The 10 Crypto Commandments

Expensive lessons I’ve learned in the past year.

I set off on my cryptocurrency journey halfway through 2017.

I don’t talk about when I started very often because we’re in a age of weighing

peoples worth in the amount of days they’ve spent peering over charts.

Which is ridiculous.

Don’t get me wrong, there are plenty of O.G’s whom I tip my hat to — I

wouldn’t have learned as much as I have this quickly, if it weren’t for the

thought leaders in this community.

There is also a lot of negativity whenever someone who is obviously new,

asks something that only someone who’s obviously new would ask.

We should be lighting the path for curious new investors, not shaming them.

I’m proud of the short length of time I’ve been involved in crypto. In less

than a year, I’ve managed to see higher returns than any traditional investor

could dream of.

I’ve learned about new technology, taught myself technical analysis

(with the help of a mentor), and even managed to get involved on a deeper level

by advising and consulting with blockchain projects as they prepare to

launch.

The best part of it all is that I feel like I haven’t even scratched the

surface.

Because I don’t care how long anyone has been doing this.

This industry is young enough, that a few years of experience doesn’t give

anyone much of a head start.

A few years of advantage can be outweighed by working harder, smarter, and

bringing in more value to the community than others are willing to.

I started investing less than a year ago and I will outwork you.

“You think that your time spent trading crypto is your ally?

You merely adopted crypto.

I was born in the bear market, molded by it.

I didn’t see green candles until I was already a man.”

I’ve been waiting for an opportunity to pull this quote out.

I was baptized in the Great Bear Market of 2017 (I don’t think anyone has ever

referred to it as that, but I’m going to roll with it).

The first time I bought a coin, I bought Ether (ETH), the coin that fuels the

Ethereum Network, at its all time high on June 6th or 7th. It was right above

$300 at the time. I had been studying Ethereum for weeks, reading all about

it, Bitcoin, and other blockchain projects.

I was convinced Ethereum was going to change the world — but I also knew from a

brief stint day trading that one should never buy into the tail-end of a

uptrend.

“Don’t chase green candles”, I thought.

Which is investor speak for “don’t buy an uptrend that’s already started as you

never know when it will stop”. It’s a part of the mantra conveyed by the famous

investing quote, “buy when there’s blood on the streets”.

I waited patiently for the price of Ethereum to drop. Weeks passed and the price

continued to rise. Soon it was over double where I had initially considered it

for investment.

I panicked.

I bought the top.

It lost over 50% of its value the next day.

I was rekt.

Too stubborn to realize the loss and cash out, I decided to spend the next

several months studying everything I could get my hands on regarding

Blockchain, Technical Analysis (TA), and Investment Strategy.

I started scalping Ethereum. Selling the highs and buying the lows, using what I

was learning from studying TA.

I obsessed over chart patterns, lagging indicators, leading indicators,

Fibonacci, Elliot wave — I fell so deep into the matrix, I forgot I was even

plugged in.

Soon, despite Ethereum still being 50% of the value I had bought into, I was

back at my breakeven investment. I had doubled the amount of Ethereum I

initially owned.

While I may have only been around for under a year — I like to think I was

forced into the accelerated program — where I had to either learn fast, or lose

everything. It wasn’t my initial strategy but circumstances forced me into it,

and now I am glad.

Most of what I’ve learned, the knowledge that allowed me to recoup those losses,

has come as a result of the losses occurring in the first place.

“Adversity is like a strong wind. It tears away from us all but the things

that cannot be torn, so that we see ourselves as we really are.” — Arthur Golden

You’re not too late to get into cryptocurrency; this market is just getting

started.

Furthermore, you have a better chance of outworking and surpassing your peers

in this market because it’s 24/7.

I’m forever a student and while proud of my progress, in many ways I’m still a

beginner. I take methodical notes on anything I’m studying, and if I really want

to learn something — I publish it. I’ve found that the best way to force feed my

brain subject-matter is to consume as much as possible and then distill it down

to easily digestible bites.

Digital hors d’oeuvres.

This is not financial advice — merely a description of my journey and the

locations of the pot holes I tripped over — in hopes that you can sidestep them.

