The Budget Challenge: Principles and Systems for People Who Can't Stick to a Fixed Plan

Photo taken by: @ybanezkim26

This post is my entry to @smaeunabs' challenge. I absolutely adore the idea of the community helping each other achieve their growth on and offline. Thank you for initiating this challenge @smaeunabs! If you're looking to learn a bit about budgeting and maybe even join the challenge yourself, read The Budget Challenge.

Why the heck did you join?

I'm a financial advisor myself. I've dedicated quite a huge portion of my time into learning all there is I can know about managing money. I personally think that I can work my way to becoming rich. Well, "being rich" can mean a lot of things to different people but what I'm referring to is becoming financially free. I know that the road to building wealth isn't a straight and narrow path, especially for me who wasn't born with a silver spoon in my mouth. But I'm willing to take steps that may lead me to where I want to be. I believe joining @smaeunabs' challenge is a step that will lead me to that.

"It isn't about what you have, it's what you do with you have."

Get on with your scheme, already

Easy now. Since this is my budget plan, I will work with my principles and personality. No offense to @smaeunabs though, her article was really thoughtful and put together but I think it'll not work on me.

My cash flow in isn't fixed and consistent since I don't have a stable job yet. I work as an ESL teacher with a flexible schedule and my earnings here on Steemit hasn't quite stabilized as of yet. The commissions I get from financial advising isn't consistent either so I think it'll not help me to count my eggs before I even get them. Sticking to the rules is also something I'm not good at, though I believe that the rules should be known and respected, I was always making my own rules and that is how I've always managed to do things.

An entrepreneur I look up to, Sabrina Philipp, puts it

It’s not that I believe in “breaking the rules,” it’s that I believe that I can make my own.

Okay wise girl, what makes you think your methods are effective?

Well, I've been paying my bills with my own money. I've bought almost all of my wants in a span of three months and I get to enjoy my guilty pleasure of drinking expensive coffee in my favorite coffee shop once in a while. A bit of disclaimer though, I still live with my parents. I don't have to worry about setting up a budget for food and groceries and utilities like water and electricity. But being the eldest daughter, I have to always prepare myself to take over the family expenses when it comes down to it.

Let's get to the good stuff

I can narrow down my budget principles to five:

1. Work with your spending behavior

I personally use an application called "My Wallet" and I try my very best to log in all of my expenses daily. Here are some of the entries that I've logged for the past 5 months that I've been using it:

