The Emergence of Money in the Economy

The emergence of money was a milestone in the history of the economy, created to solve the limitations of barter, such as the difficulty of direct exchanges, the lack of standardization of value and the impossibility of accumulating wealth.

Why Did Money Emerge? Barter worked only in small communities and simple situations.

As societies grew and exchanges became more complex, the need arose for: A common means of exchange.

A standard of value accepted by all.

A form of durable storage of wealth.

A unit of account to facilitate records, pricing, and contracts.

Types of Money Over Time Commodity Money (primitive): Goods with their own value, such as salt, shells, cattle, or grain, were used.

They were still useful goods, but were more widely accepted.

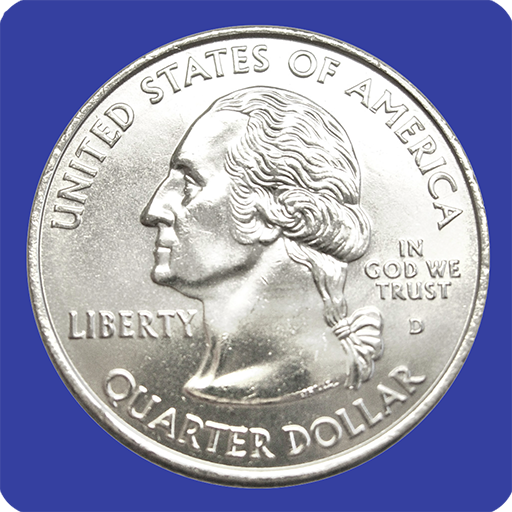

Metal Money: Early coins were made of precious metals such as gold, silver, and bronze.

They had intrinsic value and were minted with the symbol of a kingdom or empire.

Paper money: It emerged as a receipt for deposits of precious metals.

It gained exchange value and began to be widely used.

Fiduciary money (current): It has no intrinsic value, but is accepted because it is guaranteed by a government.

It includes banknotes, metal coins and digital forms.

Functions of Money in the Economy Medium of exchange: Facilitates the exchange of goods and services.

Unit of account: Allows for measuring and comparing values.

Store of value: Can be saved for future use.

Deferred payment standard: Used to make future payments (such as debts).

The emergence of money was essential for the development of complex economies, allowing efficient exchanges, growth of trade, emergence of markets and the advancement of civilization.