The 13 Trillion Dollar Lie - A Must Know For Investors

Source

Don't burn your hard-earned cash for fees and underperformance

As of today I will write at least 3 times per week about a book or a chapter of a book that has impacted my way of thinking in a way. Those who follow me from the beginning know that I am a big advocate of reading every day, that really changes your way of thinking for the better, making your life better in general. Keep reading, friends :)

The 13 Trillion $ Lie - Actively Managed Mutual Funds

Please note that the knowledge I am going to discuss with you today is acquired from the book "Money. Master the game" from Tony Robbins and I recommend you purchase and read it .

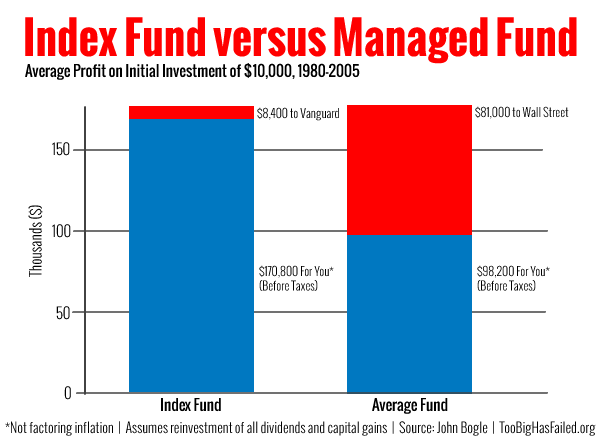

The lie I am going to talk about is that actively managed mutual funds can beat the market. This is what actively managed funds want to sell to the average investor - we can beat the market - Well, they can't and they certainlly don't !

You might ask what is a actively managed mutual fund. Such a fund has a team of experts and managers and they can make changes to the underlying portfolio as they wish. For example if they thing that the market is going to fall, they might allocate the funds resources into gold and thus hedge against such a reaction. A passively managed funds does not have the freedom to do such things, it sticks with the market for better or worse.

Robert Arnott, founder of Research Affiliates, spent two decades studying the top 200 actively managed mutual funds with at least $100 Mllion under management. The results are

***From 1984 to 1998, 15 full years, only 8 of 200 managers outperformed the Vanguard 500 Index ( An index that tracks the 500 largest companies in the USA).

Over a 20-year period ( December, 1993 to December 2013) the S&P 500 returned an average of 9.28% and the average mutual fund investor made 2.54%. This is an 80% diffrence. If you invested 10k$ with the S&P 500, you would have made 55,916$ and with the mutual fund - 16,386$. Some diffrence.

Actively Managed Funds Can Outperform The S&P 500

The funds can outperform the index and they have done it a lot of times. The catch here is that over a long period of time this is extremely unlikely, in fact only a handful of managers have achieved such results. Your chance to pick such a manager is below 4%.

The active managers best sell point is that are going to protect your money if the markets are falling. They will manage to protect your capital, even increase your capital if the markets go down - Wrong again !

Let's see how the fund managers did when the market was down. 2008 is a good place to start.

*** Between 2008 and early 2009, the market had its worst one-years slide since the Great Depression (51% from top to bottom). The managers had plenty of time to make defensive moves. Maybe when the market was down 15% or 25% or even 35%. Once again the facts speak for themselves. According to a 2012 report titled S&P Indices Versus Actively Managed Funds Scorecard, for short the S&P 500 Growth Index outperformed 89.9% of large cap growth mutual funds.

Bottom Line

Through advertising and high ratings of the actively managed funds their managers have managed to attract enourmous capitals. The managers are perfectly fine even if they lose, because they get paid their management fee and no matter if you are up or down on your money they will charge you. Most of this confusion came with the introduction of the 401(k) and with the notion that ordinary people have to manage their own portfolios. Ultimately they decide to place their trust into "professionals" that will outperform the market.

Warren Buffet in his 2013 letter to shareholders said

The goal of the nonprofessional should not to be to pick winners - neither he nor his "helpers" can do that - but should rather be to own a cross section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal

As crypto-enthusiasts when we see such percentages we tend to ignore them. We all know how unicorn projects made 50x, 1000x , 500x and we prefer to risk it all to catch that unicorn. It is your personal decision what do with the money but always invest in a manner that wont damage your psychology, your mental account should be in place and perfectly balanced.

P.S. This was originally posted on steemit.com a year ago but I consider it even more relevant today !

What's your thoughts on the matter fellow investors? Let us know in the comments :)

Congratulations @ervinneb! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @ervinneb! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!