Is Tokenized Stocks a Reliable Investment Choice? How Do They Compare to ETFs?

#ETF #RWA #Tokenized

In the wake of Bitcoin and Ethereum ETFs gaining regulatory approval, the boundary between traditional finance and the crypto world is becoming increasingly blurred. A new concept is taking shape - tokenized stocks - a digital innovation that seeks to bridge Wall Street and Web3. As more institutions explore blockchain-based versions of traditional assets, a crucial question arises: Are tokenized stocks just a passing trend, or a reliable new investment pathway? And how do they stack up against ETFs, the current darling of traditional-finance-meets-crypto narratives?

Tokenized Stocks: Bridging Old Money and New Infrastructure

At its core, stock tokenization refers to issuing digital tokens on a blockchain that represent shares of real-world companies. These tokens can be traded 24/7 on blockchain platforms, bypassing many limitations of traditional brokerage systems.

Unlike traditional stocks, which are held in custodian accounts and only trade during business hours, tokenized stocks enable real-time settlement, global access, fractional ownership, and programmable liquidity. They operate much like stablecoins - but instead of being pegged to the U.S. dollar, they're backed by equity.

This fusion of legacy asset value with blockchain flexibility is no longer theoretical. In early 2025, Coinbase announced the issuance of tokenized versions of its own shares on Base, its Ethereum Layer 2 network. The move was widely seen as a milestone, signaling that mainstream crypto platforms were now serious about real-world asset (RWA) tokenization.

What Makes Tokenized Stocks a Compelling Investment?

- Round-the-Clock Trading and Instant Settlement

Traditional markets are plagued with latency - trades only execute during market hours, and settlements can take T+2 days. Tokenized stocks eliminate both constraints. Platforms like AlloX now offer 24/7 stock trading, significantly increasing flexibility for retail and institutional investors alike.

Blockchain technology enables real-time clearing, meaning trades are executed and settled simultaneously without relying on third-party intermediaries. This removes counterparty risks and reduces overall transaction costs. - Fractional Ownership and Global Access

One of the key barriers to traditional equity investing is capital requirement. Buying a single share of high-priced companies like Amazon or Tesla can be prohibitive for many retail investors. Tokenization enables fractional ownership, allowing anyone to own a portion of a share.

Moreover, with tokenized stocks available on-chain, investors from jurisdictions with limited access to U.S. equities can now participate, creating a more democratized financial system. - Increased Liquidity and Accessibility

Tokenized assets can be transferred peer-to-peer or traded on decentralized exchanges, often with lower fees than traditional brokers. Some platforms offer on-chain lending using tokenized stocks as collateral, unlocking new layers of utility.

For crypto-native investors, the ability to diversify without ever leaving the blockchain ecosystem is a major benefit. You can hold Bitcoin, Ethereum, and Tesla - all within a single on-chain wallet. - Legal Clarity Is Emerging

Skeptics argue that tokenized stocks exist in a gray regulatory area. While this is partially true, regulatory clarity is advancing. Switzerland and the EU have already established legal frameworks for digital securities, and the U.S. under a crypto-friendly administration is showing increasing willingness to regulate rather than ban.

For example, Backed Finance recently issued $wbCOIN, a tokenized version of Coinbase stock, which is fully backed, freely transferable, and provides legal shareholder rights. The announcement went viral on X (formerly Twitter), generating over 595,000 engagements, showcasing the growing interest in such instruments. - Risk Hedging for Crypto Investors

Tokenized stocks aren't just a new asset class - they also serve as a risk mitigation tool for crypto-native portfolios. When Bitcoin becomes too volatile, an investor can rotate capital into tokenized equities, effectively hedging exposure without needing to exit the blockchain.

This positions tokenized stocks as a kind of "stabilizer" within DeFi - bringing some of TradFi's resilience to the high-octane crypto landscape. - Institutional Adoption is Already Underway

Far from being limited to crypto startups, major players like Citibank, JPMorgan, and BlackRock are exploring tokenized asset offerings. Citibank, for instance, has partnered with SDX, a Swiss digital exchange, to tokenize private equity shares.

These actions aren't experimental - they represent strategic shifts in how global capital markets are being reimagined. By leveraging blockchain for equity issuance and trading, traditional giants aim to cut costs, enhance efficiency, and unlock access to new markets.

But Is It Safe? The Reliability Debate

Despite its promise, tokenized stocks face hurdles. Legal enforceability, custodial models, and technical risks (like smart contract exploits) remain legitimate concerns. Yet, the same could be said of ETFs in their early days - now considered one of the safest vehicles for retail investing.

The key is infrastructure maturity. As KYC-compliant wallets, regulatory frameworks, and licensed custodians emerge, tokenized stocks are poised to move from the "Wild West" to mainstream compliance. Projects like Base, Polygon, and Avalanche are already working on institutional-grade tokenization layers, supported by entities like Circle and Fireblocks.

Like all investments, risk exists - but with growing institutional support and maturing tech, tokenized stocks are evolving from fringe concept to credible investment alternative.

How Do Tokenized Stocks Compare to ETFs?

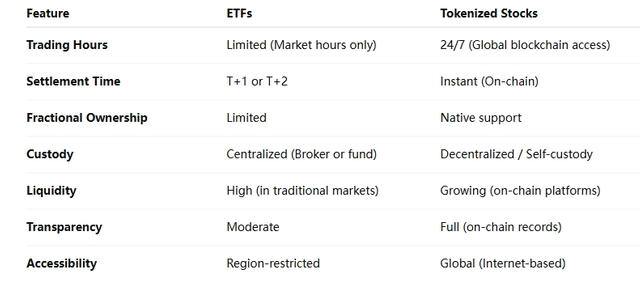

At a glance, both ETFs and tokenized stocks offer indirect exposure to underlying assets - but their architecture is fundamentally different.

While ETFs remain the go-to choice for institutional and conservative investors due to regulatory protection, tokenized stocks offer greater flexibility and interoperability with crypto-native systems.

One isn't necessarily better than the other - they serve different investor profiles. ETFs are the "training wheels" of crypto integration; tokenized stocks are the next-gen vehicle.

Conclusion: Not a Replacement, But a Bridge

Tokenized stocks are unlikely to fully replace traditional equity markets anytime soon - but they don't have to. Their value lies in connecting the two financial realms. For crypto users, they offer access to real-world assets. For TradFi investors, they provide an on-ramp to blockchain.

Much like ETFs unlocked institutional access to Bitcoin and Ethereum, tokenized stocks could become the gateway product that finally brings mainstream capital into DeFi.