Aerospace Wires & Cables: Fast to 2028, Steady to 2034

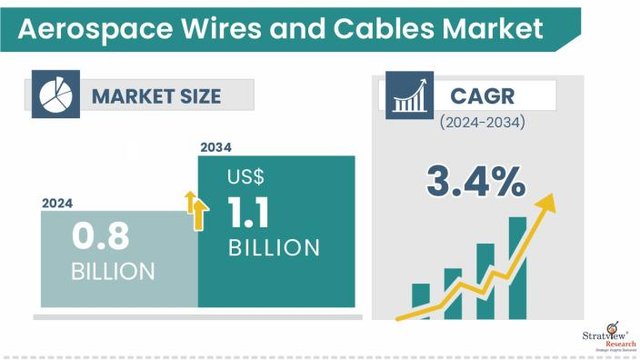

The aerospace wires & cables market—covering power distribution, data transfer, avionics, EWIS bundles, and specialty interconnects—continues to track the broader aircraft production upcycle. Stratview Research pegs the market at about US$ 771.4 million in 2024 and projects it to rise from US$ 818.9 million in 2025 to roughly US$ 1.11 billion by 2034 (global).

Download the Sample Report Here:

https://www.stratviewresearch.com/Request-Sample/628/aircraft-wire-and-cable-market.html#form

Key Growth Drivers

• Production ramp-ups at major OEMs: Narrow- and wide-body build-rate increases lift line-fit demand for power, signal, and hybrid cables across airframes, engines, and interiors. (Inference aligned with Stratview’s market expansion outlook.)

• Electrification of aircraft systems: More electric architectures and higher installed content per aircraft (actuation, environmental control, galleys, seats) expand wire/cable runs and thermal/EMI requirements. (Supported by Stratview’s related EWIS analysis.)

• Connectivity and IFEC upgrades: Higher bandwidth backbones (Ethernet, fiber) and distributed antennas increase demand for data/avionics cabling and better shielding. (Aligned with Stratview’s long-term forecast commentary.)

• Fleet modernization & retrofit: Cabin refurbishments and avionics refresh cycles sustain aftermarket cables and harness replacements, especially as fleets age into heavy checks. (Consistent with Stratview’s near-term growth phase to 2028.)

Trends to Watch

• Two-speed growth profile: Stratview signals a brisk recovery through 2028 (CAGR ~9.5% to ~US$ 975.1M), then a steadier glidepath with a 2024–2034 CAGR of ~3.4% to ~US$ 1.1B—reflecting normalization after the post-pandemic rebound

• EWIS tightening & materials innovation: Weight, heat, and fire/smoke/toxicity constraints continue to push insulation and shielding advances; EWIS content per aircraft remains structurally high.

• Data-centric architectures: Growth in high-speed copper and selective fiber-optic lines for avionics, radar, and cabin networks; emphasis on EMI/EMC performance and maintainability. (Inference consistent with Stratview’s technology/segment coverage.)

• Aftermarket resilience: As utilization normalizes, inspection-driven wire replacement and reliability upgrades keep MRO demand healthy. (Aligned with Stratview’s rebound narrative.)

Conclusion

With build-rates climbing and aircraft subsystems steadily electrifying, aerospace wire & cable content per tail remains robust. Expect a firm uptrend through 2028 and a moderated, sustainable growth trajectory to 2034. Suppliers positioned in high-temperature, low-weight, and high-bandwidth niches are set to outperform as OEMs and airlines prioritize reliability, safety (EWIS), and lifecycle economics.