Some financial tips every student should know...

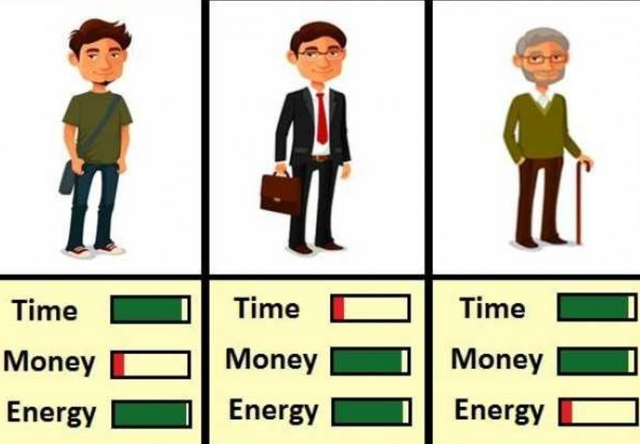

One day I was running through my Quora feeds and stumbled upon the below picture in one of the answers.

This is an accurate representation for most of the students, unless you are born with a silver spoon.

So is the case with me. I have plenty of Time and Energy but little money.

To tackle this money problem I implemented the “Earn-Plan-Spend” (EPS) system.

Earn: Being a student, you have got a little time to Earn as most of your time is consumed in Studying, which is your top priority. Following are the sources from which I earned money without spending a significant time

Stock Market: Well, this is my favorite and most profitable source of Income. You cannot earn money from stock market without having adequate knowledge of it. You can refer my answer to gain knowledge about the stock markets. Rajeev Rai's answer to How can I become a self-taught stock trader?

Online Business: I along with my friend Kabir Kashyap have setup an Online Fashion Store which technically neither took our Time or Money. We don’t earn a significant amount now, but I am pretty confident that the earnings will increase significantly in future. Click on the link below to see my Online Store. Zeusfashion - My Online Store | Best Shopping Experience

Mutual Funds: If you don’t want to take risk by investing in the stock market or spend time learning about it, then, simply go for Mutual Funds. You can invest amount as small as Rs. 500.

Internship: If you have sufficient time try getting an paid internship.

Apps: There are multiple apps which provides some Cashbacks and Referral Bonus. I have earned money using Tez, Mcent, Mcent Browser,Skrilo and other such apps.

2 . Plan:

“If you fail to plan you are planning to fail.”

Plan your Finances carefully. To plan your finances you can create a budget for a period of time and break it for weekly and daily expense.

Carefully invest the portion which is allocated to saving before spending a penny from the budget.

- Spend: Keep a track of all the expenses you have incurred during a period of time. You can use Expense Tacking app to track all your daily expenses. To track expense i use ET Money.

Further, track your Budget vs Actual Expenditure over a period of time.

I Hope this helps you in your Finances,

Thanks!!

@ steemerhrn.......its a great informative post for every student,,they can invest their savings......its really a valuable thought.........thanks for your best share........