Steemit Learning Club S23W4 | New Feature in TradingBoard to Calculate Trade's Risk/Reward, Profit, and Position Liquidation Price

Hi everyone, This is faran, and I hope every person is happy and fine in their life and spend a peaceful Ramadan by the grace of Allah. I am here again with new feature in my trading Dashboard which calculate your risk reward ratio and provide help to make better risk management. So every trader can become a decipline trader and manage multiple accounts.

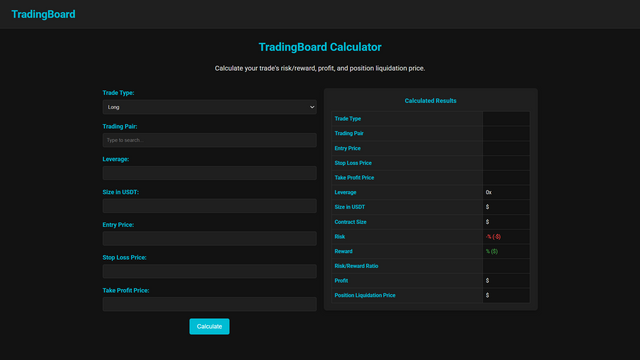

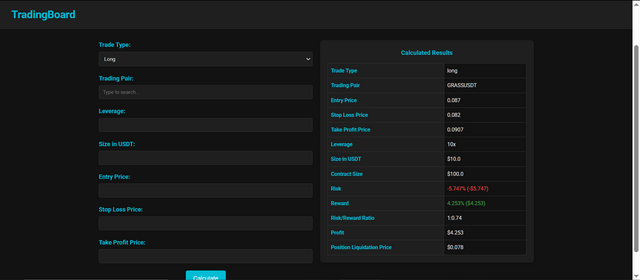

Welcome to my new version of TradingBoard Calculator, powerful tool that help us to manage trades as I also have created the master-client model. This calculator allow you to estimate potential profit, risk, and liquidation price base on the chosen trade type, trading pair, and the leverage. We can easily input our position size, entry price, stoploss price, and take profit to see the important results. It's user-friendly design same as previous and give us a clear view of possible outcomes. By using this tool, we can plan our trades with confidence and reduce guesswork. Give it try and take trading strategy to the next level. It is free to use for everyone.

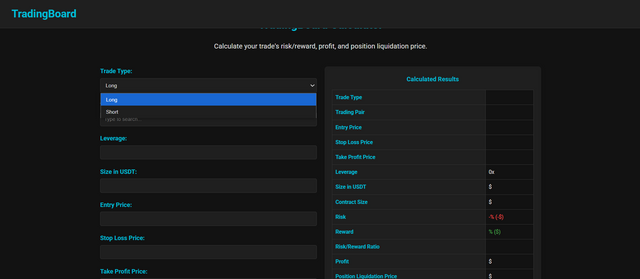

With this calculator, user can easily select preferred trade type, like Long or Short. This featur lets to decide whether us expect the market to rise and fall. When I choose my trade type, the calculator adjust the figures to match my strategy. By use of this option, we can plan your position, measure potential gains and losses, and control risk more effectively. Take advantage for smarter and efficient trading.

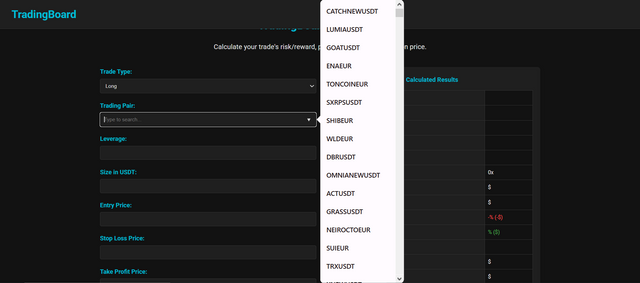

One of the helpful features is the ability to select the trading pair that is automatically fetch from the Bitget API. This ensure that we have up-to-date market pairs of Bitget exchange, so I can trade with most accurate information. Simply open dropdown list and choose the pair that you want, such as BTC/USDT or ETH/USDT and other. The calculator will calculations base on selected pair. With the reliable data source, We can feel confident about our trades, as we are always use current market information.

