Crypto Currencies explained in Laymen's Terms : Ripple

In June 2017 there was around 900 Crypto currencies. Each of these crypto's addresses different issues in our world and also have different business models.

You can view a full list of all crypto currencies here

I have been writing posts aimed at non-technical people and decided I will expand this series to include explanations for various crypto currencies. Please feel free to drop me a message in the comments section should you have a specific question or interest which you want me to explain in Laymen's terms.

Ripple explained in Laymen's terms.

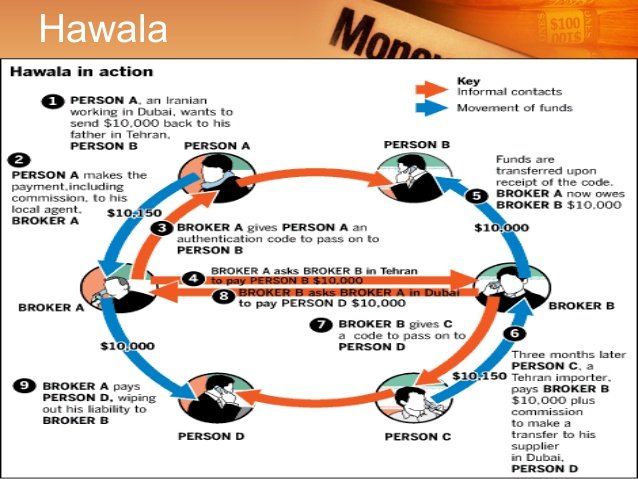

The easiest way to explain Ripple is that it is both a currency and a payment protocol. It is based on a very old concept or process, called Hawala, which was a non-digital way of transferring money from city to city in the event where there were no banks in operation.

Example for Hawala:

- Ben goes to a local agent and gives him money to send cash to Gertrude. He also gave Gertrude a password.

- The agent then phones Agent B and gives the go-ahead to somebody that has the password.

- Gertrude goes to Agent B, provides the answer and receives the cash.

How does Ripple work?

Websites, shops and people doing business can now use Ripple to a similar effect than Hawala. Ben goes to his Ripple gateway and deposits cash, and instruct the network to release the money through Gertrude's Ripple gateway. That's it. You now understand how Ripple works :)

But Ripple does not only transact in cash, you can basically exchange anything on the Ripple network as long as the gateway will deal in them.

Thinking back to the Hawala system, what if Gertrude's agent does not deal with the specific item that Ben and Gertrude wants to trade in? Well, that is where Ripple's come in. The Ripple algorithm always look for the shortest distance of trusted parties. Let's say Gertrude's agent did not trust Ben agent, but there is Agent C who is trusted by Gertrude's Agent, the network will ensure that the transaction happens.

There was a very nice Coindesk Article way back in 2014 which explains it nicely.

This is where 'ripples' (XRP) come in. XRP is the 'currency of last resort' for the ripple network.

All gateways provide a price in XRP of anything they deal in (for example: a dollar is 200 XRP; 1 oz of gold might be 260,000 XRP).

You could say, USD is the currency of last resort in the USA – that is, everything has a price in USD.

This means, within the Ripple network, you can convert anything to a number of XRPs, transfer the XRPs via the trust chains, then convert back at the end gateway, if needed.

There is more here, and as you dig, you'll learn about market makers, who provide prices at which they are prepared to trade between goods (for example, cash for gold, gold for silver, silver for XRP, XRP for GBP, and so on).

Some of my other in Laymen's Terms Post.

Some of these posts have been written more than 10 Months ago :)

Artificial Intelligence in Laymen's terms

Blockchain and Digital Signatures - In Laymen's Terms

Trustless - What does it mean in laymen's terms?

Cyber Attacks explained in laymen's terms

Machine Learning - In laymen's terms

Internet of things and what it is in laymen's terms

Big data - What is it really about - In laymen’s terms

Happy Steeming!

I think you have explained it in very simple way. Thank you @jacor

Thank you for your insight! This was very helpful to a beginnger in the crypto world like myself. I feel as if Ripple and its technology will be adopted across many banks and institutional money will start flowing in. It has many uses and can create many cost effective approaches that cannot be ignored. I look forward to reading more of your content.

Awesome post. Would love to see more of this for other currencies :)

Ripple = Debt

Nice and easy explanation. I am excited about Ripple.

Yo tengo Ripley y es útil para eobot

Yo tengo Ripley. Sirve para el eobot, pero

Thanks bro .... Are you advise us to buy and order this Ripple?

This is where the risk in XRP the token comes in and the rewards are so huge. If large banks use XRP the token to transfer large sums of money from one bank to another they will need to buy up large sums of XRP the token.

If XRP the technology is used, but banks decide not to use XRP the token then the currency is virtually worthless except for the fact that people will be left bag holding.

This is why investing in XRP tokens are so risky.

great job bro.