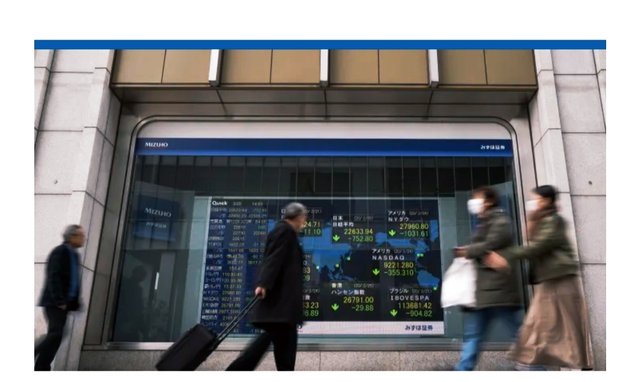

Australia stocks jump after smaller-than-expected rate hike; Asia markets rise

Asia-Pacific shares traded higher on Tuesday after stocks on Wall Street rallied overnight.

The Nikkei 225 in Japan rose 2.96% to close at 26,992.21, marking the biggest daily gains since March 23. The Topix index gained 3.21% to close at 1,906.89. South Korea’s Kospi advanced 2.5% to close at 2,209.38.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1.95%. In Australia, the S&P/ASX 200 jumped 3.75% to close at 6,699.3. The Reserve Bank of Australia raised its benchmark interest rate by 25 basis points.

The Dow Jones Industrial Average popped 765.38 points, or nearly 2.7%, to close at 29,490.89. The S&P 500 advanced about 2.6% to 3,678.43. The Nasdaq Composite added nearly 2.3% to end at 10,815.43.

It was the best day since June 24 for the Dow, and the S&P 500′s the best day since July 27.

suggession

Conventional wisdom suggests that holding cash in an inflationary environment is not recommended, but “cash is probably not trash anymore,” according to Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management.

Asked if cash and Treasury bills look attractive given the inverted yield curve, Mitra said he agreed, emphasizing the benefits of holding cash in U.S. dollars.

“I think that’s an area which still looks pretty good, it’s an extension of the overall long dollar story,” he said.

The U.S. dollar index has steadily climbed this year, from below 98 to above 111 as of Tuesday.