Forty Seven : Product & Technology Blockchain

Products and Services

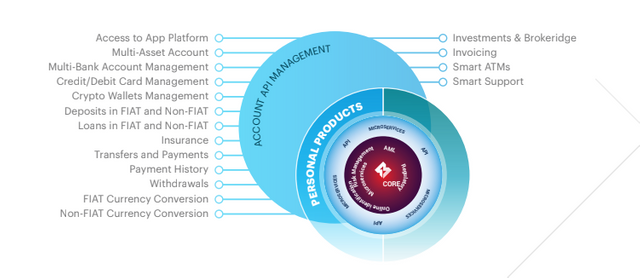

Forty Seven Bank is aiming to provide broad traditional and digital financial products and services spectrum for individual clients.

Products for Private Persons

Together with secured remote on-line identification, automated scoring, due diligence and AML of the client, customers could proceed with quick and secure banking. The bank is going to do that according to latest technologies using biometrics. The use of biometrics in the banking sector has proven its eectiveness and precision and that is why it is rapidly growing over the last years and is yet far from its peaks.

After the full identification of the potential client and further registration in the operational database is completed, the client can access the following services provided by Forty Seven Bank:IBAN, access to secure crypto wallets and tokens, credit and debit cards, personal and travel insurance, loans, access to Forty Seven App Platform with wide range of applications, invoicing, investment and brokerage services, etc.

By the virtue of the new banking regulations and decentralisation of the services which optimises communication between transaction parties, the PSD2 directive imposes significant operational changes and creates single digital market in Europe where consumers can proceed their financial management from the platform which aggregates previous individual services. Forty Seven Bank in this case, outstands by the fact of the digital cryptocurrency transaction services and processing support. Forty Seven Bank clients will have an opportunity to analyse and manage all financial operations in fiat and non-fiat curren- cies using flexible analytical functions of our smart software. For technically advanced clients, there will be the possibility to manage a bank account via API.

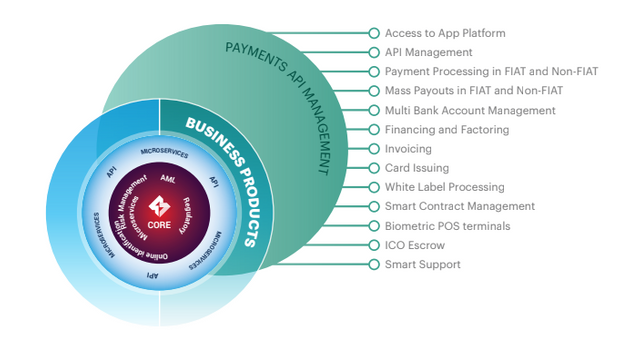

Products for Business

Synergy of smart contracts and blockchain will open new unbeliev- able opportunities. Our team is aiming to break through traditional banking and step into the new banking perspective using the current innovative exclusive services for future advantage. We are creating not just technological bank, we are creating the bank of the future.

Technological and operational facilities of our platform will be fully built to support customer needs where customers can pay full attention to their personal or business expertise and benefit from highly digital and cost eective solutions when it comes to payments and transaction management. Our clients will have opportunity to easily scale up their business using our infrastructure and business model.

Forty Seven App Platform and API Management

For our business customers, we will oer wide range of financial products and services. All the services will be available via API for management via smart contracts or customer applications. We will allow to create completely autonomous business thanks to full API access to our products and all their functions.

Payment Processing and Invoicing

Forty Seven Bank will provide wide range of payment processing solutions to our business clients. E-commerce clients will have the possibility to easily accept payments on their web-pages, platforms, applications, games, etc. with easy to use and informative merchant cabinet/panel. They will have opportunity to accept payments in traditional fiat currencies via credit or debit cards (Visa, China UnionPay, MasterCard, Diners) and direct bank transfers. Apart from that, entrepreneurs will be able to accept payments in digital currencies with support of the bank which will provide clearing procedures. At the same time, the bank will provide convenient and eective invoicing services. Having all these services provided by Forty Seven Bank, companies will have the opportunity to substantially decrease costs, increase eective- ness of working procedures related to financial management and get access to wide audience of potential customers.

