The Best Personal Finance Summaries (for Malaysians) - 10 March 2020

The Best Personal Finance Summaries - 10 March 2020

Clarification on the RM500 Giveaway

Last week we talked about the giveaway that we'll be holding.

One lucky person will be winning RM500 (and who knows, maybe there will be even more prizes to be won…)

But you don't simplify qualify for the giveaway by filling a form on our end.

You will qualify for the giveaway by:

- Signing up for one of our approved actions

- Completing the task that the approved action states.

For example, one of the verified actions is to open a StashAway account. StashAway makes passive investing super easy and you'll end up doing better than 90%+ of unit trusts in the long run.

If you decided to sign up for StashAway as the approved action from us, you will need to:

- Sign up on our StashAway form

- Create an account on StashAway

- Fill out all the details that StashAway requires

- Funding the account (even RM1 will do)

- Provide the proof that the account was created and funded

Note: steps 2 - 5 are also given to you in an email once you sign up on our StashAway form.

This goes back to our emphasis on wanting to see you improve your financial situation by taking action.

The most common actions you can take is listed at the bottom of this email. But if you want the full list, you can go to our giveaway page.

The first winner will be announced in:

From Us

[VIDEO] Book Summary: Financial Peace Revisited

Don't be one of the almost 20,000 people in Malaysia to declare bankruptcy. This summary will show you how.

Money in Daily Life

Should Women Take Control of Their Finances?

How do you take charge of your own financial needs? Feel overwhelmed, and you would instead leave it to your spouse?

Low Level of Financial Literacy

The financial literacy rate for fellow Malaysians is among the lowest globally, as revealed by the 2016 OECD statistics. This means many Malaysians are unprepared for an unexpected economic shock or surprise bill payment.

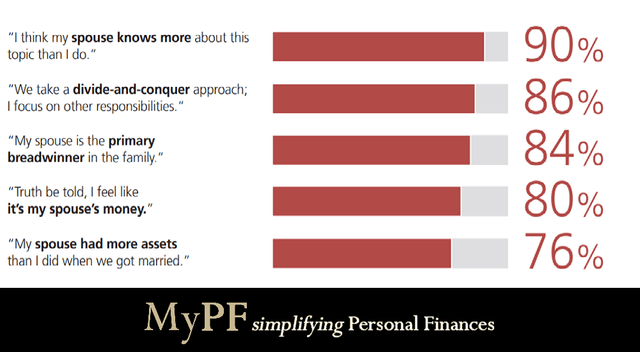

Leaving Major Financial Decisions to Spouse

To make things worse, most women in Malaysia depend on their spouses to decide for important financial planning - according to a survey by UBS, as shown below:

Leaving It to Circumstances

In today’s age, it should be up to each household’s discretion to decide whoever should make critical financial decisions. However, women should not take a back seat on this matter. Women generally live longer – about 5.1 years more. Also, what if things didn't go according to plan? There are many financial consequences due to the unfamiliarity of the subject matter:

- Unaware of Financial Status/ Not knowing own or family economic status. Proper records of cash flow and assets are essential. Next, it is crucial to be aware of the whereabouts of the relevant documents.

- Readiness for unexpected life events. After establishing an understanding of current financial standing, proceed to have a list of summaries of your existing policy coverage. After that, find out your financial commitments and debts.

Being Risk Averse

A basic understanding of your risk profile, asset allocation, and investment options are essential information that every woman needs to have. However, women are generally adverse risk-takers. Thus, it is necessary to take note of the following:

- Splurging your income. Many people tend to delay the habit of saving. If they earn more, they spend more. The same goes for women. Hence, it is crucial to realize the importance of savings and start depositing early. Start small, but consistently.

- Unaware of administrative procedures and related costs when the death happened. It is common nowadays to find both husband and wife taking joint long-term debt commitments. Thus, women need to know the administrative procedures so that they could plan accordingly.

Taking Charge and Be A Value Addition to the Family

Women need to take an active role in financial planning – be it for themselves or their families. Being financially savvy means that women could bring more to the family table. Remember, each one of us is responsible for our own financials.

