What You Need to Know About Interest Rates- How To Profit - How They Affect the Markets

Interest rates are something the market is being very attentive to, and rightfully so. The lower the interest rates, the easier it is for businesses to continue their operations, thus having a more fulfilling journey. Investing may become more difficult or much easier, depending on the percentage. It is all within the power of FOMC, or the Federal Open Market Committee.

Understanding what federal reserve interest rates are and how much influence they have on the market will help you understand how investing is affected by these changes.

What Is the Effective Federal Funds Rate?

To put it simply, the rate refers to the amount of money a bank charges when another bank borrows money from it. Basically, each and every bank should have a reserve of money in a Federal Reserve bank account. If they happen to own a little more than the necessary amount, then that money is being offered to banks that run short of cash.

The final percentage of the interest rate a bank is going to charge will be decided between the two banks making the deal after the FOMC gives them a target rate. They can’t hold a bank at gunpoint to follow the exact rate.

Effective Federal Fund Rate since 1993

Why Are Federal Interest Rates so Important?

When it comes to the importance of the interest rates, you need to know that the federal funds rate influences the prime lending rate. This lending rate is the one that pushes lenders to set their own rates. As a result, this has an influence on auto loans, credit cards, and so on.

Basically, the monetary policy decided by the FOMC has a huge influence on the economy of the U.S. because it is what affects interest rates in the first place. This also decides what happens to credit and money. Consequently, growth, employment, and inflation are also affected. And these factors have a huge influence on the economy. For example, lower interest rates increase inflation, and vise versa.

As such, those into investing are paying a lot of attention to how the federal reserve interest rate fluctuates. The smallest change can have a huge impact on the economy.

What Is the Impact on the Economy?

If interest rates are increasing, people will have less money to spend, which means that businesses will suffer by receiving less cash. This is because banks will have a harder time borrowing money from the Federal Reserve. As a result, they make loans harder to afford for customers too, by increasing their rates as well. Companies are also having a hard time as it will be more difficult for them to borrow money from banks – money that is invested to grow the business.

On the opposite side of the spectrum, when interest rates are lowered, it is an attempt to stimulate the economy. As things are not that expensive anymore, people will be more likely to spend, as they can afford more things now. So, businesses are going to benefit from a decrease.

Since lower interest rates increase inflation, rates need to be adjusted with caution.

Rate Cut Impact on the Total Market & How to Potentially Profit from It

In a scenario like we have today, a raging bull market, a cut in the federal funds rate will cause stocks to move higher eventually. More info on this topic here. Many banks and investors are “pricing in” a rate cut, fully expecting the fed to cut rates in July 2019. This anticipation of a rate cut has already driven the market to new all-time highs as of July 3rd, 2019. Therefore, if rates are left unchanged, the stock market will drop. Also, if rates are hiked (which is extremely unlikely to happen) the markets will drop even more. Therefore, lower interest rates are a market positive.

Lower interest rates devalue the currency of the country lowering rates.

For example, if interest rates are lowered in the US, the US dollar will likely drop, which is a positive catalyst for everything denominated in US dollars such as stocks and commodities. Bond yields will also drop when rates are cut. A decrease in bond yields will cause their prices to increase. One can potentially profit from this price increase by going long a bond ETF.

If you are expecting a decrease in rates, you would possibly be able to profit by buying stocks, gold and bond ETFs, and/or betting against the USD before rates are decreased. However, this is not meant to be a gamble. Thorough research must go into deciding if you personally think rates will be cut. Remember, always be cautious.

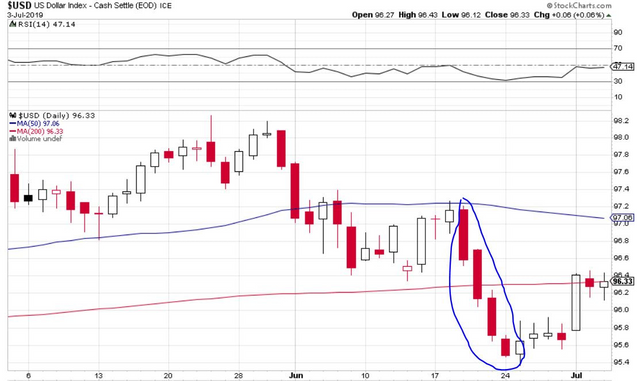

How the USD was affected by the FED hinting at rate cut in June 2019.

Thanks for reading. Visit our website https://www.stockbrosresearch.com/ or follow us on twitter @ stockbrostrades

Hey buddy. Use the tag Steemleo its an platform on top of steemit, but its all about investment!

Posted using Partiko Android

Thanks for the heads up! I haven't been on steemit in a long time so I'm not sure what's happened as I was gone. How does it work? Do I just use steemleo as my tag on the post? Or do I make a steemleo account? And do you think I should delete my 3 most recent posts and repost them with the steemleo tag? Thanks again

Well. A lot have happend xD

The steem-engine launched and a shit ton of tokens have been created. Including steemleo, palnet, mediaofficials, zzan and so on and so on.

You dont have to create another account, just login with your steem. When you get the tokens you can exchange them to steem and withdraw them from the steem-engine :D

Do some digging and do some reading and you will quickly catch up :D

Posted using Partiko Android