Financing and Factoring

We would like our business clients to put the main emphasis on running core procedures at their entities that is why Forty Seven Bank will oer factoring solutions that will allow to receive immediate cash for accounts receivables. The bank will finance, manage and guarantee invoices issued by the company via smart contracts. Companies will have wide range of short-term financing options to cover operational activities, as well as possibilities of long-term financing for their development, expansion and growth. Besides that, by integrating machine learning, the bank will help business clients with credit risk profiles of their customers.

Biometric POS Terminals

We will develop POS terminal software, which will give users of our bank a possibility to connect a credit card or a bank account to his/her fingerprint, and pay in the store by applying a thumb to the fingerprint scanner attached to POS terminal. This technology will increase eectiveness of payment process in the store, and will provide benefits not only for customers, but also for business clients, by lowering the amount of queues and increase the amount of sales.

White Label Processing

We will provide infrastructure services for finan- cial institutions. Thanks to principal membership in Visa and MasterCard, we will oer full spectrum of on-line acquiring services and we will give opportunity to our partnering banks and payment processing companies to provide to their clients all types of payment solutions such as SMS, DMS, OCT, P2P, recurrent, moto, reversal, refund and others. Additionally, we will oer processing of Point-of-Sale (POS) terminals. Apart from that, we will oer card issuing and bin sponsorship services to our partnering financial institutions.