Our free budget calculator can help you get a complete picture of your monthly finances, providing insights into where you’re doing the most of your spending (and where you might want to cut back!).

Proudly presenting the Budgeting Calculator, created by the MintLife personal finance blog.

How to Use the Free Budget Calculator

1. Enter All Sources of Monthly Income

Enter your Salary & Wages (after taxes): “net monthly incomes” and Other: “supplementary income”.

2. Enter All Monthly Expenses

Put in the Housing: “total monthly rental or mortgage with utilities”, Food: “grocery bills” and Transportation: “transportation costs”, Credit Cards & Loans: “credit payments”, Health Insurance: “premiums”, Pets: “pet-associated fees”, Entertainment: “entertainment activities”, Personal Care: “essentials”, Child Care: “child-associated fees” and Other: “any other recurring expenses”.

3. Enter All Monthly Savings Contributions

This includes Emergency Funds: “3 months of living expenses”, Investments, Retirement, and Others.

4. Visualise Your Finances

Once you enter all your information, the calculator will indicate either you are overspending or still within your budget.

Budgeting Calculator: Frequently Asked Questions

1. What are standard budgeting techniques?

Commonly, there are 4:

- The Envelope System – Add up all fixed and variable expenses, then subtract this number from your income. Put each payment into a labeled envelope.

- Reverse budgeting – Instead of categorizing your spending, start by creating aggressive savings goals.

- Zero-based budgeting - Allocate ALL your monthly income to expenses, savings contributions, and debt payments.

- The 50/30/20 Rule – Split your costs into 3 main categories: 50% for needs, 30% for wants, and 20% for savings as well as debt repayment.

2. What should my budget be?

No one method suits all. Your budget varies based on your income, financial responsibilities, and objectives. However, all budgets start with understanding your current financial standing – which can be done using the budgeting calculator.

3. What should my budget include?

Generally, your budget should include housing, food, transportation, credit card payments, debt payments, savings accounts, insurance coverages, and entertainment expenses.

4. How do I create a budget?

First, get a bird’s eye view on your financial cash flow and set up your financial objectives. Next, just keep your spending on track.

5. How often should I adjust my spending based on the free budget calculator?

Reassess your spending only when your income, expenses, or savings contributions change significantly.

6. What is an excellent free budget app?

Mint app! It is available on the Apps Store and Google PlayStore.

5 Different Types of Insurance Policies & Coverage That You Need

There is an overwhelming amount of insurance options on the market.

…

How do you know what types of insurance are necessary, and what’s superfluous?

There are 5 different main types of insurance, namely health insurance, car insurance, homeowners’ or renters’ insurance, life insurance, and disability insurance.

Check out the handy table below to help you assess and evaluate your decision on taking or dropping insurance.

| Insurance Type | Description | You don’t need it if … |

|---|---|---|

| Health Insurance | It prepares you from financial hardship (medical bills are expensive). Consider your needs (if you use it frequently, get a plan with low deductible and copays), doctors (find a plan to keep your current doctor), and costs (optimize your priorities – higher premiums translate to lower deductible and copays and vice versa). | Children are usually covered under their parents’ health insurance. |

| Car Insurance | It covers liability (pedestrians’ injury and property damage), personal injury protection, collision, comprehensive (any damage to your car), and uninsured or underinsured motorist (if the person who hits your car doesn’t have enough insurance). Try to look for car insurance discounts. Every state (in the US) requires vehicle owners to have one. | Well, if you don’t own a vehicle. |

| Homeowners’ or Renters’ Insurance | It covers your home (homeowners’ insurance) or you (renters’ insurance) against damage and theft in a property. It is essential if you have a large apartment with plenty of valuables. Also, it is cheap. | As a homeowner, you don’t need renters’ insurance and vice versa. |

| Life insurance | It covers costs associated with dying (burial and mortuary fees). It also pays off your debts and helps your family offset the lost income. It is important as it can safeguard your family financially. | You might not need one if you’re single and unmarried. |

| Disability Insurance | It covers costs associated with disability (temporary, permanent, partial, or total). Consider getting one because it’s affordable if you’re young and single. | Children don’t need disability insurance because they have no income. |

Also, there are 5 most unnecessary insurance policies:

- Flight Insurance - Flying is one of the safest modes of travel.

