All Crypto Must Go; Bitcoin on Sale!

In Januray, I spoke about bitcoin’s first bottleneck, the price and the second bottleneck, exchanges. I feel the series needs a brief interruption so that we can discuss, yet again, the price; before we move onto different subjects, more technology related.

Some are calling this correction a complete bloodbath. I’ve read in many places how this has to be connected with regulatory scrutiny in eastern Asia: due to heavier restrictions being applied to crypto exchanges and mining companies, people are fleeing the markets.

How many times have you read news about China or South Korea or Russia (and so on), imposing heavy restrictions on cryptocurrency?

How many times has China banned cryptocurrency trading?

And how often have do you read about the ‘impending bitcoin bubble‘.

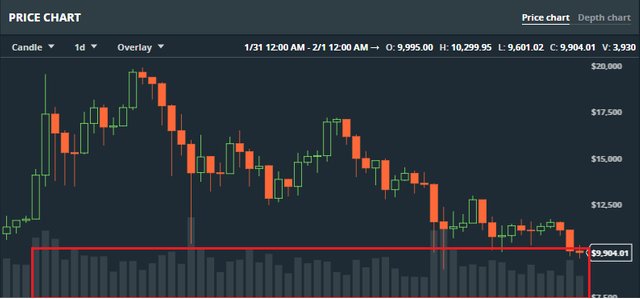

I really don’t see that much of a connection between such news and what’s really happening in the market. We can conclude that, by looking into what’s been happening to volume over the last month or so.

-1.20% $8,541.29

RUPX

RUPAYA

+123.91%

$0.0057

BTCR

BITCURRENCY

-64.25%

$0.0063

NEWS FEBRUARY 01, 2018 12:06

Opinion: All Crypto Must Go; Bitcoin on Sale!

Get Trading Recommendations and Read Analysis on Hacked.com for just $39 per month.

Advertisement

In Januray, I spoke about bitcoin’s first bottleneck, the price and the second bottleneck, exchanges. I feel the series needs a brief interruption so that we can discuss, yet again, the price; before we move onto different subjects, more technology related.

Some are calling this correction a complete bloodbath. I’ve read in many places how this has to be connected with regulatory scrutiny in eastern Asia: due to heavier restrictions being applied to crypto exchanges and mining companies, people are fleeing the markets.

How many times have you read news about China or South Korea or Russia (and so on), imposing heavy restrictions on cryptocurrency?

How many times has China banned cryptocurrency trading?

And how often have do you read about the ‘impending bitcoin bubble‘.

I really don’t see that much of a connection between such news and what’s really happening in the market. We can conclude that, by looking into what’s been happening to volume over the last month or so.

https://www.gdax.com/trade/BTC-USD

I really don’t notice much of a difference between now and December 2017. Is this really the apocalypse, or rather the expected correction we’ve been all waiting for? Most of the selling orders seem to be coming from small investors: people who need to use the money to buy things and people who got scared.

Yes, there are a few spikes, which may be related to institutional investors. There seems to be a correlation between some of those spikes and bitcoin futures settlement dates, that is.

Let’s see the below example:

If you compare it to the above GDAX graph, look at what happens to bitcoin’s price on settlement days like the 17th or the 23rd. If this isn’t enough today, January 31st is another settlement date. And guess what’s happening!

If you ask me personally, although I agree that news may have a huge influence on people’s decisions, usually deep corrections don’t happen due to a single cause. I’ve read on reddit (as many of you I’m sure), in 3 or 4 weeks’ time it’s the Chinese New Year, which could invite people to dump bitcoin for USD.

I’ve actually done the math myself using coinmarketcap prices. And you know what I found? Bitcoin lost between 19% up to almost 40%, from the end of December to the end of January.

Every. Single. Damn. Year.

Want to guess what factor(s) usually perceives this correction?

A: Bad news!

B: The Chinese New Year!

C: People getting scared!

D: Market manipulation!

E: All of the above!

Yes, the answer is E)! All of the above reasons seem to contribute to bitcoin’s price drop in January. And that does make sense, as we need to think about how bitcoin works, being the first distributed currency:

If bitcoin is money controlled by all who own it, then we can argue that “cultural” events (like holidays, for example) can have a far greater impact on the price of bitcoin, than what is expected for fiat-markets.

Most mining corporations and exchanges are located in Asia, which increases the price fluctuations as when wealthy investors convert bitcoin into USD, the price of bitcoin drops (as expected).

Bitcoin futures settlements affect the price even harder, due to the retraction of the Asian markets. This is, the weight of Wall Street and Institutional investors is even greater.

For the above reasons we can clearly see that there is an incentive for bitcoin price to drop. Plus, during celebrations like the Chinese New Year’s the amount of money spent by consumers is insane. Should we rellay ignore this incentive for people to convert bitcoin into USD?

This is a problem that will be gone as soon as people start using bitcoin as money. The need to exchange it for fiat-currency disappears, as most accept bitcoin.

- People tend to react negatively to bad news (especially about bitcoin). So when traditional market investors or media channels release news about the bitcoin’s “doomsday” and terrible effects of regulation, people get scared. And what do you do when you get scared? You sell like crazy (to avoid bigger losses).

But every storm has its purpose.

Do you know what I really like about this one in particular? The cleanse:

If helping , just send me a bottle of beer to :

Bitcoin : 13GZJZ5phZQ2G6uA21gGcXFfxkkE4wMPR4

Litecoin : Lg3drCBVVQQJjuuMuK8a5UAFRs89bFW6Y4

Regard

Crypto hunter

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://theonlinetech.org/2018/02/01/opinion-all-crypto-must-go-bitcoin-on-sale/