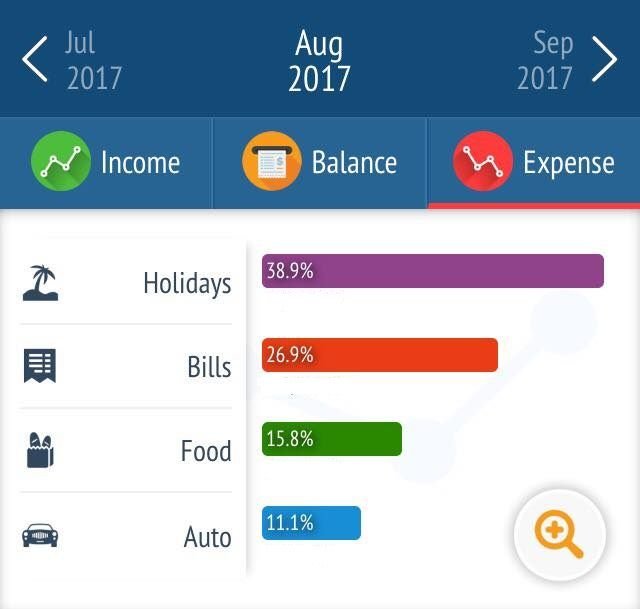

My August 2017 Expenses

My September 2017 Expenses

My October 2017 Expenses

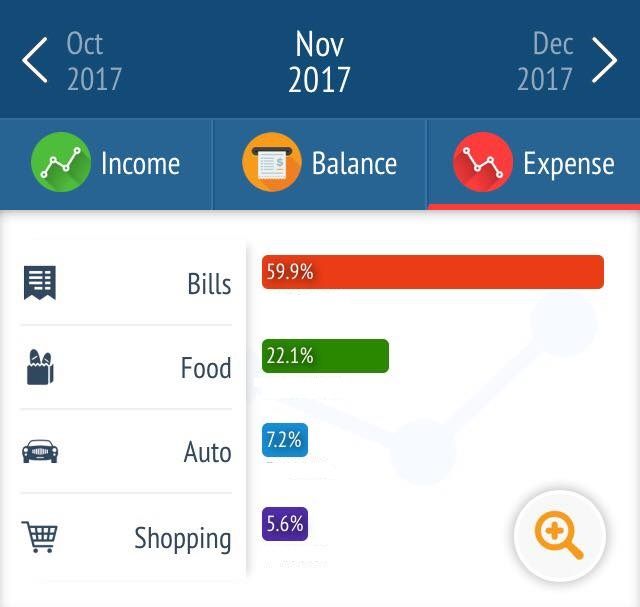

My November 2017 Expenses

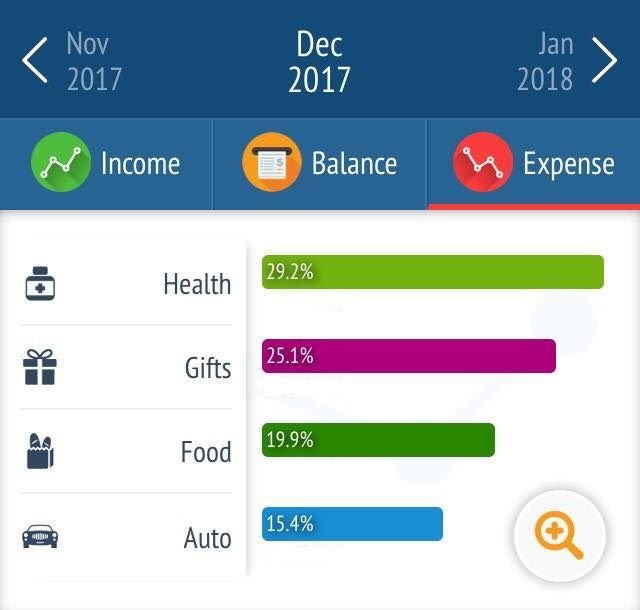

My December 2017 Expenses

As you've seen, my priorities change from time to time. In August, I spent the most on my holidays. In September and October, I spent the most on food. In November, on bills and in December, on health. I went to visit my boyfriend in Luzon last August and so a huge portion of my money went there. I attended a lot of financial advising workshops last September and October and so I did a lot of eating outside, hence the huge food expense. My mother needed my help in covering for the house bills in November, so I lent her some money. I visited a skin clinic last December, hence the greater health expense.

This taught me that my spending behavior is greatly affected by the events that happen in my life. With this, I have learned to always plot and save ahead for the upcoming events. A rule of thumb that I follow is to project an amount that I will most probably spend on the said event and save for it a month ahead. I also learned that eating out is what takes up most of my budget. I have yet to work out a system to find my way around this though, but I think that it's great to have identified the category where I spend money on the most.

2. Set aside money for the recurring bills in advance

I learned this from a mentor. My recurring bills are my Philhealth contribution and internet service. I set aside money for these a month in advance so that I'll never worry when the deadlines come. Last December, I've already set aside a portion of my money for January. This January, I've already set aside money for February bills.

