You are viewing a single comment's thread from:

RE: Never Hold on to SBD! They Are Being Devalued At 583.8% Annually (48.65% Per Month).

Great info, @dpl! I wonder how the inflation issue ties into the fact that we no longer get paid in steem, but only SP and SBD. It seems as if they are intentionally causing this. Where is this chart data sourced? It's so small it's difficult to read for me.

BTW, we are about to enter into a very interesting month and we are already in a key year for change. I'm considering doing a post on it, as there is a lot more in play with the powers that be than hardly anyone I think really realizes.

Great point @positivesynergy.

For better clarity from the start the image is from Coin Market Cap. You can zoom into the section of the time line you wish to investigate. I zoomed into the graph on the time from December 2017 to April 2018, added the $40mil market cap line and the red circles for clarity.

If we look at the definition of Steem and Steem Power (STEEM Power (SP)):

See the last sentence as per the above definition "1 STEEM = 1 Steem Power when powered up" and it is the same with powering down 1 Steem Power = 1 STEEM it just takes a while to convert to STEEM. So it does not matter whether we look at Steem or Steem Power, it is exactly the same thing (the one just takes a while to extract for use).

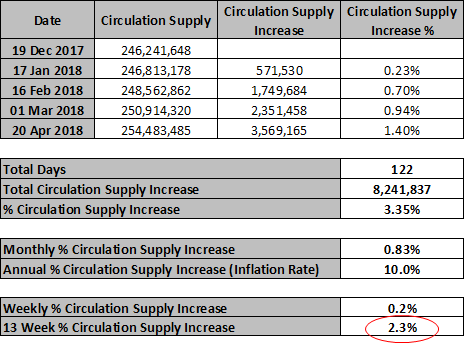

If we consider inflation of Steem (or Steem Power) over a 13 week period (only due to an increase in circulation supply) it is insignificantly small. As seen in the below table it is 2.3% if you keep it in your wallet over the entire 13 week period and do not convert to fiat currency or a different coin as it becomes available. Interesting to note is that inflation on fiat currency (due to an increase in circulation supply) is much higher - look at Quantitative Easing.

This inflation rate (due to an increase in circulation supply) is so small that you can neglect its affect on the price on the coin. In fact it is better for Steem to be locked up in Steem Power because this leads to more investment which can only be extracted over a long period of time. I know it is frustrating but it ensures a healthy Steemit ecosystem.

Can't wait for your post. It sounds interesting!

Great study there, @dpl. Of course, if one pulls it out into an exchange and trades it, they can do far better and control the liquidity too.