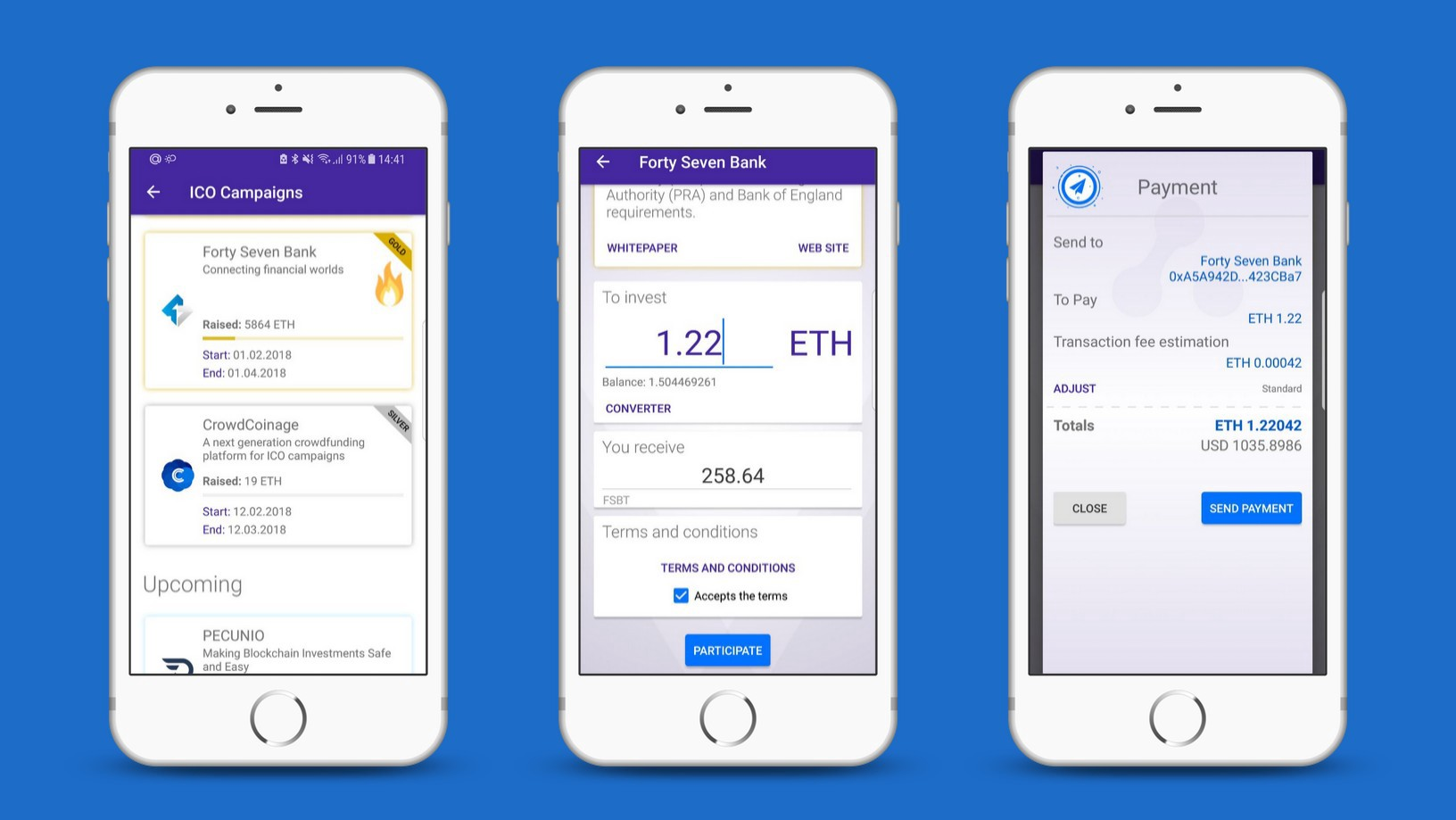

ICO Services

Forty Seven Bank is going to provide services for companies that would like to attract financing via ICO. The services will include legal support, escrow arrangements, support in transferring digital currencies into fiat equivalent. We will also develop rating procedures for ICO projects and will provide thorough analysis of interesting projects.

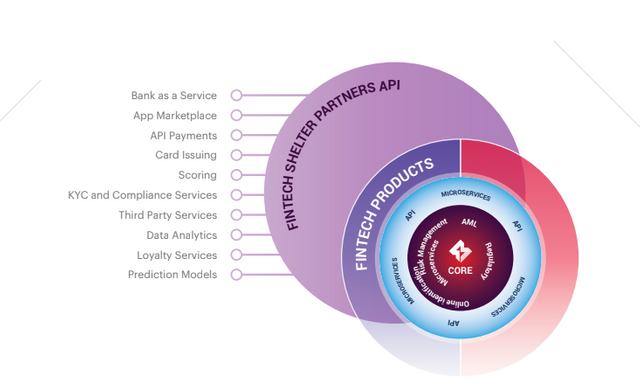

Products for Developers

All functions of our platform, from the usual activities related to account management, to opening an account, document upload, loan scoring and insurance will be created as single microservices. All these services together with the services of ailiate partners will be working via API and all will be available to our clients via secure channel.Business will have an opportunity to completely unlock its potential by automatization of its financial and operational activities using API for connection to its server and smart contracts for execution of operations taking into account dierent conditions.

Bank as a Service (BaaS)

Our service called Bank as a Service will allow entrepreneurs to get access to all infrastructure elements of Forty Seven Bank via API. Fintech startups or those who would like to try them selves in banking business will be able to create their own White Label bank or financial service institution. They will be free to concentrate on marketing activities, whereas our already devel oped infrastructure covered with banking license, technology, compliance, risk manage ment and customer service will do the rest.

Loyalty Services

Forty Seven Bank will support partners developers in their marketing activities. We are interested that developers attract as many customers to use their applications as it is possible, because each party gets benefits. That is why we will support loyalty programs of developers by providing possibilities of cash back to cards of their customers or any other marketing ideas that might be of customer interests.

Forty Seven App Platform

Opened API will give opportunity to our clients to develop applications (like applications for smart phones) which will work using potential of Forty Seven App Platform. Developers will be able to create their own banking application, a bot for account management or complex analytical application. Relying on possibilities of on-line identification they will have opportunities scale unlimitedly and earn significantly higher levels of income. We will manage marketing activities related to our platform and by introducing an application developer will have the chance to attract his own client base, as well as to use ou already existing base of clients and partners.

Developer Meet-ups

In our opinion, at the moment API is the main channel for attraction of new partners. State of the art and convenient API is only a fraction of what is needed in order to completely realise the ideas. That is why Forty Seven Bank is going to organize developer meetings in Europe, Asia and CIS where we will explain how to operate with our platform in order to realise your dreams.