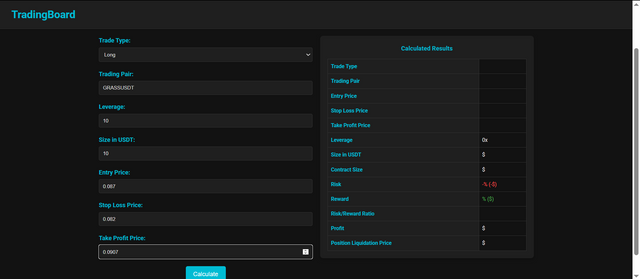

By entering the chosen leverage, wecdecide that how many times we want to multiply our initial capital, while the size in USDT show total value of our position as user can input. Set the entry price help the system calculate the potential profit and loss from that point. The stop loss price is placed to protect the capital if the market moves against our decision, and the target price for exiting with gains and profit.

The TradingBoard Calculator then automatically calculate the possible gains, risk/reward ratio, and liquidation price. This allows you to understand the trade’s full picture and helps you plan your trading moves effectively. With these features, you can fine-tune your strategy. As it's highlight the risk with red and reward with green and also show gain and loss in percentage and in dollar which we will achieve and loose. It's also show the risk reward ratio as we can see if user spend 1 then he will get 0.74 which is very bad ratio. But it is th example of how to plan the trades with risk reward ratio.

If the user try to input invalid data, for example, an entry price that does not meet the certain criteria, a stoploss and target that is out of range, or some other invalid input, then the system will highlight the problem in inputs. The TradingBoard calculator will show the error message in red text that have invalid inputs, alert the user to correct it before proceed. This ensure that the trader provide correct data, prevent all calculation errors. The bright red color message draw attention to invalid fields, make it easy to identify and fix any mistake.

Here is the example of short trade. I select the “Short” as a trade type and choose a trading pair, as “HIPPO/USDT.” Then, I enter the size in USDT, entry price, and decide on stoploss and take profit levels. After clicking “Calculate,” the system display all key information with ease, including with potential profit and loss, risk, and liquidation price. This help me to understand the trade possible outcome before execute it on the exchange.

How it's work logically?

In this I wanna explain a detailed, and step-by-step explanation of how trade example might work logically with the help of code. This explanation provide help to understand the main process, set up the interface, handle user inputs, validating the all data, perform calculations, and display the results.

1. Setting up the Interface (HTML Structure)

In this web-based calculator, I start by creating an HTML form to collect the user inputs. This form have dropdowns and radio buttons for select the trade type with only two options long or short and trading pair, with text fields for leverage, the position size, entry price, stoploss price, and take profit price. There is also the Calculate button that I clicks when they are ready to see the results

2. Handling User Input (JavaScript Setup)

Next, I need a JavaScript to retrieve the all values from these fields. I attach an event listener to Calculate button. Here is code example

javascript

document.getElementById("calculateBtn").addEventListener("click", function() {

const tradeType = document.getElementById("tradeType").value;

const tradingPair = document.getElementById("tradingPair").value;

const leverage = parseFloat(document.getElementById("leverage").value);

const size = parseFloat(document.getElementById("size").value);

const entryPrice = parseFloat(document.getElementById("entryPrice").value);

const stopLoss = parseFloat(document.getElementById("stopLoss").value);

const takeProfit = parseFloat(document.getElementById("takeProfit").value);

Here, parseFloat() convert the string value into numbers, make it ready for mathematical operations. If user use framework like React, he might manage these value via data properties, but the main logic remains the same.