I won’t tell you what to buy and when, but I will tell you how to make those

decisions yourself.

1 DON’T PANIC

Whenever someone I know begins investing in cryptocurrency and asks me for help

getting started, I know that I’m going to end up having to calm that person down

whenever there is a dip in the market.

Don’t Panic.

The reason you got into this is the same reason you’re freaking out, crypto is

extremely volatile. The same forces that allow us to see 1000x returns on our

investments, can also create situations when you suddenly see 90% of your money

disappear.

A roller coaster goes both up and down at extreme speeds.

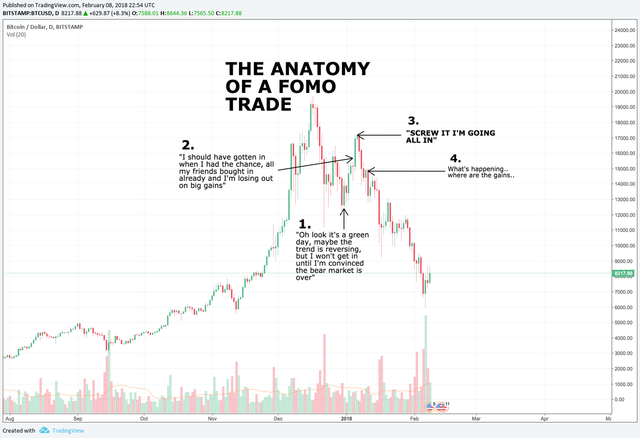

Remember when I told you about how I got started investing? I bought at the top of the roller coaster. I fell victim to rule #3 — the FOMO

trade.

Whenever you see an article claiming that this dip is the end for Bitcoin due to

some country increasing regulations or something similar — remember that China

has “banned” cryptocurrency three times or more. Believe it or not, Bitcoin and

other coins are still standing.

2 YOU’RE NOT TOO LATE

I hate when people talk about wanting to get into cryptocurrency but feeling

like they’re, “too late”. Bitcoin does this thing called “correcting” every few

months, when it tends to drop in price drastically to prepare for the next surge

up — buy-in during any of these dips, and you’ll be fine.

YOU’RE NOT TOO LATE.

Buying during the dip in Bitcoin has been a winning investment strategy since 2009.

Two thousand and nine!

The funniest part about the fact that I constantly hear, “I’m too late to get in

now”, is that people have been saying that same statement since Bitcoin hit $1.

I shit you not.

If you dig deep enough into the BitcoinTalk forums, you will find stories of

people saying, “Oh it’s too late”, as early as 2014.

Furthermore, everyone I know who is now in cryptocurrency, at some point had

that same thought.

“I’m too late”,

Until they watched it gain another 100% and realized that this magic internet

money doesn’t always make sense.

Here’s a link to an article in Forbes from 2015 where the author outlines all the risks and dangers of investing in Bitcoin, at the time it was $400.

3 DON’T CHASE GREEN CANDLES (FOMO TRADING)

I’ve written about this several times before and I’ll write about it again.

FOMO trading is one of the more common (if not the most common) causes of

traders and investors losing their shmeckles.

We’ve all done it, I’m certainly not immune to FOMO. Every once in awhile, I

still find myself inching closer and closer to that market buy when I see a coin

exploding, before hitting one of my carefully thought out limit orders. It’s an

hard impulse to resist.

It’s a disease.

Buy when there’s blood on the streets.

You should approach crypto investments like you’re bargain hunting. Study a

coin’s history; zoom out and look at its entire lifespan. Determine a good entry

point and set your buys. I always try to buy into whatever coin I’m trying to

load up on when the market is down. I’m a huge believer in both Neo and Ethereum

(although they’re competitors), but I’ll never buy either of those unless

they’ve had a series of successive down days and are showing signs of reversal.

Bonus: I highly suggest starting with an extremely small investment. Before

you start investing, you have a lot of studying to do.

Before you begin studying, take a tiny amount of money and invest it into

cryptocurrency- this will incentivize you to watch the charts more often, and

get an idea of how volatile this market really is.

4 DON’T LISTEN TO TWITTER TRADERS (DYOR)

There are some people on Twitter who bring serious value to investors by

providing solid analysis and investment strategy.