- Life Insurance for Kids - Kids have no income.

- Accidental Death Insurance - It has many restrictions and nearly impossible to collect.

- Disease Insurance - A proper health insurance can replace this.

- Mortgage Life Insurance - A right life insurance can cover this.

Money Talks Your Way to Create Healthy Finances and Lasting Marriage

Creating a long-lasting union with healthy finances with your spouse requires hard work.

Why it is essential to have money talks with your partner

Money is the number one cause of 90% of separations/ divorces. Often, your partner’s money issues are interwoven with yours in a relationship. It is essential to talk about money, because your partner’s money condition, habits, and values can have a material impact on your finances.

Why do couples find it difficult to discuss money?

In short, different life values raise different perspectives – as in the different perceptions of money too. Therefore, we should realize and address this difference as soon as possible.

4 steps in having a money talk with your partner

- Talk during a neutral time. Find a suitable (quiet and calm) time to hold a casual conversation with your partner.

- Set up for the discussion. Respect and pay attention to your partner and the whole debate. Pose inquiries for clarity.

- Pick a subject of debate. Disclose your financial standing, goals, expectations, and wants. Be honest with yourself. At the same time, listen to your partner’s too!

- Set a subsequent discussion weekly and keep it going!

The most important rule to foster healthy finances

No secrets and surprises, including debt. Bare yourself naked, financially, and prepare to accept your partner’s as well.

Hot buttons: Debts and Bank Accounts

Discussion on debts can be distressing. Keep in mind, the earlier you discuss it as a couple, the faster and easier for you to tackle the debt. For bank accounts, decide whatever system that works for you both as a couple – be it separate accounts, one or a mix. Most importantly, your decision should reflect your financial objectives.

Conclusion

To maintain a good relationship with your spouse and to have a good financial life - the key is communication. Nonetheless, do consider professional services if you find that there are barriers to communicating as a couple.

Want To Have Your Money Accelerate Your Goals?

Sign up for our free program and get ready to have your money fuel your aspirations.

Grow Your Wealth

How to Make Money From Home in 2020

Making money from the comfort of your own home has never been easier. No matter your background, education, skills, or age, you can make money on your couch.

Lars Lofgren, one of the contributors at I Will Teach You to be Rich blogging site recently compiled a list of updated methods to earn money remotely. The summarised list is available below:

| Ways | Description |

|---|---|

| Google Adsense | If you have a website with sizable traffic, Google Adsense will pay you for displaying its ads. |

| Write a Book | Consider writing and publishing your book – physically or electronically if you can write well! |

| Sell Online Courses and Webinars | If you are an expert on a subject, turn your knowledge into money by selling online courses. |

| Start a Youtube Channel | Once you secure a niche and accumulate a steady subscriber base, you can monetize your channel through ads, memberships, merchandise, stickers, or Youtube Premium. |

| Virtual Assistant | You can be a virtual assistant if you can communicate clearly and stay organized. |

| Airbnb Host | Monetise your vacant room using Airbnb – after all, it is extra money! |

| Customer Service Representative | Apply yourself at the outsourcing companies to work as a customer service representative. Nowadays, the demands are huge, and they pay well. |

| Telemarketing | Similar to the Customer Service Representative above. |

| Take Surveys Online | Some companies pay you to take surveys online. While the amount might not be great, the surveys often require minimal time and effort to complete. |

| Online Juror | Think of it as an online focus group but for court rulings instead of products or services. Use platforms to find these opportunities. |

Apart from the 10 ways listed above, there are several more new methods to generate income from home. Do click the link above to check them out!

How to Invest Money in 5 Easy Steps

Investing is the best way to build wealth. Ask anyone living an abundant life how they got there, and they’ll say investing.

…

Regardless of your situation, you can start investing money in just five easy steps.

1. Understand Your Options and Available Investments

First, the core types of investment are:

- Stocks – Shares of a specific company. Publicly traded companies (Apple or Google) sell shares to raise money. Stocks have high risks and can yield high returns.

