More than half of all STEEM that will exist in 30 years has already been created

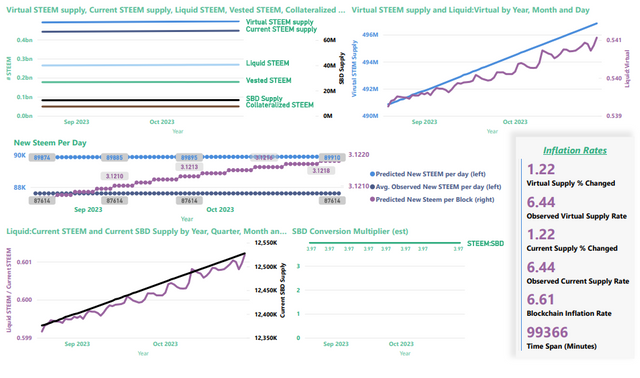

About a month ago, I posted A quick look at Steem inflation as Q3 comes to a close where I focused on daily STEEM production and concluded that if I'm understanding things correctly, the expected daily production of new STEEM will peak by February, 2024.

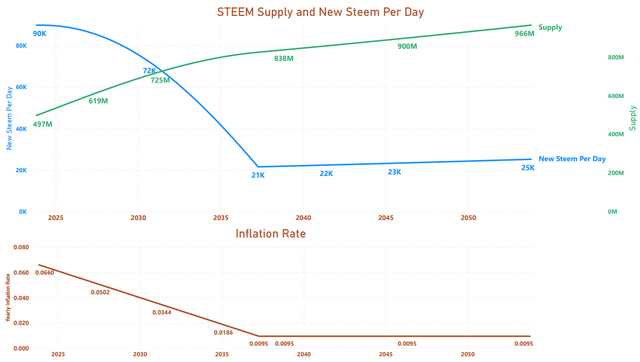

What I didn't do in that post was to say much about the virtual supply size. So this morning I took a closer look at that curve. Here's an update to one of the graphs, showing the inflation curve, the daily STEEM production, and the topic of today's post - the virtual supply. Lets look more closely at the numbers in the green curve.

In support of this post's title, today's virtual supply value is 497,239,775, and the value on Oct. 20, 2053 is projected at 966,391,357.

What that tells us is that from the blockchain's launch in March, 2016 until today - a bit over 7 1/2 years - 497 million STEEM have been produced (considering 1 SBD as a claim on $1 worth of STEEM at the blockchain's internal prices). From today until October 20, 2053 - roughly 30 years - only 469 million new STEEM will be produced. 51.4% of the projected 37 1/2 year total has already been produced in ~20% of the time (aside: in the next 7 1/2 years, only about 225 million new STEEM are projected - not quite 1/2 of the first 7 1/2 years).

And, if I understand things correctly, the projected virtual supply number in 2053 should be seen as an upper limit, not as a prediction. There are multiple factors that might bring that number down.

- A rising price of STEEM (only above the SBD print threshold) will reduce the size of the virtual supply.

- Burned STEEM/SP/SBD will reduce the virtual supply.

- Missed witness blocks will reduce the virtual supply.

- Anything else?

On the other hand, I'm not aware of any factors that could raise the virtual supply above the projected value (aside from a hard fork with a rule change that could conceivably do anything imaginable). Please correct me if I'm missing something.

(I imagine that this is why SBD has been able to stay above $1 for a period of years on the external markets, when it was intended to be pegged to a dollar.)

Update: Based on the code, I believe there is an exception to seeing this value as an upper limit. Namely, SBD interest could drive the virtual supply value above the projection if the witnesses were to set the interest rate above 0. End update

As long as I'm posting, it's also noteworthy that our actual inflation, ~87,614 new STEEM per day, is almost 2 years ahead of the projected inflation curve. Presumably, this is mostly due to the #burnsteem25 project. The current daily production vs. the projected production can be seen in the middle row of the graphic below.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Hence, inflation will decrease from now on. Perhaps this will slightly reduce the selling pressure in the market. But this, of course, is only one factor.

Right. According to the model, the new daily supply is expected to increase slightly (~30 STEEM per day) between now and February, and then turn down after that until 2037. It's a gentle downslope until about 2026 or 2027, then it gets steeper.

As you noted, though, the model can't predict the other factors that also influence the virtual supply, and still other factors that could influence the market prices.

One more question. Are you no longer doing paid Facebook promotion of your popular science community? How do you evaluate the achieved results?

No, unfortunately, I had to stop the post promotions. When I was doing them, I was just using the Facebook page's metrics to evaluate the results. It tells you the cost per click that's achieved by each advertising campaign. In general, I think it ranged from about $0.04 to $0.15 per click.

TEAM 1

Congratulations! This comment has been upvoted through steemcurator04. We support quality posts , good comments anywhere and any tags.This is very difficult for me, I am not an experienced blockchain user, and you freely give an assessment and forecast of the rate and cost of Steemit and explain the details of how blocks work in general. This means that you are an experienced professional who wants to make improvements to our platform. So I want to thank you and wish you continued success, sir.

Thanks for the feedback! I also wish you well as you build your experience here.

I am very pleased to hear from you. Thank you very much for your kind words and wishes.

Hello @remlaps-lite you are very knowledgeable about the steem blockchain . I feel many including myself are concerned about the TRX distribution . Could you please look into this and make a post about the TRX distribution .

Unfortunately, I don't think I have access to any information about the status of the TRX distribution. Sorry.

Thanks for the reply @remlaps-lite . who would have this info ?

You're welcome. As far as I know, only people from Steemit or Tron would have this information. I'm not aware of any way for the general public to see anything other than the wallet addresses that have been used for distributions in the past.

Just saw this in the latest post by @steemitblog, Steemit Update [ November 7th, 2023 ] : The Steemit Awards 2023

Thanks for the info @remlaps-lite .

I fail to see how

...

...

If this would help provide greater value to our users then would it not also be wise to pause steem rewards as well .

WOW talk a about a ridiculous statement . This kind of thinking makes me question the future of this platform.

Just to be clear, I'm not an insider, and I have no input into Steemit's decision-making. I was just passing along the remark since it was relevant to our conversation.

That said, I get your point. I always figured that the TRX rewards had to run out eventually, so it doesn't bother me that they're paused (or probably, "terminated", is my guess). But... it would definitely have been better to announce the pause before implementing it and to take down the various indicators on the web site that are still suggesting that TRX rewards will be paid, even today (i.e. the TRX integration announcement, the TRX payout listed when you mouseover the price, and the TRX amounts in the "claim rewards" space of the wallet.)

I think the platform is going to be fine, but we need to look for growth from the rest of the ecosystem, too. In the past, I have worried more about the absence of leadership outside of Steemit than about Steemit's decisions that I might, or might not, agree with (and might or might not fully understand). Fortunately, I think that other leadership has slowly been emerging in the last year or two. Being patient is hard, but I still think things are trending in the right direction.

Thank you for the informative reply @remlaps-lite .