Plan stop loss and sudden stop loss - rational and decisive victory over greed!

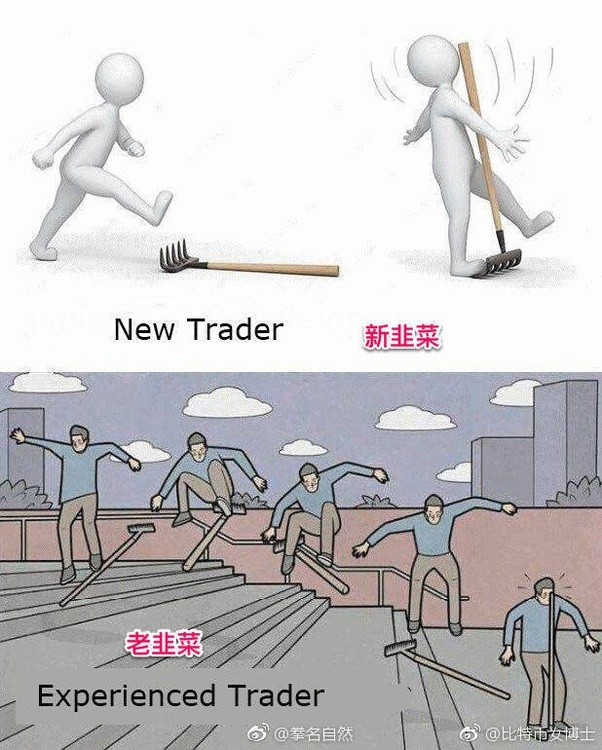

Stop Loss is a must-have trading skill for futures investors. For novices, many people believe that everyone must go through the process of losing money before they can reach the other side of success, and losing money is the “tuition fee” that investors must pay. If this is the case, the author hopes that this "tuition fee" is best to "pay by installment" instead of "paying tuition in one lump sum". After all, many loss-money experiences make it easier for investors to pay attention to the correct ideas and methods of futures trading.

Loss-money must worth the losing! There is also a trading idea that the loss caused by the planned stop loss is not a loss, and the real loss is the loss outside the planned stop loss. In mature futures trading, investors generally only trade when the expected profit-loss ratio exceeds 3:1. If you invest in this principle, you will not be prone to losses in the long run. In general, the final loss is due to an unplanned excess stop loss due to a stop loss ratio of 3:1. Most of this loss comes from the so-called sudden stop loss. Therefore, controlling sudden stop loss becomes one of the important means and ability for futures trading success.

Planned stop loss

From the surface point of view, the planned stop loss is the stop price level or condition signal set when the trading plan is formulated. However, from a deeper understanding, the planned stop loss (which can also be said to be a stop-loss action) can be executed at a price set according to the plan in actual operation. Generally, the market trend has a continuous price and sufficient market liquidity. .

Stop loss methods can generally be divided into three categories: fixed stop loss, trailing stop loss and conditional stop loss. Fixed stop loss, which is the amount by which the stop loss is fixed by defining a specific stop loss position. For example, 10% stop loss method or technical form price stop loss. This type of stop loss generally has a clear plan loss limit, which can well reflect the principle of profit and loss ratio of 3:1. This type of stop loss method is easier to understand and simple to implement.

Tracking Stop Loss is accomplished by setting and tracking the relevant Stop Loss conditions and signals. This type of stop loss generally does not set a specific stop loss price. The advantage is that it can be used in combination with trading conditions. Since the stop loss position is variable, most of the trailing stop loss also has the function of take profit tracking, which is conducive to the purpose of effectively expanding profitability. For example: moving average stop loss, channel stop loss, trend line stop loss, etc. Because the trailing stop loss strategy is closely integrated with the homeopathic trading philosophy, many old traders prefer to use trailing stop loss. It is a better stop-loss strategy that helps traders capture the vast majority of a trend.