Scoring, KYC and Compliance Services

We will help our partners-developers with compliance services related to their customers. As Forty Seven Bank will have complex software tools with integrated machine learning that will be used in scoring and KYC procedures, our partners developers will have opportunity to use these tools in full capacity and save much time and money at the same time being fully concentrated on the main tasks related to their business.

Data Analytics and Prediction Models

Our sophisticated data analytics techniques powered by machine learning technology will provide developers with important useful information that can be later used in decisions making process. The amount of information and its significance with respect to particular issues will help to test dierent hypotheses and build prediction models related to success of particular product or service.

Consulting Services

Forty Seven Bank is going to have consulting department that will share our knowledge and experience, as well as will help our partners to reach their goals more quickly. The department will act as the accelerator it will help to answer and resolve legal, technical or organizational questions of our API partners.

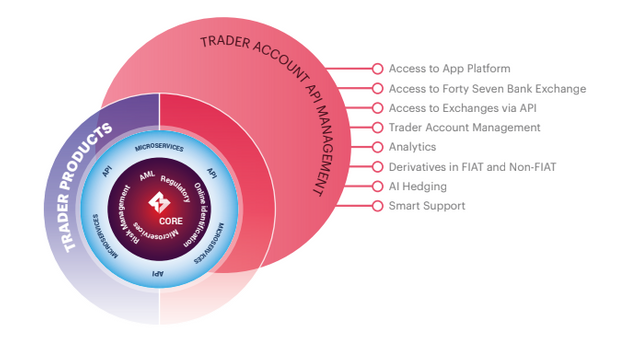

Products for Traders

Account Management

Our Trading Account Management system will allow our customers to manage their trading account and access features such as trading reporting, configuration, funding and account tracking showing them information such as margin, positions orders and execution to analyse trades and evaluate their performance and optimize strategies. For institutional clients there will be features to allow service providers such as brokers, advisors and hedge fund managers to link and manage multiple accounts configuring dierent tools for them to provide cost eicient services to their own clients.

Access to App Platform

Forty Seven Bank will provide customers with access to our state of the art trading platform to oer them a cost eicient opportunity to trade equities, options, futures and forex. The mobile platform will feature a variety of userfriendly functions to monitor the markets in real time and to keep track of trading orders and positions from a customizable intuitive dashboard with links to interactive market calendars and news. Our applications will be linked to our clients’ banking account to allow margin transfers free of charge.

Access to Forty Seven Bank Exchange

We will provide foreign exchange services to our customers including bank-to-bank transfers and foreign exchange dealing for international corporations. As we will be operating large volumes we will be able to transfer the wholesale rates we operate under directly to our customers. Our clients will be able to access these services upon account opening.

Access to Exchanges

There is a growing trend towards the utilization of high-speed and direct order models as a success factor in the business strategy of dierent participants within the capital markets. We intend to provide our customers with the flexibility they need to adapt to rapid changes in the market so they can capitalize on agile orientated opportunities via Direct Market Access (DMA). This feature will provide our clients greater control over their trades and the opportunity to place orders directly on the market having an equal level playing field for their orders when trading large sizes, as well as, visibility, tighter spreads, limit order placements and both pre and post market participation.

Technology Blockchain

Blockchain technologies are going to transform whole financial and banking industry. Forty Seven Bank is proud to be part of these transformations and wants to play key role by developing and delivering cutting edge financial products and solutions to our clients. Blockchain should serve not only to the cryptocurrency enthusiasts, all people and businesses should benefit from this innovative technology.

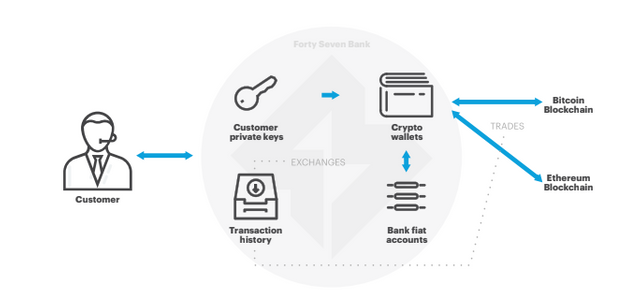

Cryptocurrency Gateway

Forty Seven Bank will operate as cryptocurrency gateway it will convert fiat into crypto currency and back to fiat. The bank will be integrated with major cryptocurrency exchanges and use it’s own reserves in fiat and cryptocurrency in order t execute exchange requests from our clients. For our clients the operation of exchange between fiat and cryptocurrency accounts will be as simple as transfer money from one fiat account to another.