3. Be smart with your saving schemes

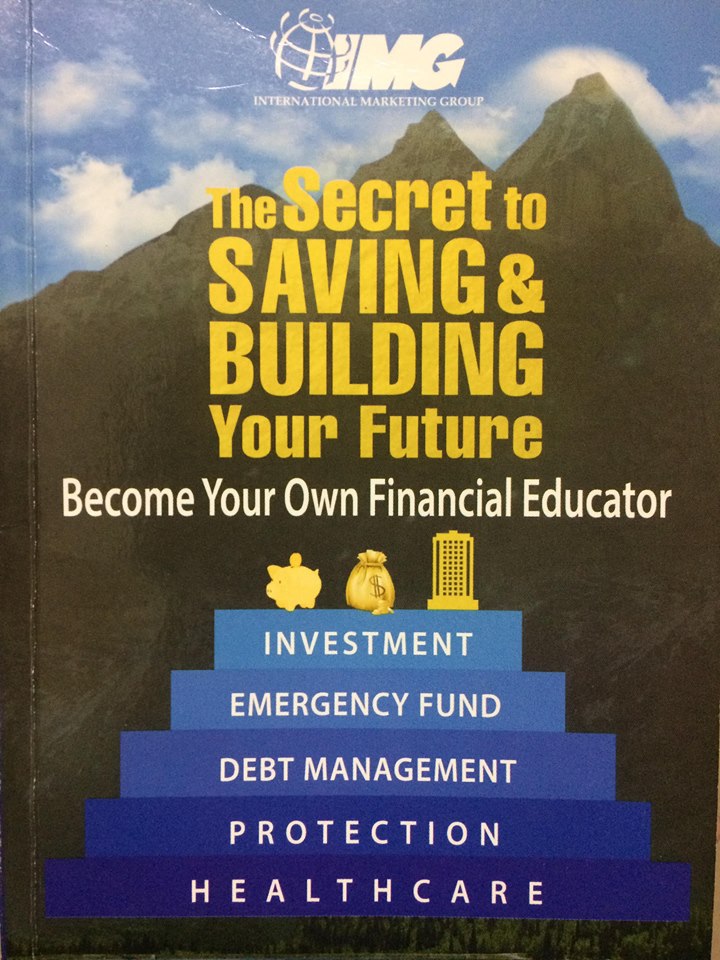

I'm not that particular when it comes to the amount that I set aside for my savings. But, I have a framework that I use as a guide to determine where should I be allocating my savings in. This is a bit lengthy, but I'm sure you can also learn from this. These are some of the essential things that I've learned from books that I've read.

This book is distributed by International Marketing Group (IMG) and I like the simplicity of its approach towards wealth building. I am personally working my way towards following the wealth building scheme that this book highlights. From the picture above you see a hierarchy of financial needs with healthcare as a foundation. Working our way up, we see protection, debt management, emergency fund and investment at the top. Though I don't have a concrete amount that I set aside for these, I follow this framework to motivate me to save systematically. Right now, I am currently saving for my emergency fund as I have worked my way to health and life insurance already. I will be explaining this hierarchy in detail

Healthcare Protection

According to this book, healthcare expenses account to 90% of all Filipino family bankruptcies. I can attest to this with my own personal experience when my mom suddenly fell ill. Because of our lack of healthcare savings, we had to borrow from my aunt who would torture us to pay our debts to her monthly. Our monthly payments to her ate up most of the budget. Needless to say, it was hard for us to cope up with the limited funds that we had to make do. In the event of a serious health problem or sickness, proper healthcare coverage will enable your family to push through financially.

Life Insurance Protection

In the event of premature death, this level of protection will pay off any responsibilities and liabilities that you left behind. I have seen this in action in Oh My G, a Filipino drama, when Sophie's (the protagonist) dad suddenly passed in a car accident, she was left with a will saying that she will have money for her education and needs that will last her lifetime. Sophie was lucky that she had a financially smart dad. Shouldn't your family be lucky they have you too?

Eliminating Debts

This book then says about the two types of debt - the bad debt and the good kind. The debts that are eliminated in this step is the bad kind, those that show no promise of capital return.

