3 Reasons Cisco Is A Potentially Great High-Yield Blue Chip Buy In 2020 by Brad Thomas

Summary

- Cisco's free cash flow has been highly stable and growing steadily, allowing it to raise its dividend at a rapid rate since it began paying one in 2011.

- Cisco is the world leader in mission-critical IT hardware with about 50% of sales coming from switches and routers.

- Cisco has gone from an overvalued watch list stock to a reasonably priced 3.2%-yielding blue chip thanks to its most recent bear market.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today »

Today I decided to step outside of my REIT wheelhouse and focus on an impressive blue chip C-Corp. However, keep in mind that this research is also helpful for me as a REIT analyst, as I cover technology sectors such as data centers and cell towers. Year to date these two sectors have returned an average of 35%. (We like Digital Realty (DLR) and CyrusOne (CONE) today.)

Assisting me with this article is Dividend Sensei, who is ranked as a top analyst. Recently a member asked us to do a deep dive on Cisco Systems (CSCO) and now I know why.

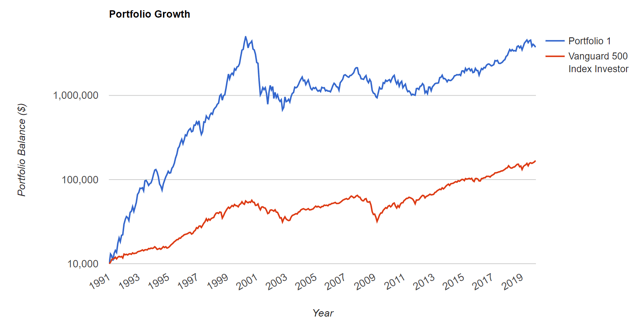

While stocks are the best performing asset class in history, few companies have been able to deliver such impressive wealth compounding as Cisco has over the past 28 years.

Cisco Total Return Since 1991

(Source: Portfolio Visualizer) portfolio 1 = CSCO

$10,000 invested in Cisco in 1991 would be worth almost $4 million today, and that's even factoring the absolutely crazy bubble valuations of the tech bubble, which saw Cisco plunge 86% from its peak.

However, today Cisco's days of hyper growth are behind it and investors are primarily interested in it as a source of generous, safe and rapidly growing dividends.

Total Returns Since Cisco Began Paying A Dividend In 2011

(Source: Portfolio Visualizer) portfolio 1 = CSCO

The modern dividend-paying Cisco has managed to match the red hot S&P 500 over the past eight years.

So let's take a look at the three reasons conservative income growth investors might want to own Cisco, including its reasonable valuation that potentially could allow it to continue delivering double-digit annual total returns over the next five years.

More important, find out at what price you could opportunistically buy Cisco in 2020 in order to enjoy not just a very safe and rapidly growing 4+% yield, but also 15+% CAGR long-term returns.

...Originally Posted On Seeking Alpha

Author Bio:

Steem Account: @bradthomas

Twitter Account: rbradthomas

Steem Account Status: Unclaimed

Are you Brad Thomas? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Congratulations @leo.syndication! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

I'm not feeling Cisco. They have had a couple of layoffs in 2019 and the only reason the yield looks great is because since March, price continues to decline...my target price is $40.