A conditional stop loss, that is, by presupposing that certain conditions will occur in the market, and then closing out if there is no expected situation. If the important information of the fundamentals is published, it is expected that the information will be bullish, but if the information after the publication is inconsistent with expectations, it will be closed. For another example, if the expected futures price should change in a certain period of time, but the expected change does not occur after that, then the closing out can also be regarded as a conditional stop loss. To say that the popular point is that it did not happen at the time of the occurrence, that is, the conditional stop loss. This method is generally less used by investors. And because the method has more subjective judgment components, it is better to use it in combination with other methods, which is more stable.

In short, there are many ways to plan a stop loss, but no matter what kind of stop loss method you take, it must be clear and enforceable.

Burst stop loss

A sudden stop loss is a stop loss when the planned stop loss cannot be effectively executed. It is manifested as an unexpected situation, or no continuous price can be executed, or a planned stop loss due to insufficient liquidity. A sudden stop loss is a loss that exceeds the planned stop loss.

For example, if someone is buying long at the price 5000, the planned target is 5300, the planned stop loss is 4900, and the planned profit-loss ratio is 3:1. However, due to the sharp slump overnight, the price jumped beyond its stop loss to a sharply lower opening around 4700, which made it all overwhelming. After some struggle, it still rebounded to around 4850. After that, the price will start a sharp rebound. This situation is a typical sudden stop loss. In this case, investors face very great mental pressure and the ideological struggle is also very intense. On the one hand, the price has already touched the stop loss. According to the plan, it is necessary to stop the loss. On the other hand, because the futures price is excessively oversold, the futures price may rebound sharply at any time. If the stop loss may stop at the low level, if not Stop loss, and the possibility of continued decline. All kinds of ideological struggles seriously interfere with the investors' normal decision-making thinking. At this time, if the price continues to fall, it may cause investors to make psychological stops at any time.

In the above example, the person's loss can be divided into two parts. That is, total loss = planned stop loss, sudden stop loss = (5000-4900 yuan) (4900-4750) = 100 150 = 250. The total loss per mouth reached 250, which is almost equal to 300 of the original planned profit. At this time, the profit-loss ratio becomes 1:1. If this is done for a long time, it is difficult for investors to make money in the futures market.

In actual trading, there are many such examples, especially in terms of emergencies. In addition, the market sometimes makes a sharp rise and fall due to the drastic changes in the market, so that investors can not effectively stop the loss as planned. Therefore, it is very important for investors to effectively avoid or mitigate sudden stop loss.

Countermeasures and Suggestions

Sudden stop loss is difficult to avoid, but to some extent we can still reduce the loss of sudden stop loss through some measures. The author believes that to effectively reduce the loss of sudden stop loss, the first is to strengthen the research on varieties and understand its characteristics. Second, we must conduct reasonable fund management. In addition to ensuring that the account does not have a vicious loss, reasonable fund management can also alleviate the psychological pressure of the trader and stabilize its judgment ability, which is conducive to subsequent operational transactions. Third, increase the ability to judge transactions. In the example above, the futures price is in a short-term downtrend. When the customers rebounded from the trend, they did not fully realize that the performance in the first half hour before the market closed was very weak. At this time, it is not suitable for entering the market to buying long, and it is not suitable for holding multiple positions overnight. Fourth, improve the trading plan. A good trading plan should sometimes include a response to the occurrence of a sudden stop loss.

For a sudden stop loss, its psychological impact on the trader is very large. This requires traders to constantly understand the degree of psychological impact of market changes on them, and to grasp the ways to reduce panic. In addition, when the sudden stop loss occurs, the recovery of trading psychology is also necessary. The best way is to be good at forgetting. In order to stop loss in the market, you must be good at making two forgets: The first is to forget the purchase price. No matter what price you buy, you must immediately forget your purchase price after buying. Only decide according to the market itself, when should you stop the loss according to plan, and do not let your subjective feelings and emotional influences on the execution of the trading plan. The second is to forget the stop loss price, that is, to forget the stop loss immediately after making the stop loss, not to be bitten by the market. Should not hesitate to act again when the market reappears trading signals.

The last thing I want to emphasize is the words of a professional: "Always stand at zero." Just as a purchase may make a mistake, the stop loss will make a mistake. When you find your own stop loss error, you must overcome the psychological obstacles and run into the forward team again.

In short, we must use rationality and decisiveness to overcome greed and luck, and we can walk with the market for a long time.