Are cryptocurrencies in relation to to go conventional? All news are here just read..

steeminer is here !

hello all steem friends!

Last Sunday a communication posted on communication board 4Chan in progress the report that Vitalik Buterin, the originator of crypto currency Ethereum, had been killed in a car collapse. News of the 23-year-old, Russian-born programmer’s termination was almost immediately proved bogus – but not before 20%, or more or less $4bn, had been wiped from Ethereum’s towering bazaar charge.

The practical joke not only drew concentration to Ethereum, the subsequent major digital currency after bitcoin, which had seen its value increase fiftyfold since the start of the year to $300 a coin, but also to the flourishing market in other so-called cryptocurrencies that could now be on the cusp of conventional monetary reliability.

Last week Barclays’ CEO for individual and business banking, Ashok Vaswani, exposed the lender had opened deliberations with UK regulator about adopting digital currencies.

“We have been talking to a couple of fin techs [financial skill companies] and have in fact gone with the fin techs to the FCA [the Financial Conduct Authority, the UK regulator] to talk about how we could bring the corresponding of bitcoin, not of necessity bitcoin, but cryptocurrencies into play,” Vaswani told CNBC at a discussion in Copenhagen, Denmark.

“perceptibly [it’s] a new area, clearly an area we’ve got to be cautious with. We are working our way from end to end it.”

Vaswani’s comments came after quite a few central banks from across Europe and Asia said they were looking into establishing digital-only currencies in addition to customary denominations.

The People’s Bank of China has supposedly sprint trials, while the Danish central bank is bearing in mind a digital-only e-krone.

On 19 June, the international Monetary Fund issued a staff conversation note stating that banks should believe investing in cryptocurrencies, saying: “Rapid advances in digital technology are transforming the monetary armed forces landscape, creating opportunities and challenges for customers, once-over providers and regulators alike.”

At the same time, IBM announced it had made a contract with the Digital Trade Chain Consortium – a group of seven European banks that includes Deutsche Bank, HSBC, KBC, Natixis, Rabobank, Societe universal and Unicredit – to build a digital trade display place that will run on IBM’s cloud.

Andrew Levin, professor of financial side at Dartmouth and co-author of a learn on central bank digital currencies, told the protector that the thought of confidential institution creating new forms of expense was not in itself new, “but the greater need is for customers and businesses to have right of entry to money that has a steady value and is practically costless to use. We imagine there’s a muscular case for central banks to matter digital currencies that would be free to use.”

Crypto- or cyber-currencies are digital-only currencies in which encryption and registry techniques, often called blockchains, are used to regulate the age group of units of currency self-governing of a central bank.

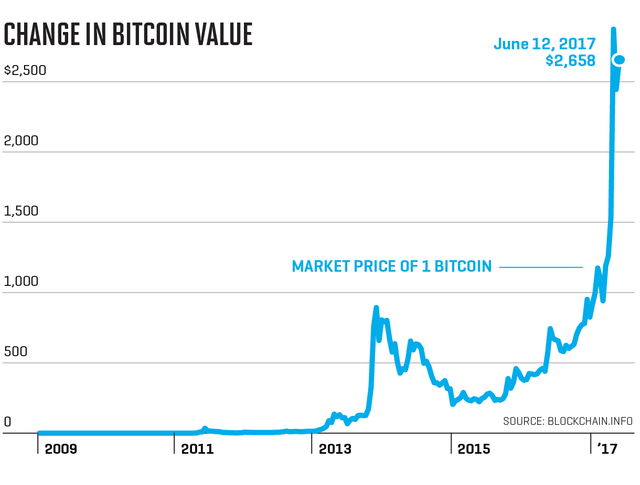

It is a thriving, dizzying market. Since the start of the year, bitcoin, the world’s major cryptocurrency, has almost tripled in value to $2,565. By some estimates, the cryptocurrency business could be worth $5tn by 2022. There are now close to 800 cryptocurrencies value, in total, around $96bn.

One of the latest obtainable to market is Tezos, backed by billionaire business enterprise industrialist and early bitcoin investor Tim Draper of Draper Fisher Jurvetson. According to a prospectus, a total of US$893,200.77 worth of XTZ tokens will be issued on 1 July.

“The best thing I can do is lead by example,” Draper told Reuters last month. “Over point in time I in fact feel that some of these tokens are going to improve the world, and I want to make sure those tokens get promoted as well. I think Tezos is one of those tokens.”

Tezos’ founders, Kathleen and Arthur Breitman, anticipate their ICO will become a “digital commonwealth” or “self-governing network”. The couple’s backdrop in finance speaks to the implication of the effort: Arthur worked at the high-frequency trading desk at Goldman Sachs; Kathleen at Bridgewater Associates, the world’s largest prevaricate finance.

“We think our spirited advantage is in our capability to assign supremacy,” Kathleen told the Observer. “The thing about blockchain is it’s very interdisciplinary. You have to have an understanding of finance and financial side, but also game hypothesis, pure science and networking theory.”

She concedes that blockchain difficulty is also reason for shareholder cynicism. “A lot of people struggle to understand its worth proposal, because it offers incredible miscellaneous to everyone. I like the idea of putting business judgment in a decentralized network, and with any luck, it will help people to conduct business more easily.”

Brock Pierce, a co-founder of Blockchain Capital and a family member veteran of the ICO market, recently launched a observable, digital securities token called BCAP that he considers “the next giant leap in the democratization of business enterprise capital and liquidity where everybody has equal right of entry”.

Three days ago, Pierce launched the token distribution of EOS, a blockchain coin (or token) offering that’s already taken in $100m. “This is a 340-day scheme that’s already broken every record. It’s 100% certain we’re going to surpass Bancor, the most successful ICO to date.”

Pierce predicts that the underlying technology of blockchain – in effect a public record of actions – “is going to collision our world more than the internet has”.

He added: “The implications are huge, and it’s going to have huge implications not only on venture, but private evenhandedness, real estate, digitizing currency. This is going to be the technology that democratizes the global financial organization so everyone has equal right to use.”

But such rapid increases in value are cause for concern. Five-year-old Ripple XRP, which is connected to 75 banks, including Bank of America and Royal Bank of Canada, has greater than before in value by 40 times this year alone. According to CNBC, 100 billion XRP are in survival, each priced 26 cents.

“A lot of lessons will be learned and a lot of money will be lost, before a lot of money can be made,” Peter Denious, head of international undertaking money at Aberdeen Asset Management, told Bloomberg last week. “Prices right now aren’t being determined by network usage, they’re being driven by conjecture that tokens are going to be glad about. It’s a gold-rush frame of mind.

But Les Borsai, an early investor in Ethereum, believes that what is underneath way is a re-ordering of the financial systems. At root, he argues, blockchain technology shows “we don’t need a centralized explanation for no matter which. It’s a freethinking approach and the implications are gigantic”.

.jpg)

whats your Prediction about ether??

as soon as i search i will post here just wait and watch