How to invest in a Bitcoin Loan

How to invest in a Bitcoin Loan

Investing your Bitcoin is an appealing proposition. Afterall who doesn’t want more Bitcoin? If your able to earn interest and grow your Bitcoin, and Bitcoin continues to appreciate in value your effective USD ROI can grow through the roof!

One way to grow your BTC is by investing in loans. Due to the nature of how Bitcoin works, Bitcoin loans work differently than fiat loans. So every Bitcoin borrowed in a loan comes directly from a lender. Fractional reserve lending and 3rd parties don’t work well with P2P money.

Bitcoin loans already come in multiple forms, and we will try to break them down and inform you how to safely invest in them.

Types of Bitcoin Loans:1. Margin Loans

|

Margin BTC loans

Margin BTC loans are essentially collateralized loans on cryptocurrency exchanges. They are generally safe due to how margin loans work.

If a borrower’s collateral on a his/her margin loan goes below a certain percentage, the exchange will liquidate the collateral ensuring Bitcoin + interest can be returned to the lender.

How to Margin Lend Bitcoin and earn interest

Lending out your Bitcoin via Margin loans is relatively easy and safe to do. Multiple cryptocurrency exchanges allow leveraged trading and have markets for this type of trading. The market consists of lenders willing to lend out their Bitcoin (or other crypto) for interest, and borrowers who want to borrow these cryptocurrencies to increase their trading capital and potential returns.

The process for lending is quite easy on most exchanges and has its own separate portion of the website for doing it. 1. Simply deposit, 2. move funds to lending, 3. lend them out at your terms, and earn interest. We will briefly cover it here, but check our our more extensive guide on how to margin lend here.

Bitfinix.com

Bitfinex.com is one of the largest and best known cryptocurrency exchanges where you can lend out your Bitcoin for interest. Their lending market usually sets the trend for market lending rates. Rates are determined through supply and demand and are relatively low risk but their are still risks to account for.

Risks/Rewards

All investment is determined by risk and rewards. Margin lending is the same.

When the risks are high (i.e. chain splits, high volatility) margin lending rates can go very high.

When perceived risks are low (normal trading, low volatility) margin lending rates can be quite low as well.

You as an investor have to decide what % return you are willing to lend at and for how long.

| Reward APR Range: 1%-250%+ APR.

Risks: Exchange hack/collapse, margin lending system failure, your funds seizure by governments, tying up Bitcoin so you cannot sell or borrow for period of time. |

Platforms:

Types of Bitcoin Loans:1. Margin Loans

|

Collateralized P2P Bitcoin Loans

Peer to Peer Bitcoin lending is a natural fit for Bitcoin loans and was/is the main way Bitcoin loans are issued today. While the concept of using P2P money to do P2P lending makes sense, it has gone through some difficult growing phases as Bitcoin itself and the P2P lending industry have developed. Early leaders like Btcjam and Bitcoinlending Club were hit so hard they even had to close their doors. But others have adapted and changed their models to survive and even thrive as the industry grows.

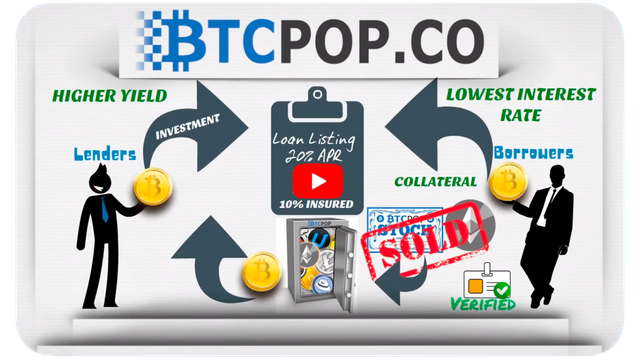

Btcpop.co

Btcpop.co is one of the original P2P Bitcoin lending sites and the ONLY known platform to offer collateralized P2P loans at the time of writing. While the website went through a management change during the hard times for P2P lending, Btcpop has adapted to market and industry volatility through using collateral for Bitcoin loans.

The collateral used is naturally altcoins and this along with stronger verification methods has helped combat the catastrophically high default rates associated with Bitcoin lending. With collections far from developed in the judicial system, Btcpop has adopted a prevention first and/or collateral method for P2P lending.

How to invest in Collateralized P2P loans

Btcpop has published a guide for investing in Bitcoin loans on its blog, with the main points being:

- Collateral is King

- Diversification

- Diversification

- Do your own research

Diversification is listed twice as that is a point of emphasis as 1 default without collateral when lending out your Bitcoin in P2P lending can greatly decrease your ROI.

Collateralized cryptocurrency loans has become Btcpop’s primary loan offering, though, peers are free to list without collateral as well. Investors at Btcpop like the tangible security in lieu of a solid online identity and credit rating system.

Risk Reward

The risk/reward proposition for collateralized P2P loans is different for every offering. However, from my watching of this market it appears there are some very favorable risk reward ratios on highly collateralized loans. Other times questionable or insufficient collateral leaves a less appealing offering, though it those offerings tend not go get funded

| Reward APR range: 8-12% very low risk (100%+ collateral), 12-20% medium risk (100% or less), 20%+ (less desirable collateral types or less than 50% of loan).

Risk: Default, platform collapse, collateral price drop, tied up Bitcoin (is a note market but not very liquid) |

Platforms:

Types of Bitcoin Loans:1. Margin Loans

|

Non-collateralized P2P loans

Once a profitable and thriving industry, reputation only based Bitcoin loans has come and went. The idea is great, and even worked very well when Bitcoin was young and stable. However, as the cryptocurrency gained popularity and volatility defaults on Bitcoin loans skyrocketed as borrowers decided not repaying their loans was hard to punish and could be very profitable as the price raised.

How to invest in P2P Bitcoin Loans

With the right strategy and thorough research P2P Bitcoin lending can still be profitable, but much caution is advised. Having experienced the default rates first hand in the early days of Btcjam and Bitcoinlendingclub.com I would recommend allocating a very small portion of your portfolio to this type of loan, and only invest in users you know very well and that have been around for a long time.

Similar to collateralized P2P loans you are going to want to do the following when investing in P2P loans without collateral:

- Diversify

- Diversify

- Research

- Research

In short, there is no foolproof strategy for getting this right. Even if there is, 1 rogue defaulter can break that strategy and make it unprofitable. The key is to be very careful when lending on Bitcoin in this way. If you do want to participate in this futuristic new way of finance, just do so very carefully and spread your funds out very thinly among many borrowers

Risk Reward

| Reward APR range: 15-25% low risk borrowers (long good repayment history, verification, social collateral), 25+% medium-high risk borrowers

Risk: Default, platform collapse, collateral price drop, tied up Bitcoin (is a note market but not very liquid) |

Platforms:

Wrap up

We hope this information was helpful to you and can be of use to you if your looking into supporting this brand new area of finance with a brand new type of money. If you liked this content please share and follow us on social media. Thanks for reading

Like this:

Related

Types of Bitcoin Loans and How to Get OneOctober 10, 2018In "Types Of Loans"

How do Bitcoin Loans work?October 10, 2018In "Borrowing / Investing BTC"

How to get a Bitcoin loanOctober 26, 2018In "Borrowing / Investing BTC"