Building an Emergency Fund

A rough amount needed for you to build this one is about 3 to 6 months of your current income. Businesses are unpredictable and your job is no exception, it's best to build this level of protection to deal with sudden changes in your industry. This fund can also be used to pay for unforeseen accidents or repairs.

Investment

This part is all about making your money work for you. You can start to make long-term investments in mutual funds and stocks to reap the benefits of compound interest in the future. Lucky for us Steemians, investing in cryptocurrencies has been made accessible for us, too.

Building your wealth in these six steps will have to start from the ground until you work your way up. Getting long-term healthcare and protection should be a priority since sickness, disability and death are unpredictable both in occurrence and value. Emergency funds then come as second priority because second in terms of unpredictability is your job. If you haven't protected your job, you have no choice but to get into bad debts. It will then take you a step back into your wealth building. The objective of building wealth is to actually have a sturdy and resilient financial foundation.

4. Trick yourself into putting off your wants

I have this system that I use for keeping track of my wants. It goes like this, when you want to buy something take note of it. Beside it, place the date when you've decided that you want it. After a month, go over that list again and ask yourself if you still want it. If you still do, buy it. More often than not, your interest in buying things will have been lessened in a month's time.

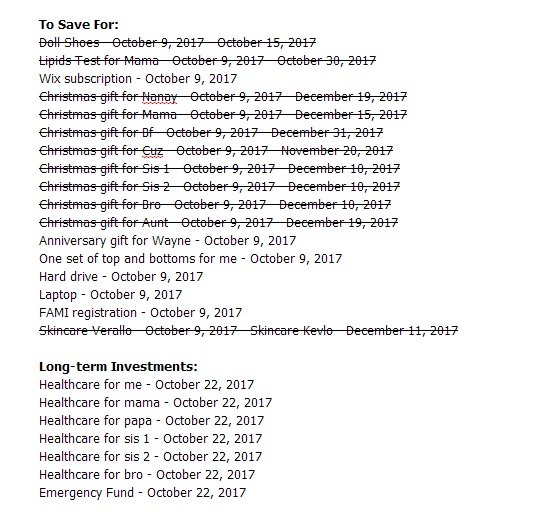

This method prevents me from buying expensive things on an impulse and so far, having everything that I've wanted in a list and seeing how I've managed to get them gives me a feeling of satisfaction. Here's my of my list:

My Things to Save For List

You can see that there are items that I haven't ticked off yet, but I'm very excited to purchase them when I have money to spare.

5. Little sound financial knowledge will go a long way

I had little to no motivation to save money before, but when I started reading financial-related books, I've convinced myself that systematic saving is more beneficial for me in the long run. Here are some concepts that have helped me strengthen my will to save:

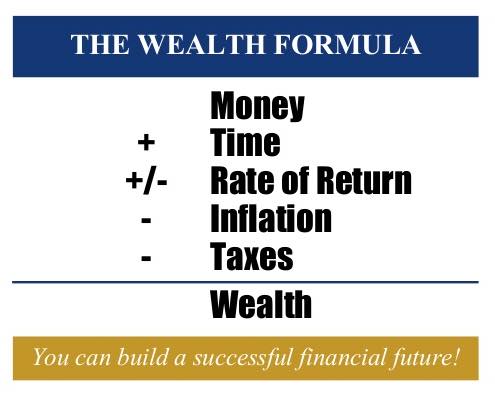

Understanding How Money Works

The Wealth Formula from brokawteam.com

Grow more of the pluses, limit the minuses and wealth is grown! Though simple in form, it's a bit hard to execute. This also states that while saving money is wise, it is not enough to build wealth. These are the skills needed to build it: increase cash flow, have the patience to wait, understand different investment options that give better rates of return to beat inflation and know basic strategies to minimize (not evade!) paying taxes.

Here is another concept that really motivated me to save as much as I could while I'm still young.

