Ethereum Long-Term Technical Analysis: Was it a Normal Correction?

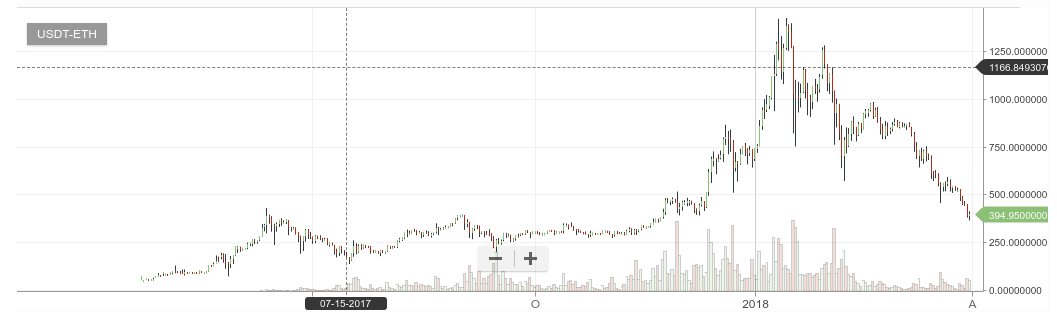

Ethereum Daily Chart (Bittrex)

There has been a remarkably sharp decline in Ethereum price, which brings to mind if the drop is permanent, caused by fundamental problems, or a price correction that was due to happen. I side with a price correction that should have been expected due to the over inflated speculative price. In other words, I think the Ethereum price imitated the price pattern we see on many alt-coins after they are introduced to the market, or the prices of many IPO stocks, but at a longer time scale.

The rude dynamics of wider market introduction can do the same to any asset but in Ethereum's case, this was not expected because there had never been quite a bubble pop. When I analyzed the bubble pops in popular altcoins, I saw that drawdowns of 60-80% are typical. Ethereum has lost about 75% off the peak therefore it nicely matches the later value from a speculation pop.

Ehtereum network may have technical glitches or upgrades, however the platform remains the most popular innovative form of fundraising, and the infrastructure used by so many startups' decentralized computing and service projects certainly forms a bedrock of value that is not visible in the case of bitcoin. They have also been directly addressing efficiency and scalability issues by introducing Proof-of-Stake consensus mechanisms and sharding (more distributed storage).

After such corrections, a security usually adopts a horizontal price pattern, and it takes time for the value to stabilize and gain more steam for a coming rally. Similar episodes can be seen in the last big price correction down from $400 to $150. However, in the case of Ethereum, the changes can happen more rapidly, and the last correction was not this sort of correction, it was not so popular by then. I correctly predicted that Ethereum would slip towards $350, though I think it is possible but not likely that Ethereum will rapidly decay to $150-200 band again; however, the trend is clearly downward on the daily graph therefore, the market participants should try to watch any developments quickly rather than making bets against the market and sticking with them. Probably the hardest part of trading is understanding that we cannot act according to our own wishes or whims, and it is the hardest to predict in the most turbulent of times, such as in a bottom pattern formation or the beginning of a rally. We might see some flat movements for many weeks until the trends form more clearly or even a rapid recovery may be expected. The lower prices will encourage the greed of new investors and therefore we may see interesting price patterns evolve over the next weeks.

the problem with Ethereum Is it's Utopian knuckelhead Buterin running his mouth

To be fair, ETH/BTC are quite correlated, but the press has a different way of conveying a technical lead's words. They probably twisted to make it look like Ethereum has major technical obstacles, which is not the case.