There are even more people on Twitter who are just looking to pump shitcoins

after they’ve bought in, and dump after you pump their bag.

A lot of these accounts will tweet out calls for coins that have already broken

out into an uptrend — and then a few days later post results saying something to

the tune of, “My followers booked 583% Gain on BSCoin”.

They’ll rinse and repeat this process until they have an army of people whom now

will pump whatever coin they Tweet — some use this power with responsibility,

others go fall to the dark side.

Pay attention, listen to others when you know they’re credible sources, but come

to your own conclusion and do your own research (DYOR).

5 DON’T JOIN PUMP AND DUMP GROUPS

Much like the several guys on Twitter who pump their bags by telling their

followers to buy coins which they’ve already bought into, there are “pump and

dump” telegram and discord groups that will promise huge gains.

The problem with these is that there is always a loser, and 9 times out of 10,

it’s you.

In order to move up the ranks and get trading signals ahead of the pack, you

need to invite more people to the group.

The more people you invite, the sooner you get the trading signal.

If you join a group that already has a large amount of members already, it’s

going to be difficult to invite enough people to increase your “rank” enough to

receive trading signals before the herd.

If you join a group that doesn’t have a large amount of members already, and you

invite as many people as you can to join in on this literal pyramid scheme —

you’re a part of the problem.

6 DON’T BUY WHAT YOU DON’T UNDERSTAND

I wasn’t sure if I wanted to include this commandment or not. To be completely

honest, there are some coins now that I invest in solely based on their chart. I

could know absolutely nothing about a company — if I see enough positive buy

signals and price history to back it up — I’m going in.

I find that when I’m looking at coins for extremely short term trades (0–3

weeks), focusing on Technical Analysis over Fundamental Analysis brings me

greater returns. That’s just me — I don’t suggest buying into coins you haven’t

done research on, unless you’re also a TA geek like myself.

For long term investments you absolutely need to DYOR. The biggest % gains I’ve

ever had in crypto were my long term bags. Bags that I would’ve emptied to FOMO

into other trades at the beginning of my dive into crypto — but I’ve learned

from my mistakes.

When I’m looking at a coin that I’m considering as a long term hold, I think of

the worst case scenario.

If crypto were to figuratively burn to the ground tomorrow, would this coin be

one of the few that would survive the crash?

I’m a bull when it comes to cryptocurrency as a whole, but I also believe that

there is a shocking amount of money in this market with a very small amount of

meaningful use cases that have been successfully executed.

Blockchain technology has the potential to create serious impactful change in

this world, but right now some of the largest examples of blockchain projects

coming to fruition are TRXPuppies and

CryptoKitties.

With that being said, I foresee a reckoning in the future where the vast

majority (99%) of cryptocurrencies fade out of existence, with the ones

remaining being those that address serious widespread issues (or streamline

existing processes), while capturing more market cap than their competitors.

Operating under this assumption, means that most, if not all of the coins I

trade on a short term basis, would not pass my screening for long term holds.

For example, I don’t see Verge (XVG) passing the test of time — but I do see it

going 2–3x in the near future, and I’ll hold it until it does or I’m proven

wrong.

On the other hand, ETH and NEO are competitors. They solve the same problems,

are both serious coins with large market caps, and I hold both as long term

investments. I’m not hedging against my bets by investing in competitors. It’s

feasible to me that these two entities could co-exist in the future in a fashion

similar to how Apple and Samsung coexist.

I believe they both have too much funding, too much support, and too large of a

community to fizzle out completely.

7 MONEY ON EXCHANGES DOESN’T BELONG TO YOU

I know that everyone and their mother preaches about this on Reddit/Twitter, so

I won’t spend too much time on this.

It defeats the purpose of a decentralized currency — one in which you are in

complete control, with no need for third parties to store or transfer your money

— to trust a third party to store and transfer your money.

There have been several times in the past when trusting third parties

(exchanges, mining pools, even gambling sites) has resulted in the loss of a

devastating amount of cryptocurrency.

Read up on Mt.Gox, the first Bitcoin exchange ever to open its virtual doors.

