80% reduction in Indian money in Swiss banks under Modi government: Sources

The Government on Tuesday claimed that money held by Indians in Swiss banks has come down by 34.5 per cent in 2017. This is contrary to an earlier report that said deposits went up by 50 per cent, which attracted a lot of criticism for Government.

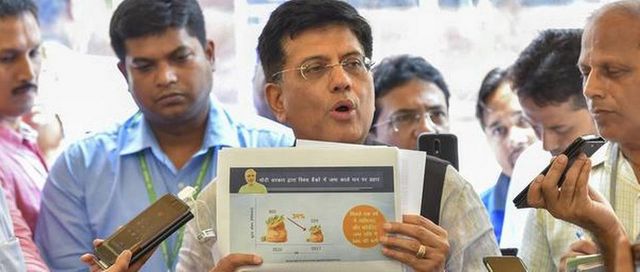

Quoting a letter received from the Swiss authorities, interim Finance Minister Piyush Goyal said the data on a 50 per cent increase was misinterpreted as it includes non-deposit liabilities, business of Swiss branches located in India, inter-bank transactions and fiduciary liability.

The letter also mentioned that the right data to identify Indian residents’ deposits in Switzerland is published by the Bank of International Settlements (BIS), which collects Locational Banking Statistics (LBS) in collaboration with SNB.

Data from BIS shows non-bank loans and deposits (which really constitute the individual and corporate deposits used as black money in the past and excludes inter bank transactions) have fallen by 34.5 per cent in 2017 compared to 2016 ($524 mn in 2017 vs $800 mn in 2016).

Goyal also mentioned that Swiss Non-Bank Loans & Deposits have reduced by a significant 80.2 per cent between 2013 and 2017 under the NDA government. This broadly corresponds with SNB reports, which show an 82 per cent reduction in the total Indian customer deposits in Switzerland since 2013, though BIS data is the right way to measure actual deposits from India in Switzerland.

Goyal also informed that India also signed an agreement with Switzerland on December 21, 2017. Both countries started collecting data in accordance with global standards on January 1, 2018, and would start the exchange of data from September 2019 on a yearly basis. This would make available relevant information in India, eliminatings the threat of black money and action can be taken against any entity indulging in such activities, he said.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.thehindubusinessline.com/economy/macro-economy/indian-deposits-in-swiss-banks-fell-345-in-2017-goyal/article24505515.ece