- Bonds – Loans made to the government or a specific company. If you buy a bond, the bond issuer borrows your money and pays it back with interest. Bonds offer lower returns but have lower risks.

- CDs – Certificate of Deposits are like bonds but issued by banks and credit unions. CDs lock up your money for the full duration of deposit (unlike bonds that can be sold whenever you want).

- Mutual Funds – A basket of investments. They have a manager who will follow a strategy and invest the pooled money for you (and others). Mutual Funds have higher fees associated with trading and commissions.

- Index Funds – A type of mutual fund. They track an index (S&P 500) passively, therefore, have a lower fee compared to conventional mutual funds.

- ETFs – Exchange-traded Funds are similar to Mutual Funds and Index Funds. However, they trade like stocks – you can buy or sell anytime.

- Options – Buying or selling a contract. The contract allows you to buy or sell a particular stock before a specific date at a set price – however, you aren’t obligated to buy or sell the stock.

- High-Yield Savings – The money in these accounts can be easily liquified.

2. Open the Right Investment Accounts

There are also many types of investment accounts:

- 401k – A company-sponsored retirement plan. Some employers will match your 401k contributions up to a certain percentage of your income. Make sure to max out your company matching before investing in other accounts.

- Roth IRA – Another type of retirement investment account. It is tax-free. Max this out after maxing your 401k matching contributions.

- SEP IRA – A Simplified Employee Pension Individual Retirement Account. This is the best retirement plan for self-employed individuals. The contributions in SEP IRA effectively lower the taxable income.

- Brokerage Accounts – Bank accounts to purchase investments like stocks and bonds. Unlike retirement accounts, everything in a brokerage account gets taxed.

3. Set Up Automatic Contributions

Reserve approximately 20% of your take-home pay for the investment. Set up an automatic monthly transfer. After 2 to 3 decades, the amount will compound and can provide for your retirement.

4. Pick Your Investments

Generally, there are 2 ways to do this:

- Super Easy Method – Target Date Funds. For each of your accounts, get a target date arrangement. You simply decide the year you want to retire, and the fund will do everything for you. They will automatically pick, rebalance, reoptimize your investments according to your target date.

- Advanced Method – Build Your Portfolio. If you prefer, you can build a portfolio yourself. By doing this, you need to do your due diligence or at least follow one of the lazy portfolios. Albeit it is much complicated, it can potentially earn you more money.

5. Sit Back and Do Nothing

After setting up your contributions, you can spend the rest of your money guilt-free. Just take note, if your pay increases, make sure to increase your contributions accordingly to keep investing 20% of your income!

Here’s Our Take on Day Trading in 2020

I’ve been tempted to try day trading too. Then I did my research, and it turns out that day trading is one of the most challenging ways to earn a living. The odds of making money through day trading are lower than those of winning by gambling at a casino.

What is Day Trading

Day Trading, by definition, is buying and selling stocks on the same day. Day traders care about making money right now, and they try to profit from the changes in prices of shares in a trading day.

Most People Fail Miserably at Day Trading

Less than 1% of day traders consistently make a profit. This is because the short-term price movements are subjected to irrationality and uncertainty. In short, it is complicated and not as easy as it sounds.

The Risks of Day Trading

Apart from random fluctuations in price movements, there are other associated risks as well:

- Costs and Taxes – While trade commission fees are abolished on many brokerages, you still have to pay taxes for capital gain.

- Stress – Your earnings or losses are dependent on how fast and accurately you react to the price movements.

- Significant Losses and Profits – Most day traders leverage to enter a trade. While your profits are magnified, keep in mind your losses are enlarged as well.

How NOT to Get Sucked into Day Trading

Undeniably, some people succeed in day trading – but the odds are less than 1%! A common rule for speculative investments is only to put 10% of your portfolio at risk. If you’re not taking heavy losses regularly, this works well. Even if you lose the whole 10%, nothing will change your financial future.

How to Tell if You Are Special and Should Try Day Trading

- Trading System – You have logical reasoning behind your trading system. You can generate sustainable, yet consistent profits.

- Back Test Your System – Next, you should backtest your system. Make sure you accounted for the full economic cycle, including recessions, bull or bear markets, fluctuating inflations, different interest rates, and so on.