You’ll begin to understand that danger of unnecessarily trusting third parties

in a trust-less system.

So what do you do?

Download the official wallets for your cryptocurrency holdings, and store them

there. An alternative would be purchasing a Ledger Nano, or a Trezor — which are

both hardware wallets similar in appearance to thumb drives.

8 DON’T MARGIN TRADE

If you don’t know what margin trading is, just skip ahead. Don’t even look it

up. It’s dangerous, and a very efficient way to lose your money fast.

Margin trading is trading with leverage. Which means that I can put $100 into a

margin account, and get 3x my trading balance in buying power.

That also means that if I trade 3x my balance ($300), and my position goes

-$100, I will lose everything I’m holding as collateral.

I made more money in a short time frame than I’ve ever made in my life through

margin trading.

I also lost more money faster than I’ve ever lost it before in my life through

margin trading.

9 IF YOU DO MARGIN TRADE, NEVER MARGIN TRADE WITH BITCOIN AS YOUR COLLATERAL

I knew you wouldn’t listen to me.

Since you still want to margin trade, at least heed these words of advice:

Never use Bitcoin as collateral for your margin trading.

Never put Bitcoin into your margin account, and open long or short positions

with the buying power given to you by that Bitcoin.

I can’t think of a better way to say it.

Don’t do it.

If you’re going to margin trade, leverage fiat.This is something that was told

to me when I first started margin trading. I didn’t do it for a while, but after

a God-like winning streak, I felt untouchable.

For about 2 months, I didn’t place a losing margin trade. My account balance was

exploding. I had been religiously removing my profits every week from my margin

account to buy BTC and set aside as a long term hold. It was part of my

investment strategy; use margin trading to increase my holdings in coins I really believed in.

One day, I saw an opportunity that I thought would make me rich.

The market had just finished the bull run that took Bitcoin to $20,000. I had

closed most of my margin positions and realized a solid profit from the run — at

this point I was just sitting patiently with my entire margin balance available

to me.

I was waiting for the dip.

I thought my salvation came when BTC dropped down to $10K and bounced back up to

$13K. I was blinded by my winning streak.

Confirmation bias is a bitch.

I went all in on a few long positions. I hadn’t seen some of my favorite coins

this low in months, it felt like the greatest flash sale of all time.

The next day, the market dropped.

I was completely maxed out on the leverage available to me, and the only funds I

had available were the BTC profits I had been setting aside every week.

I loaded them up into my margin account, and gave myself a lot more breathing

room to avoid liquidation.

If I had stopped there, I would have been fine.

After transferring BTC into my margin account, I noticed that I had a lot more

of a tradable balance from leveraging the BTC than I realized I’d have. Still

feeling semi-God-like, I decided to double down on my positions.

“Nothing has changed…I still believe the market will correct within a couple

days…I’m not going to have weak hands and realize the loss”, I thought to

myself.

The next day, the market dropped.

I freaked out for a couple more days until I woke up to being liquidated.

Much of what I had made in my two month spree was gone.

10 DON’T TRADE/INVEST WITHOUT A STRATEGY

My next piece is going to go in depth on creating your own investment strategy.

You should not be investing without a strategy and goals.

Your strategy will include the tactics you will use to reach your goals.

For example: if my goal is to own X NEO, X ETH, X BTC, and X ETC by Q4 2018.

My strategy will include all the methods I plan on using to add to those long

term holds I have in my goal.

Failure to plan is planning to fail — or so say the Boy Scouts. Determine your

goals, and write them down by hand.

Most of what I’ve learned has come as a result of the huge loss I took as soon

as I began investing.

If there’s only one thing you take away from this piece, I hope it’s this:

Don’t panic, and don’t give up if your first investment doesn’t go well. Use

it as an opportunity to reflect on what caused you to make the mistake — and

seek education to pull yourself out of the hole.

Adversity is like a strong wind, you can run away with it pushing you faster, or

you can hold your ground, letting it tear from you all except what is absolutely

necessary.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

If you’d like to meet and learn with other likeminded investors, check out

this cryptocurrency discord — it has an active

community and tons of helpful people if you’re looking for some advice.

I originally published this article in Hacker Noon on Medium. You can find the original blog post here.