Over $721 Million Floods the Crypto Market with Unlocks

According to data from Tokenomist.ai, the imminent release of $190 million in SUI, OP, and DYDX tokens is expected this week, as projects like ZBCN and ETHFI defy the logic of supply and demand with meteoric price increases. Get ready for some action!

The dynamic cryptocurrency market is under scrutiny following the release of crucial data from Tokenomist.ai, dated Monday, May 26, 2025. A staggering Weekly Total Value Unlock (WTU) issuance of $721.61 million was detected. This sizable injection of new tokens not only increases liquidity but also exerts inherent selling pressure, which can lead to market capitalization dilution if demand fails to absorb this surge in supply. Savvy investors are closely monitoring these events to anticipate movements and adjust their strategies.

Leading with a staggering 10.12% issuance, representing a considerable injection of new tokens into the market in a short period / Tokenomist

Cliff Unlocks: The Weekly Time Bomb

Cliff unlocks represent massive releases of previously locked tokens on a specific date, events that have historically caused sharp price movements. For the next 7 days, a total release of $190.10 million is projected, with the following protagonists:

SUI: Leads the list with $152.66 million in unlocks, representing 1.3% of its circulating supply. This is the largest release, and its impact on price will directly depend on demand's ability to absorb this volume.

OP: $23.56 million in releases are expected, equivalent to 1.8% of its supply. Its performance after the unlock will be key for Optimism investors.

DYDX: With $4.84 million unlocked, representing 1.1% of its supply. Although this figure is relatively small, it is still a significant factor for the project's tokenomics.

In addition to these cliff releases, a linear daily issuance of $56.37 million is anticipated, with significant contributions from projects such as SOL ($11.61 million per day), WLD ($7.18 million per day), and TRUMP ($6.25 million per day), gradually adding to the total market supply.

Weekly Issuances: Who's Driving the Supply?

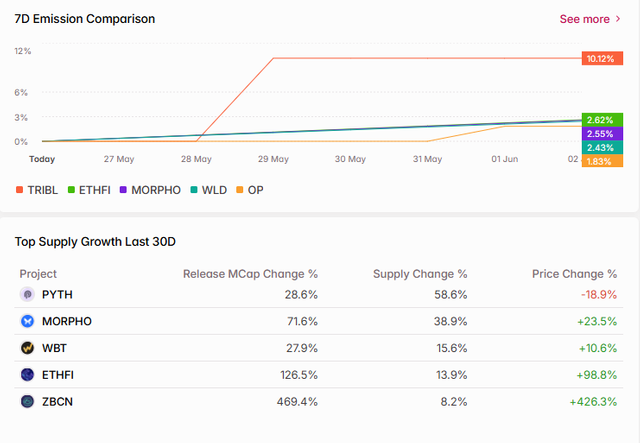

The analysis of issuances over the past 7 days (7D Emission Comparison) highlights the following tokens with the highest supply growth rates:

TRIBL: Leads with an astonishing 10.12% issuance, representing a considerable injection of new tokens into the market in a short period of time.

ETHFI: With 2.62% issuance, it remains a significant issuer.

MORPHO: Registering 2.55%, with an issuance rate very close to ETHFI.

WLD: Presents 2.43% issuance, indicating steady growth.

OP: With 1.83%, it represents the most conservative issuance among the top 5.

It is essential for investors to analyze the context behind these issuances (such as scheduled unlocks or staking rewards), as high issuance without effective absorbing demand can dilute the value of the tokens.

Supply Growth vs. Price Performance (Last 30 Days): Market Surprises!

Analyzing the behavior of the tokens with the highest supply growth over the past month, comparing the "Release MCap Change%", "Supply Change%", and "Price Change%", reveals surprising dynamics:

PYTH: Experienced supply growth of 58.6%, almost doubling its "Release MCap Change%" of 28.6%. This correlated with a significant price drop of -18.19%, confirming that excess supply outstripped demand, exerting strong downward pressure.

MORPHO: Despite a considerable 38.9% increase in supply, it achieved an impressive price increase of +23.5%. Its Release MCap Change % of 71.6% was significantly higher, suggesting robust demand driven by project development or partnerships.

WBT: With moderate supply growth of 15.6%, it showed a healthy price appreciation of +10.6%. The Release MCap Change % of 27.9% indicates positive uptake.

ETHFI: An exceptional case: With supply growth of 13.9%, its price soared a spectacular +98.8%. The Release MCap Change % of 126.5% is extraordinarily high, evidencing massive demand.

ZBCN: The token with the most astonishing performance. With the lowest supply growth (8.2%), its price soared a staggering +426.3%. The "Release MCap Change %" of 469.4% is the highest, implying an extraordinary valuation of the new units, driven by stratospheric demand.

Demand is king, not just supply.

Data from Tokenomist.ai underscores the vital importance of monitoring issuance and supply metrics. While high supply growth (as with PYTH) can lead to dilution and price drops, controlled supply growth or over-expansion is a key factor.

Exceptionally strong price increases (such as in ETHFI and ZBCN) can result in meteoric price increases, defying the simple logic of supply and demand.

Investors should pay attention not only to the number of tokens being unlocked, but, perhaps more crucially, to the project's ability to generate demand and utility that absorbs or even exceeds the impact of this new supply. The ratio of "Release MCap Change %" to "Supply Change %" emerges as a critical indicator of how the market is valuing new issuances, offering deeper insight into a token's health and momentum in the volatile crypto universe.

Disclaimer: The information provided in this news story is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risks.

Upvoted! Thank you for supporting witness @jswit.