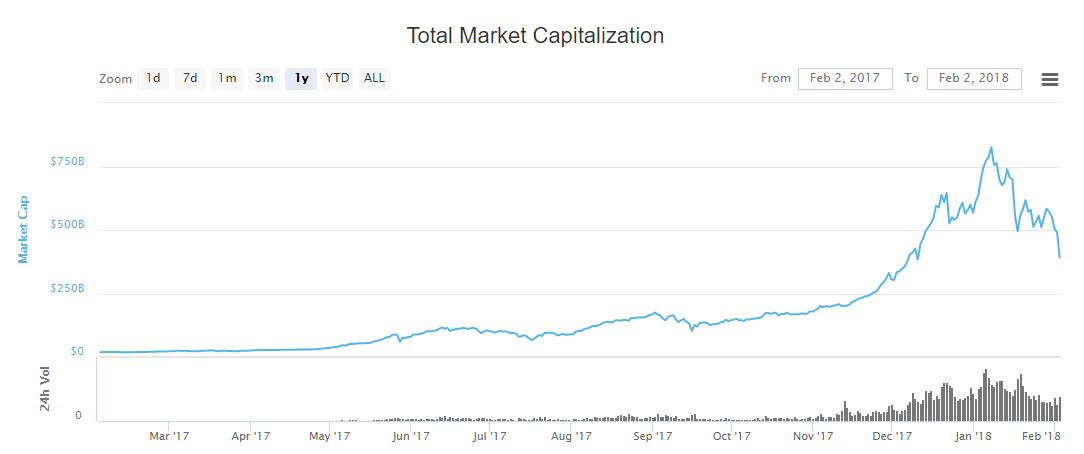

The valuation of the cryptocurrency market has nearly halved from its all-time high. Bitcoin has declined by more than 14 percent in the past 24 hours, while Ethereum, Ripple, Bitcoin Cash, and other major cryptocurrencies fell by more than 20 percent.

Throughout the past 12 months, the cryptocurrency market has experienced several 30 to 40 percent corrections. But, the latest correction is one of the worst corrections the cryptocurrency market has endured in the past year because it has lasted for awhile. For a few weeks, the cryptocurrency market has struggled to demonstrate any signs of short-term recovery and as a consequence, the valuation of the market has continued to fall by large margins.

Still, the cryptocurrency market is not at its 3-month low. In November, the valuation of the cryptocurrency market was less than $200 million, less than bitcoin’s market cap in January. Hence, even if most major cryptocurrencies fall by more than 30 percent from current levels, it will set back the market by only three months.

Several analysts including BKCM’s Brian Kelly and renowned trader Peter Brandt stated that the price of bitcoin could dip again before the market shows signs of short-term recovery. Kelly said that the price of bitcoin could decline by 15 percent and the cryptocurrency would still be overvalued. Brandt explained that based on the current trend, the price of bitcoin could drop to $7,700 before rebounding. Kelly noted:

“The intrinsic value, the way I measure it is transactions. And I do kind of a simple regression with number of transactions and velocity. And you get an intrinsic value somewhere in the $8,000s.

This is such a young technology. To short it, makes absolutely no sense in terms of the risk/reward because this thing can move 20 or 30 percent in a day. So the most I’m going to make is 100 percent of my downside [over time]. And the worst is I’m going to lose 30 percent in a day. And then compound that.”

Kelly emphasized that he would not bet against bitcoin even after the recent correction, as it still remains the most dominant cryptocurrency in the market.

Brandt, who continuously called out bitcoin’s $7,700 dip since January 22, stated that based on classical charting, bitcoin would likely experience another dip before a recovery.

“The crypto-snobs have been quick and dependable to blast classical charting. Yet, classical charting has been an outstanding lens to understand bitcoin price movements,” said Brandt.

$BTC likely headed to 7700-7800, but $ETHBTC could thrust to 2.9xxx pic.twitter.com/cwpeiqxQL0

— Peter Brandt (@PeterLBrandt) February 1, 2018

Brandt added that during a phase like this, it is important for traders and investors to remain patient with their investments. The market is extremely volatile and it could move upwards or downwards by more than 30 percent overnight. “Patience and discipline to trade well defined geometric price patterns with predetermined risk/trade mgmt provides me with my trading edge,” added Brandt.

But, one positive development which has occurred in the past few days is the elimination of premiums in the South Korean market. While the decline in demand for cryptocurrencies may have contributed to it, the South Korean government’s crackdown on investors taking advantage of the arbitrage opportunity acted as the driving factor of decreasing premium rates.

If helping , just send me a bottle of beer to :

Bitcoin : 13GZJZ5phZQ2G6uA21gGcXFfxkkE4wMPR4

Litecoin : Lg3drCBVVQQJjuuMuK8a5UAFRs89bFW6Y4

Regard

Crypto hunter

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/opinion-bitcoin-price-dip-get-worse-inevitable-rebound/