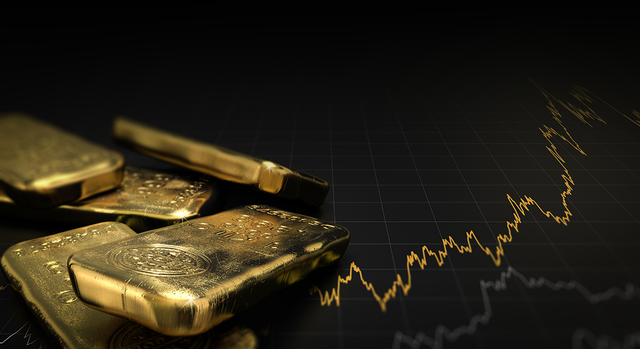

Why Investing in Gold is Beneficial Right Now

Gold has traditionally been viewed as one of the most reliable investment assets, especially during times of economic instability. In recent years, several factors have made investing in gold even more attractive. Let’s explore why now is an especially advantageous time to invest in this precious metal.

1. Inflation Hedge

One of the key arguments for investing in gold is its ability to protect capital from inflation. In periods of rising inflation, when the value of money declines, gold maintains its value. According to data from the World Gold Council, inflation in the US reached 4% in 2023, while in Europe it hit 5.4%. During the same period, gold prices increased by 6%, demonstrating its capability as a hedge against inflation risks.

2. Geopolitical Instability

Global geopolitical situations also enhance the attractiveness of gold as an investment tool. Conflicts in Eastern Europe, tensions between the US and China, and instability in the Middle East create uncertainty in financial markets. Investors often turn to gold in such periods because it retains its value regardless of political conditions. For instance, in 2023, amidst the escalation of the conflict in Ukraine, gold prices increased by 8%.

3. Declining Trust in Fiat Currencies

The declining trust in fiat currencies such as the US dollar and the euro also contributes to the growing popularity of gold. In times of financial market instability and economic crises, many investors prefer to convert their assets into gold. This is because gold is a physical asset that does not depend on the financial system or government policies.

4. Limited Supply and High Demand

Gold is a rare and non-renewable resource, which further increases its value. According to the World Gold Council, the annual global gold production is about 3,500 tons, while demand for gold remains consistently high. This leads to a steady increase in the prices of this metal.

5. Investment Opportunities

Modern technologies and financial instruments make investing in gold more accessible and diverse. Besides purchasing physical gold (bullion, coins), investors can use exchange-traded funds (ETFs), futures contracts, and other financial instruments, allowing for flexible investment management and risk minimization.

In the current economic conditions characterized by high inflation, geopolitical instability, and declining trust in fiat currencies, investing in gold becomes especially relevant. This precious metal provides reliable capital protection and offers numerous opportunities for diversifying an investment portfolio. Considering all the factors mentioned above, now is an excellent time to invest in gold.

Website : https://gold.storage/

Whitepaper: https://gold.storage/wp.pdf

Follow us on social media:

Telegram: https://t.me/digitalgoldcoin

Steemit: https://steemit.com/@digitalgoldcoin