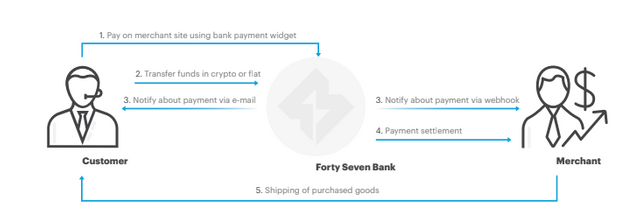

Cryptocurrency Payment System

For merchants who sell their goods over internet, we will provide secure cryptocurrency payment system. The buyers will be able to pay for products in crypto and fiat currencies via our payment system. The system will be easy to use for buyers and easy to integrate for merchants. Payment API and payment button for integration into merchant shop will be developed and provided for our customers. When buyer purchase the product, he or she can choose how they want to pay either using fiat or crypto currency.

When purchase is accepted, the funds from fiat or cryptocurrency account of buyer are securely transferred to fiat or cryptocurrency account of seller. If seller wishes, the funds can be automatically converted to desired fiat or crypto currency. Forty Seven Bank can perform chargebacks for cryptocurrency transactions in case of duplicated billing, fraud or technical issue on merchant side. Our payment system will be safe and secure for both buyers and merchants.

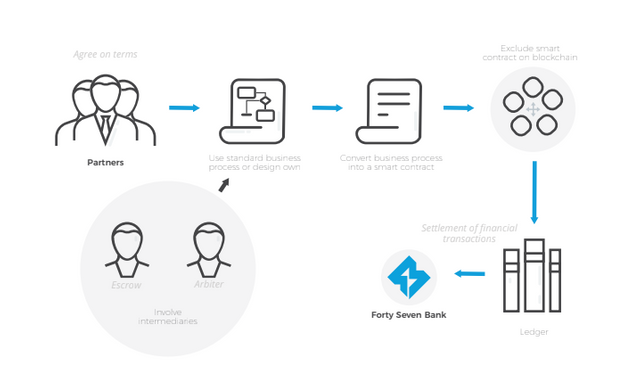

Smart Contracts

Forty Seven Bank will oer digital currency instruments such as Cryptobonds and Cryptofutures to our trader clients. Strict execution of contract terms will be guaran- teed by smart contracts that will be carefully developed and tested by our bank. Our smart contracts will be written in Solidity contract-oriented programming language and wil be executed on Ethereum blockchain network. The sourc code of these contracts will be transparent and publishe on GitHub for public inspection.

Forty Seven Bank will oer broad range of services based on smart contracts

Basically, smart contracts are computer programs that are run by the whole blockchain. These contracts can operate with financial data of Forty Seven Bank customers and partners and ensure strict execution of all rules specified by the given contract. The result of the contract execution is stored in the blockchain. Nobody can erase or change this information. The source code of the smart contract will be provided in open source and anyone can read and check all the rules specified in each particular smart contract.

Forty Seven Bank will provide a set of predefined smart contracts and these contracts can be used as standard agreements between bank customers.

The smart contracts will be legally binded to all involved counterparties. The rules of these smart contracts can instruct the bank to transfer the fiat or crypto funds from the account of one customer to the account of another customer. Such transfer of funds will be performed by the bank when specific conditions of the smart contract are met. The bank will be legally bound to strictly execute the outcome of these smart contacts.

More Information about Forty Seven :

- Website : https://www.fortyseven.io/

- Whitepaper : https://drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

- ANN Thread : https://bitcointalk.org/index.php?topic=2225492.0

- Facebook : https://www.facebook.com/FortySevenBank/

- Twitter : https://twitter.com/47foundation

- Telegram : https://t.me/thefortyseven

Author

- Name : Muhammad Alpi Syahrin

- Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1324600