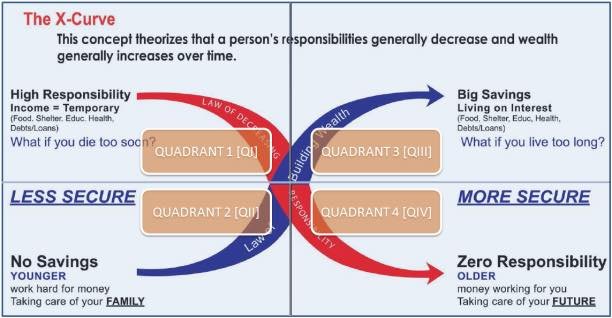

Laws of Building Wealth and Decreasing Responsibility

The X-curve Concept

X-curve Concept from pauljabadan.com

Quadrant 1

When we are young, though not specified how young, we have a high responsibility. The book says that one of our major responsibilities is our income from our job or business. He makes a point by saying that the challenge is that our income is usually temporary because nobody works forever and our needs like food, shelter, clothing, education, etc. are permanent. Our temporary income supporting permanent needs doesn't exactly make sense. This is where saving comes in.

Quadrant 2

Typically, the author says that when we are young, we have little to no savings at all. The hard work that we do is to provide for our family and ourselves. In our younger years, we are less secure.

Relevant questions that the book and the author say we should ask ourselves are "What if we die to soon? Are we prepared? Is our family ready? Who will take care of them?"

Quadrant 3

Because of these questions, the author says that we need to move on to quadrant 3 for answers. From older to younger years, we build wealth by saving and investing. We have to aim for enough savings to support us during retirement years. With enough savings and investments, we pair it with the right financial knowledge and we move on to quadrant 4.

Quadrant 4

The way we can battle out the temporary nature of our jobs and the permanence of the support that we need is to save enough and make investments so that our money can work for us. Investing our money in a safe and secure savings or investment program will allow us to live off from the interest of our investment.

The relevant questions to ask ourselves in this part of the curve are "What if we live too long and don't have enough savings? Who will take care of us? What if we're not financially educated?" We then retire broke. Discipline and having the right financial education are keys to wealth building.

Woah, you sure said a lot

Yes, I did. That's because I've learned the importance of financial planning by heart. My method isn't as particular as that of @smaeunabs and that's because I don't work best that way. I work best when there is plenty of room for me to adjust. Basically what I've laid out in my principles are frameworks and systems that set me off in the right direction. I really hope that this will lead me to the future that I've always dreamt for myself and for those dear to me.

Thank you, once again to @smaeunabs for initiating this challenge!

I hope you guys can join in as well! Let me just close this write-up with a quote from Dolly Parton

Find out who you are and do it on purpose.

This is exactly what I'm looking for in a budget challenge. I can really relate the "not sticking into a particular budget scheme thing". As the eldest, we really have to prepare for everything. It's an additional burden, but it's the reality. It's how the family structure in the Philippines functions. Good job! As always, well-written.

Thank you, @ybanezkim26! I personally think that a budget plan (or any plan at all!) is made more effective if you take into account how you work best. I know! The responsibility is overwhelming if you think about it, so I try not to. Haha

I can relate to how being an eldest "needs to prepare for everything" kim. And the eldest needs to get ready for all circumstances when your wallet needs to be challenged. HAHAHA

I think you two are super alike. :D but wa jud btaw ko kasabot sa uban formulas diri @thegaillery. magkita nata ninyo oy. pasabta ko. hahhahaha

It'll be my pleasure, @honeyletsgo! We three have a lot more in common than our being Steemians and being the eldest is one!

Kanus.a man ta magkita para magchika? Haha

Thanks for this @thegaillery. These are really useful tips. I'm also using an app to track my daily expenses. It helped me become more conscious on how I spend my hard-earned money.

Yes @legendarryll! That happened to me too. Just knowing where your money goes does wonders to your spending behavior. Keep at it!

Thank you for your awesomeness.