- Trading Psychology – Make sure your trading system matches your personality.

- Live Market Test – Lastly, test your system in the live market.

Alternatives to Day Trading

There are many alternatives to day trading. Nonetheless, the best way would be just buying index funds. Invest consistently monthly with a lazy portfolio. More money, less stress, and simple enough for everybody else!

A Cautious Guide to Cryptocurrency in 2020

Whatever the case, we want to help you understand what exactly cryptocurrency is and—most importantly—what it isn’t.

Cryptocurrency: Investment or Speculation?

Blockchain is a technology, and cryptocurrency is considered investments. However, compared to other investments (stocks and bonds), cryptos are not suitable investments. They are volatile, lack a traceable history, and prone to fail. Thus, investing in crypto is considered as speculation.

What Is a Cryptocurrency?

Cryptocurrency is a decentralized digital currency that leverages blockchain technology to manage transactions. It relies on a blockchain – a public ledger maintained by the P2P network.

How Cryptocurrency Works?

Imagine two people: Andrew and Bea.

Andrew wants to buy a painting from Bea via Bitcoin. So, he transfers the amount by interacting his private key with the blockchain to record transactions. A network of P2P computers then analyses the purchase and adds it to the blockchain once it is verified. Finally, Bea will receive her money once the transaction is announced on the blockchain.

Most Popular Cryptocurrencies

- Bitcoin (BTC) – The first and the most popular coin. Satoshi Nakamoto created it in 2009. To date, there are more than 7 million active Bitcoin users.

- Litecoin (LTC) – Developed by Charlie Lee in 2011. Identical to Bitcoin, but faster.

- Ethereum (ETH) – Created by Vitalik Buterin and Gavin Wood in 2005. Uses smart contracts.

Investing in Cryptocurrency

Just like any other investment, buy it, let it appreciate, and sell it.

Crypto is High Risk: Here is Why

The price of a cryptocurrency is extremely volatile. For instance, Bitcoin was trading at $900 in early 2017 and skyrocketed to $20000 by December. In the following November, it dropped to $3700. Unlike conventional currency, it is not backed by gold, government, or bank – instead, its value is based on pure speculation only. Also, there are no corporate balance sheets or investor reviews for cryptocurrencies as well!

How to Buy Cryptocurrency?

If you want to invest in crypto, you need to know the following:

- A place to buy it. For starters, you can use Coinbase to exchange your fiat money (US dollar) with other cryptocurrencies.

- A place to store it. Typically, you need a digital wallet. However, the wallet comes with two randomized sets of numbers and letters – which are named public key and private key, respectively. You can choose to store your cryptos in software, hardware, or paper wallets.

Ways to Qualify for the Giveaway

Here are some ways you can qualify for our giveaway happening in

Here's the full list of the ways you can qualify for the giveaway.

Compare the different car insurance providers from one site

Is your car insurance coming up for renewal soon? If so, make sure you check if there are better deals that other car insurance providers are willing to give you by comparing them all at once.

The best part is you can customize what it is you want and have your quotes in real time.

Oh and your No Claim Discount will carry over to the new provider as well.

Check it out today and start saving!

A way for females to get free insurance

We were talking to our super humble financial advisor friend one day and she started talking about some insurance product for females that provides coverage for all these female related illnesses. But more importantly, the contract also states that all the premiums will be returned at the end of the contract.

Seriously something for all females to consider!

Learn how you can be paying 50% less for medical insurance

We had to interview an expert insurance agent who told us ways that we could be reducing our premiums by 50%+ by following these few tricks. Take a watch and qualify for the giveaway after answering a few questions to prove that you had watched the interview.

Figure out investing in 30 minutes and never deal with it again

Truly investing on autopilot. By signing up for Stashaway, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with any amount as there are no deposit or withdrawal fees!

Plus get the fees even lower by signing up for Stashaway through us*!

Figure out investing in 30 minutes and never deal with it again (halal version)

Truly investing on autopilot (halal version). By signing up for Wahed Invest, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with as little as RM100 and there are no deposit or withdrawal fees.

Plus get RM40 from Wahed Invest for signing up through us and funding your account by RM100.