Akamai Technologies: This Time Is Different by Michael A. Gayed

Summary

- Stellar 2019 performance for Akamai - 60% up this year.

- Stiff competition threatens to spoil the party.

- Rising wedge or running triangle - something to consider for both bulls and bears.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

Akamai Technologies (NASDAQ:AKAM) is a software and Internet industry services company that had a fantastic 2019 so far. Its share price rose about 60% before dropping recently. Is this the start of a healthier correction or just a pause before attempting for new highs?

With services ranging from cloud and enterprise securities, web and mobile performance, media delivery, and Dev/Ops, Akamai serves various industries like financial services, hotel & travel, media and entertainment, public sector, retail & consumer goods, software, and technology.

According to the company's website, it interacts with a billion devices and 100+ million IP addresses every single day only in the area of Internet security, being trusted by the top 10 banks in the United States and Europe, to name a few of its customers.

Despite the unlimited potential when serving clients on the Internet, the software and services industry in this space is relatively small in size. Akamai develops platforms, networks, solutions, and services for the online businesses – as more and more businesses have an online presence, the growth potential remains elevated.

Because more and more businesses move their operations to the cloud (despite the concerns about security risks, such a move results in large scale savings from outsourcing internal services), the demand for related software and services will continue to increase.

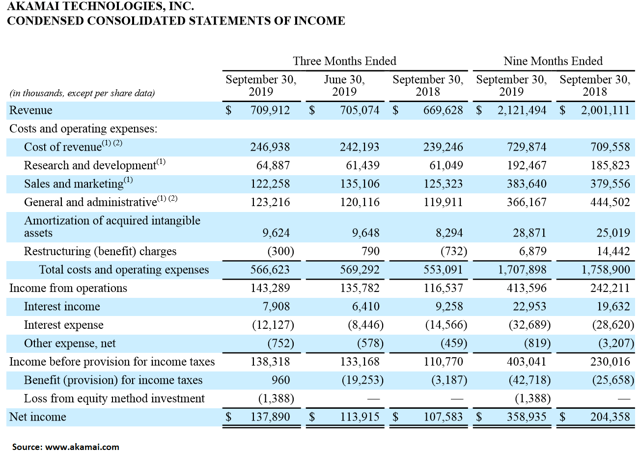

The Q3 2019 earnings release shows the GAAP income from operations rising 23% when compared with Q3 2018. Net income increased as well (up 28% over the same interval) and Akamai spent almost $180 million in Q3 2019 to repurchase two million common shares at an average price of $87.55 per share – just shy of the current $84.09, but a sign of confidence for the period ahead.

In one of the last Lead-Lag Reports I wrote, I was looking at how various sectors performed for the month. While November was a tough month for utilities, the technology sector did well.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

I love Akamai, the chart suggests to buy on a pull back at $70, with a target at $124.