3. Validating the Input

Before I perform any calculations, it’s important for me to ensure the input of user makes sense. For instance, I check if the numbers are valid (not NaN), positive for leverage and size, and if entry price is not equal to zero. I also ensure that stoploss and take profit are within reasonable range. If any check fails, It display an error message:

javascript

if (isNaN(leverage) || leverage <= 0) {

showError("Please enter a valid leverage value.");

return;

}

if (isNaN(size) || size <= 0) {

showError("Please enter a valid position size.");

return;

}

// Repeat for entryPrice, stopLoss, and takeProfit as needed

The showError() function will set the text of error <div> to the red, le me know they need to correct the input.

4. Performing Calculations (Short Trade Example)

When the user chooses “Short,” the logic for profit and risk changes compared to a “Long” trade. In a short trade, you profit if the price goes down, and you lose if the price goes up. Below is a simplified breakdown of how you might compute the key metrics:

Potential Profit:

- Formula: the formula to find the potential profit

(Entry Price - Take Profit Price) * Size - Because make money if the price dropped, our profit is the difference between the entry price and take profit price assume that the take profit is lower.

- Formula: the formula to find the potential profit

Potential Loss:

- Formula:

(Stop Loss Price - Entry Price) * Size - If the price rises above your entry, you lose money. So, your loss is the difference between the stop loss price and your entry price.

- Formula:

Adjusting for Leverage:

If we are using leverage, our actual margin is smaller, but your potential profit and loss is magnify by the leverage amount. We need to calculate the require margin as(Size / Leverage), and a variation depending on the exchange rule. Risk in terms of margin can compute by(Potential Loss / Leverage)if we want to see how it affect our actual capital.Liquidation Price:

Exchange use different formula for liquidation, often factor in maintenance margin and fee. A simplify approach canLiquidation Price = Entry Price + (Entry Price / Leverage) * (some factor)

For short position, the liquidation price is above to your entry price, since liquidated if the market move too far up. The exact formula depend on the exchange, but the concept will the same. Here is the example for computing potential profit and risk for short trade:

javascript

let potentialProfit = (entryPrice - takeProfit) * size;

let potentialLoss = (stopLoss - entryPrice) * size;

// If you want to incorporate leverage in the calculation:

potentialProfit *= leverage;

potentialLoss *= leverage;

5. Displaying the Results

Once you have compute the potential profit, potential loss, risk/reward ratio, and liquidation price, we need to show this value to the user. We can have HTML element such as <span id="profitResult">, <span id="lossResult">, and so on. Your JavaScript then update this elements,

javascript

document.getElementById("profitResult").innerText = potentialProfit.toFixed(2);

document.getElementById("lossResult").innerText = potentialLoss.toFixed(2);

document.getElementById("riskRewardRatio").innerText = (potentialProfit / potentialLoss).toFixed(2);

document.getElementById("liquidationPrice").innerText = liquidationPrice.toFixed(2)

6. Final Checks and User Feedback

At the end of this, the user see the clear breakdown of trade. User can review the number, adjust input if he wish, and run the calculation again. If the user change from “Short” to “Long,” the logic will flips (profit is (Take Profit Price - Entry Price) * Size, etc.).

GitHub repository

I create the GitHub repository, and upload all necessary files to understand how will it work, and the basic idea about fetching the balances of both accounts, fetching trade, placing orders, placing SL/TP and closing al l positions.

Now I do like to invite my friends, @sualeha, @artist1111, @uzma4882, @chant, @josepha and @sameer07 to participate in this challenge. Special thanks to the mentors @kafio @mohammadfaisal @alejos7ven'

Regards,

Faran Nabeel

La verdad es que hiciste un excelente trabajo, se nota que los cálculos son bastante bien fundamentados y precisos, no soy un experto en Trading pero creo que tu herramienta ayudará muchos en este mundo.

Tus tablas de contenido y cajas de formulario tienen un color bastante parecido al del fondo, te recomendaría aplicar algún estilo para generar un mayor contraste y así separar estos dos elementos ya que hay que batallar un poco para poder leer los resultados y los números que estás escribiendo.

Del resto creo que hiciste bastante bien, gracias por compartirlo con nosotros

Upvoted! Thank you for supporting witness @jswit.

Hi @faran-nabeel, please update the title from S23W2 to S23W4.

Got it 👍