Please read this post.

https://steemit.com/steemit/@surpassinggoogle/the-masses-are-flocking-in-on-steemit-so-gather-steem-power-now-if-you-are-minnow-powering-up-will-also-help-you-with-bandwidth

For why 50/50 is a good payout option at this point. Please share with your friends as well or explain to them

Thank you for this, @surpassinggoogle! I was reading the white paper just the other day and I decided that it'll be cool to experiment with the options that I have control over and that's what I did! Thank you so much for enlightening me that this experiment is not a good move haha.

I am so happy reading this @thegaillery! 😍 Thank you for joining! This is also one of the advantages of this #thebudgetchallenge initiated by @smaeunabs, we got to learn a lot from other's effective ways of budgeting. Wow! I am so happy we got to share these kinds of topics to our fellow steemians. Hoping we could talk sometime about these @thegaillery! 🍻

Yes, we really should talk more about this @namranna! It'll be cooler if we include @smaeunabs and @jsmalila too🍻

Wow @thegaillery!!!! Yes!! Also with @smaeunabs and @jsmalila, too!

Sounds interesting! I'm in! :D

Exactly @namranna! This will definitely help us improve ourselves financially by incorporating those helpful tips and ideas in other people's perspective. Yay! I will be looking forward to your entry too, man :D

Yes @smaeunabs 😍 I'd join your challenge! Hooooo! 💪

This post somehow made me realize I made the best choice to choose you as my financial adviser. Thank you for this informative post @thegaillery! Cheers to financial freedom! :)

Yeeee! Thank you for your trust, @jsmalila 😁To financial freedom🥂

Wow awesome post dear ..I always saw your post

Thank you @mousumimou! I gave your profile a visit and found out that you're from Dhaka :) Nice meeting you.

Yes,dear .Please tell me you tall from..

@originalworks

The @OriginalWorks bot has determined this post by @thegaillery to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Wow! This is a very helpful and informative post! Thank you @thegaillery !

Thank you for dropping by, @brokemancode! Really proud of the support our team has for each other 😁

You're always welcome!

Wow! This is really amazing @thegaillery! I've learned so much through reading this. Your flexibility in taking over your finances is truly commendable which makes you a concrete example that financial success isn't only attained through following fixed plans.

Thank you so much for sharing your knowledge on how to manage finances systematically. I believe our fellow Steemians learned so much from this.

Cheers to Financial Freedom!

Cheers to Financial Freedom, indeed! I look forward to meeting you in person, @smaeunabs. I used to think that there is only one way to attain financial freedom. A schoolmate of mine taught me that Robert Kiyosaki is well-known for his risk-taking approach towards wealth building. It was then that I started to realize that there are a lot of ways to truly attain financial freedom

Yay, I actually bought two books authored by Robert Kiyosaki just this weekend, the Rich Dad Poor Dad Series.

Certainly, there are numerous ways on how to navigate ourselves towards financial freedom :D I think I have to explore other strategies as well.

Again, thank you so much for participating in this challenge @thegaillery, I will announce the winners this coming Thursday. Stay tuned ;)

I heard a lot of wonderful things about you from a good friend @namranna :D I am looking forward to meet you in person as well :D

Having a personal exchange of thoughts from a promising lady like you really sounds interesting! :D

Nauwaw na ko @smaeunabs. Hahaha, unsa man ang giingon ni @namranna? I'm sure you're equally promising as well. I am looking forward to that, @smaeunabs :) Sa Vikings ta? 😁

Hi Gail! Oh we have the same name. Haha! Anyway, as someone who seems to be born spontaneous, I usually have fixed plans. I tend to follow it for days but I seem to forget about it.

Hi @gailbelga! Yes, we do! Haha, I have those times too :) It's as if my mind is always looking for the next big thing all the time. Hahaha

And then we would end up deficit. Hahahaha no wonder they say that marriage is a workshop. When we get that moment, the husband works while we shop.